Editor’s Note: We hope our U.S. readers are enjoying the long weekend! Last week, we sent you an article from one of our excellent editors, Justin Brill, discussing how to identify signs of a bear market. Today, we’re bringing you a guest editorial from our friends at LikeFolio with similar insights on identifying specific stocks to watch carefully. Their data, culled directly from consumer insights, provides for some excellent analysis and a slightly different take. We hope you’ll enjoy it!

Also, as you may have noticed, today’s article is coming to you at a much earlier time slot. We’re trying something new and will send you the TradeSmith Daily around this time every day moving forward, so that you can have the “news of the day” before your day gets started. Keith will be back tomorrow to talk about why oil prices are on the rise.

It’s important to be able to recognize the signs that a stock is overvalued. The sooner you become aware of an overvalued stock, the easier you can avoid losing money on an investment.

It’s imperative to carefully research every stock in which you are considering investing and to know the indicators of inflated valuations so that you can save time, effort, and money.

These five elements of stock assessment will give you a better understanding of how to identify a potentially overvalued stock.

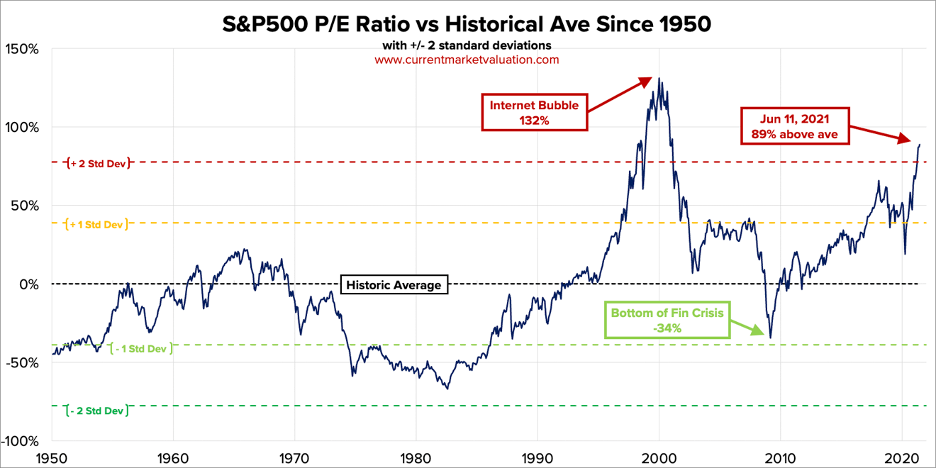

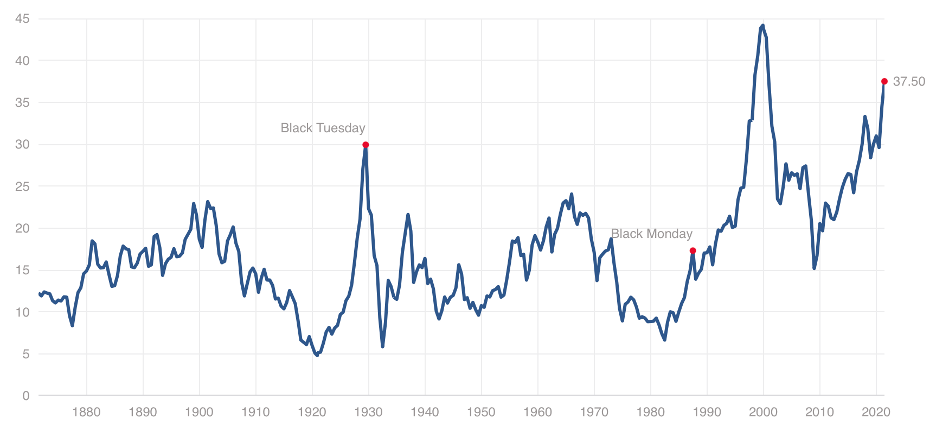

- Compare the growth rate to the P/E ratio

Calculate the price-to-earnings ratio of a stock option by dividing the price of a share by the earnings per share and then compare that to the growth rate. If the P/E ratio is higher than the growth rate, the stock may be overvalued. Analyze a stock’s growth rate by looking back over how the earnings have changed on a yearly basis.

The comparison of the two data points allows an investor to gauge the true value of the stock. Avoid investing in stocks with an average growth rate lower than its price-to-earnings ratio.

- Measure consumer demand on Main Street

Ultimately, a company can only be valuable if it is producing goods and services that others want.

Companies that are experiencing increasing demand on Main Street will often see increasing share values on Wall Street.

Company earnings reports, same-store sales numbers, and consumer demand data from LikeFolio can give you insight into whether or not the company is likely to grow over the next one to three years.

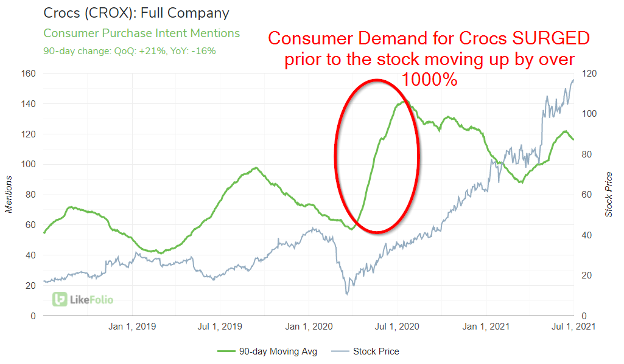

The chart above shows social media purchase intent mentions of Crocs shoes (green line). Notice how this measure of consumer demand surged at this time last year.

Consequently, so has the stock, which has increased by more than 1,000% since its March 2020 lows.

- Compare the P/E ratio to competitors

Analysis of the wider market can give a beneficial frame of reference for the valuation of specific stocks.

Identify several competitors to your target stock that compete on a relatively comparable financial footing and compare the price-to-earnings ratio of their stock to the one you’re analyzing.

If your stock’s P/E ratio is significantly higher than most relevant competitors, it’s a good sign that it may be overvalued.

Conversely, if a stock has a lower P/E ratio than most of its competitors, it may be undervalued and worth investing in after further research.

The average P/E ratio of similar competitors is a good general indicator of valuation, but it doesn’t take into account all the factors that could impact an individual stock price, so it should be used in collaboration with further analysis.

- Evaluate the reputation

The reputation of a company or a stock can have a massive impact on its value.

For example, a stock that has been recently purchased by high-profile individuals can be overvalued by the market.

In general, stocks that are attracting a lot of attention from industry-relevant media outlets and well-known investors can sell for an inflated price due to the hype surrounding them. Take the profile of a stock into consideration when calculating its true value.

Learn to resist the temptation of overvalued stocks with a lot of buzz around them and try to be as objective as possible when investing your money.

If you’re holding a stock that becomes in vogue, it can be a good opportunity to offload it and capitalize on the temporary overvaluation.

- Watch for any significant sellers

Pay attention to individuals in relevant positions of knowledge and power so you can react if they sell their shares. People with a significant role in a company will generally have prior knowledge of overvaluations and will seek to offload their shares at the best possible time, so follow their lead where possible.

Most directors or executives wouldn’t sell shares in a company with performance and growth they have full confidence in, so it can be a reliable indicator of the health of an organization if they do.

One individual offloading shares is probably no reason for concern, but if a significant portion of influential people start selling, then you should react accordingly.

Identifying the signs of overvaluation can save investors large amounts of investment capital. Knowing when to buy and when to sell is made a lot easier when you have the relevant information at your disposal, so dedicate your time and effort to discovering the true value of any potential investments before committing your money.

While none of these methods are foolproof on their own, they can be very helpful when mixed into your fundamental research process.