It didn’t last long, but it sure was damaging.

Last March, investors experienced the first bear market in more than a decade.

This COVID-19-fueled bear market, defined as a decline on the S&P 500 index of more than 20%, was also the fastest and shortest in history. It took just 16 days to fall that quickly.

Meanwhile, the recovery took just 33 days.

The COVID-19 market crash was unprecedented in more ways than one.

Historically, the average bear market for the S&P 500 lasts a little less than 13 months and occurs about every six years.

But the ensuing rally to record highs over the past 15 months has put many investors on edge.

Conditions appear ripe for another bear market.

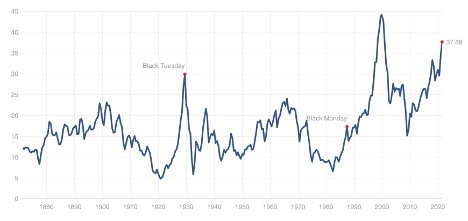

Stock valuations are the highest they’ve been since the dot-com bubble. The Shiller PE Ratio, a measurement of the average price-to-earnings ratio of S&P 500 stocks, sits at 37.68. That figure is higher than Black Monday in 1987 and Black Tuesday in 1929.

The chart below shows that the Shiller PE ratio is heading into territory not seen in more than 20 years.

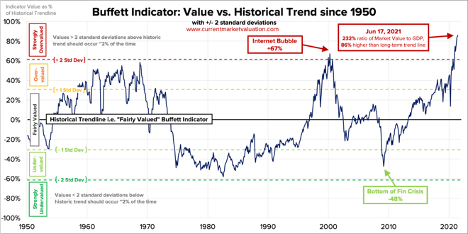

Then there’s the much-hyped Warren Buffett indicator. This measurement is a ratio of the total stock market valuation compared to U.S. GDP. The figure suggests that the market is extremely overvalued at a ratio of 232%.

The Federal Reserve is poised to raise rates, with such speculation already punishing growth stocks and companies with significant debt.

Those are just a few warning signals.

Whether the next bear market comes in two weeks or two years, it’s essential to be prepared.

That’s what we’re discussing today: how to succeed in a bear market.

Let’s look at the five Bear Market rules that you need to know today.

Bear Market Rule No. 1: Don’t Become a Day Trader

As bear markets occur, the worst strategy possible is to turn into a day trader.

Day traders attempt to make money by jumping in and out of stocks in short time durations. These trades can last a day, an hour, or even a matter of minutes.

Jumping in and out of stocks regularly based on recent moves will more than likely fuel a losing streak. If you haven’t been day trading in the past, a bear market is not the time to start.

Roughly 80% to 90% of new day traders fail in their first year, depending on which source you cite. Even worse, about 80% of day traders will quit in the first two years, according to Tradeciety.com.

Day trading is very emotional for new participants. And, as I’ve stressed in the past, trading on your emotions is not in your best interest. I stress the importance of steering clear of day trading because such failure rates can destroy your confidence in the stock market as a wealth-building machine. If you’re serious about making money in the market, it’s critical to shift your attention away from day-to-day movements and even month-to-month movements.

That sentiment brings us to our next rule.

Bear Market Rule No. 2: Maintain A Long-Term Focus

Back in March 2020, the days felt longer when investors watched their portfolios stretch deeper and deeper into the red. During those stressful stretches, it’s tough to remember that all bear markets have one thing in common: They all end.

According to the Schwab Center for Financial Research, the average bear market for the S&P 500 tends to last a little less than 18 months. If you recall the 2009 financial crisis, many people worried about the safety and security of their retirement accounts. The people who were buying at market lows could do so because they had available cash on hand. By purchasing index funds and strong companies, investors could build a portfolio on the cheap.

Six years later, patient investors made enormous amounts of profits. This is especially true for anyone who used all of the tools at their disposal to increase their exposure to long-term investing. Bear markets are a good reminder to use company 401(k) matching programs and be patient to wait for a rebound. Those who did were handsomely rewarded in 2009 and 2020. Investors who follow that same game plan will find success in the next bear market.

Bear Market Rule No. 3: Cut Your Margins

One of the biggest unforced errors for investors during bull markets is that they fail to slash their margin accounts when the markets start to fall. When investors use margin, they are effectively borrowing money from their brokerage to invest. They can enjoy the gains from this money, but they are on the hook for everything if the investments decline.

Brokerages can force you to sell your stocks or other falling investments during a process known as a “margin call.” These margin calls typically happen when prices have cratered. There’s no negotiation during a margin call, and it can cost you a lot of money if things go sideways.

Let’s say that you have $100,000 in cash in your account that you use to buy stock. And you have another $100,000 in margin on your account. If we see a 25% pullback during a bear market, a decline could cost upwards of 50% of your initial cash investment due to use of margin. The reason is that the margin capital is not your money. So, the brokerage can reclaim its capital and force you to settle from your original cash investment.

Bear Market Rule No. 4: Separate the Signal from the Noise

One of the biggest disadvantages that investors had over the last 100 years is information inequality. What I mean by this term is the idea that institutions had greater insight into events that were about to transpire than retail investors. But the combination of regulatory understanding and technological progress has helped democratize insights into when a bear market is about to transpire and when retail investors should move to cash.

In the case of regulatory filings, pay close attention to corporate insiders’ buying and selling habits. CEOs and chief financial officers are two of the most reliable sources of knowledge about a company’s short-term and long-term future.

If corporate insiders are selling – and I’m stressing a lot of them all at once – this can signal that Corporate America expects a sharp downturn in the market. In February 2020, we saw insider selling hit nosebleed levels as the markets prepared for a possible shutdown to the economy. On the flip side, corporate buying can be a sign that a recovery is in play. A wave of insider buying transpired when the Federal Reserve said it would provide full support to the markets after the COVID-19 crash.

Bear Market Rule No. 5: Generate Money on Your Long-Term Positions

I’ve explained the value of having a long-term mindset. Investors who use strategies like dollar-cost averaging to build positions during a bear market can achieve incredible gains during a market recovery. But keep in mind that there are other ways to make money off existing long-term positions.

For example, if you’re determined to be a long-term owner of Apple Inc. (AAPL), and you own 100 shares, there are simple, conservative, low-risk strategies to generate income off these positions. I recently outlined one example known as a “covered call.” In this situation, you sell a contract that gives a potential buyer the right, but not the obligation, to purchase stock from you if it goes higher and reaches the “strike price.” I outlined this strategy in TradeSmith Daily, right here.

There are many other ways to generate additional cash during a bear market. Best of all, you can use the cash generated to buy some of your favorite stocks on the cheap.

We’ll discuss additional bear market strategies in the days ahead.