Pop quiz.

Who is the most underrated name in the history of finance?

Adam Smith? Warren Buffett? Jim Rogers? Bill Ackman? Benjamin Graham?

I can understand the case for all five of them. And I’m sure you have a name or two that you’d love to send my way (please do, right here).

But let me make a case for someone you have probably never heard of until this minute.

His name is Joseph Piotroski.

And he invented one of the best money-making strategies of all time.

You just likely never knew he was there.

The Doctor is In (The Money)

Piotroski – much like Buffett and Graham – focused on identifying undervalued stocks with significant upside. He started his research as an assistant professor at the University of Chicago and moved on to Stanford University.

For a long time, the perception was that investors should buy stocks that are trading below their “book value” or “net asset value.”

Piotroski vigorously studied Ben Graham’s practice of buying stocks under book value. He found less than 50% of companies that traded below that figure generated positive returns over the next 24 months. So that wasn’t a very good value-investing strategy based on the data. Most stocks saw their share prices decline when trading below that metric.

So, he looked elsewhere. And after more vigorous research, Piotroski created one of the most critical and influential stock-ranking strategies in finance history. Not only does this system help investors identify breakout stocks, but it can be another secret weapon in your arsenal when you use momentum signals through TradeSmith Finance.

Let’s have a look at this strategy.

The F-Score

In 2002, Piotroski authored a paper outlining his famous “F-Score” model.

The model ranks a company’s financial strength based on improving or declining metrics on the balance sheet. According to his research, stocks with higher F-scores outperformed over the next 24 months, while stocks with lower scores underperformed.

The scoring is based on nine specific metrics. Thus, a company can score up to 9 points or as little as 0.

A company will receive a point if it scores the following metrics:

- Its return on assets is higher than 0.

- Its operating cash flow is higher than 0.

- Its return on assets is larger than the ROA figure from the previous year.

- Its operating cash flow is higher than after-tax net income.

- The company has reduced its long-term debt as a percentage of assets.

- Its “current ratio” (a measurement of its current assets to its current liabilities) is higher this year than the current ratio from the previous year.

- Its total number of shares outstanding is lower than the total in the previous year.

- Its quarterly gross profit margin is larger than the gross margin in the same period of the previous year.

- Its sales divided by total assets generated a bigger number than the same calculation for the previous year.

Now, that might feel like it’s a lot to unpack. There are key definitions on the balance sheet that we can define in future issues of TradeSmith Daily. For now, I just want you to know that the F-score is an important metric that can help you identify companies with improving fundamentals.

More importantly, I want to show you how to use it the right way.

Combining F-Scores with Uptrend Momentum

Right now, 55 companies have a perfect F-score and are not trading “over-the-counter” through a broker-dealer network. Instead, these are stocks trading on U.S. exchanges and have dramatically improved their balance sheets over their performance from last year.

Now, you might think that 55 is a big number. But in reality, there are thousands of stocks trading on U.S. exchanges. So, how can we identify a few companies that combine these strong fundamentals with momentum and upside?

You know the answer. We’re going to look for companies that have a perfect F-score, sit in the Green Zone (our buy zone in TradeSmith), are in a Smart Moving Average uptrend, and have low to medium risk. I’ll be honest with you. On the surface, they don’t appear to operate in the most exciting industries in the world.

But they have great balance sheets, kick off tremendous cash flow, and have far less risk than the high-flying growth stocks that remain very volatile.

Here are three perfect F-Score companies that stand out today.

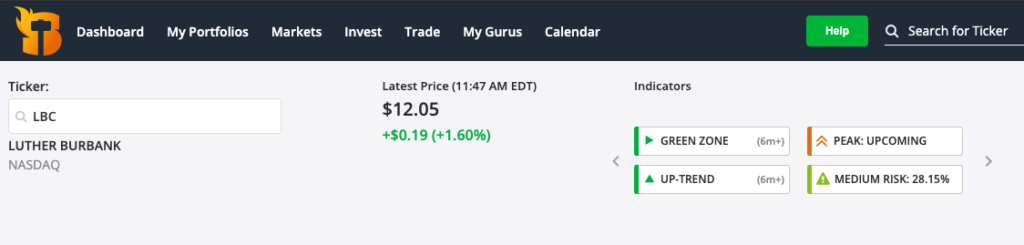

Luther Burbank Corp. (LBC): You’ve already heard me talk about mergers and acquisitions activity in the community and regional banking space. Luther Burbank Corp. is a holding company that operates out of California. It pays a nice dividend and trades at a price-to-tangible book value of 1. This means that the stock is trading at its liquidation value (if the company went out of business today, you’d get 100% of your money back). Should it become an acquisition target, it could easily fetch 1.5 to 1.7 times its tangible book value, making it an optimal buy-and-hold opportunity for investors. The stock is in the Green Zone, pays a 1.92% yield, and has been in a solid uptrend for months. As banking stocks continue to rebound from the post-COVID environment, this is a sneaky way to play the financial sector. Best of all, it has a strong history of stock buybacks, meaning that its executives are always looking for ways to return excess capital to investors.

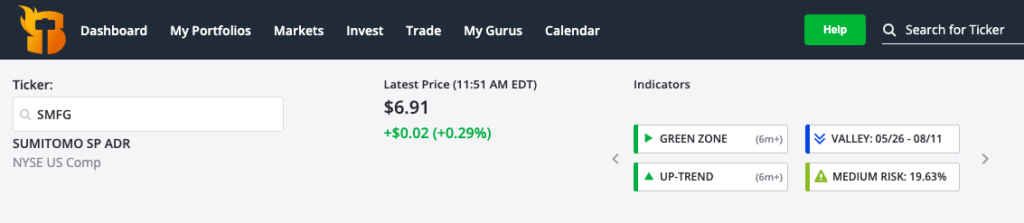

Sumitomo Mitsui Financial Group (SMFG): Next, we have Sumitomo Mitsui. It is a strong dividend stock that pays a 5.12% yield and has enjoyed improving momentum since December 2020. This Japanese financial company remains under the radar and pays at very cheap multiples, even for a company of its size and region. Shares are trading under $7.00 and look like an outstanding stock to buy, hold, and dividend- reinvest in an improving market in the wake of COVID-19.

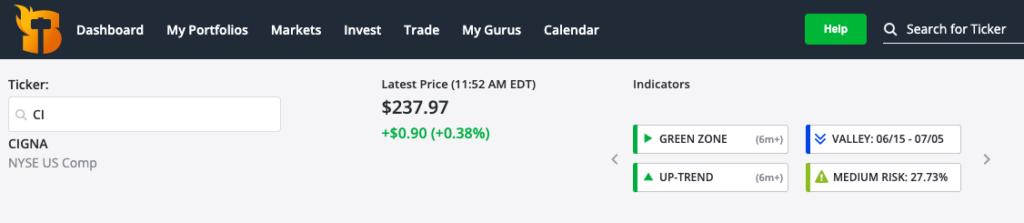

Cigna Corp. (CI): Finally, check out Cigna Corp. The health insurance company sits in the Green Zone, operates in an uptrend since December, and has a perfect F-score. Cigna fell off the radar of many investors, and it now trades at an attractive P/E ratio of 10.29 with price-to-sales of just 0.52. This is a very profitable company with solid margins and improving return on equity. Wall Street is very bullish on CI with an average price target of nearly $297, according to TipRanks. That figure represents nearly 25% upside from today’s trading levels.

Remember, we are always in the business of combining new metrics and old metrics to help us improve our conviction. So the F-Score can act as another tool to give you confidence right alongside the powerful screens and tools at TradeSmith Finance.

Tomorrow, I’ll show you how to take a stock like SMFG or LBC to generate additional returns from just their dividends.