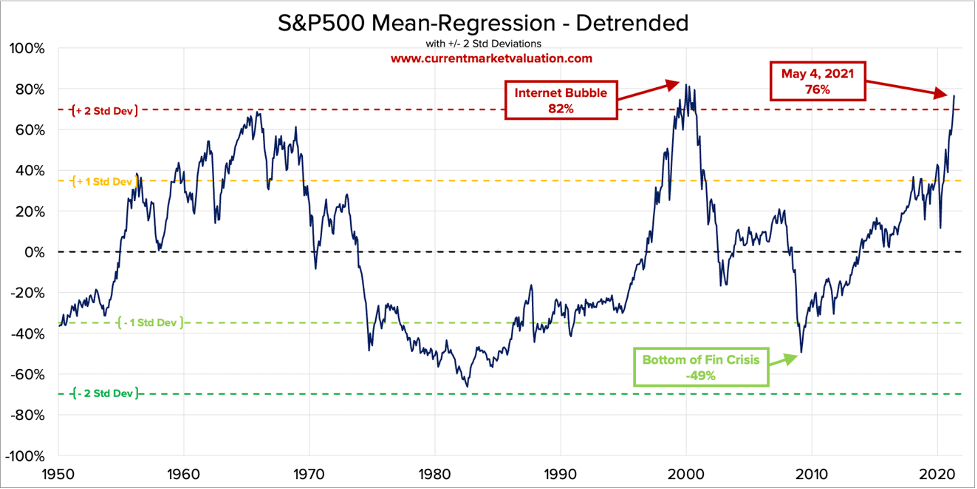

A few days ago, I told you that the markets looked frothy.

The P/E ratio of S&P 500 stocks is the highest since the dot-com bubble.

Also, the Federal Reserve warned Thursday that a “repricing” event could come in the future.

I don’t expect this event to occur in the weeks ahead.

But I do have my trailing stops in place – as always.

In the meantime, there’s a bullish case for stocks to run higher.

Why?

It’s all because of a report update from Goldman Sachs.

Companies are about to drive their stock prices higher.

How will they do it?

I’ll break it down for you.

Cash is King

It’s been quite a year for public companies.

Last year, firms played as much defense as possible by drawing on credit lines and issuing new debt. With interest rates low, it made a lot of sense to take on this risk.

But now, a year later, corporations are flush with cash.

What are they going to do with the money?

Well, take a look at what Apple (AAPL) and Berkshire Hathaway (BRK.A) are doing for clues.

Back in 2007, Apple unveiled the iPhone. At the time, its market capitalization stood under $75 billion.

They’ve done pretty well, thanks to this device. Today, the firm has nearly $200 billion in cash on hand.

A company like Apple has a few options if it wants to return profits to its shareholders.

It could increase the dividend and return cash to investors every quarter…

Or it can engage in a stock buyback to increase equity value.

A stock buyback is a term for an event where companies purchase their own stock on the open market.

Buybacks reduce the number of outstanding shares on the market.

This increases the ownership stake of investors.

As a result, share prices will increase due to the reduced number of available shares. Think of it as a way of the company reinvesting in itself.

Apple’s not the only company buying up stock.

Berkshire Hathaway has spent $6.6 billion on stock buybacks during the first quarter. It spent $9 billion in both the third and fourth quarters of 2020.

Eli Lilly (ELY) announced a plan to buy back $5 billion in stock.

Netflix (NFLX) authorized $5 billion in buybacks set for the second quarter.

And JPMorgan (JPM) said last December that it would repurchase a whopping $30 billion in its own stock. Through the first three months of 2021, it bought $4.3 billion in its own stock.

Here’s the thing.

We’re just getting started with this trend.

Goldman Sachs predicts that we’re on the verge of a “buyback bonanza.”

Behind Goldman’s Numbers

According to Goldman Sachs strategist David Kostin, we could see a 35% jump in share buybacks this year. He also projects a 5% jump in buybacks next year.

Companies are flush with cash. And from January 2021 to April 2021, U.S. companies spent an incredible $484 billion buying their own stock.

That figure is double the pace of buybacks during the same four months of 2020.

Buybacks in April totaled $209 billion, according to MarketWatch.

That is the second-highest monthly total on record. The record came in June 2018 after the passage of the Tax Cuts and Jobs Act.

Goldman Sachs isn’t the only group expecting this buying frenzy.

Last month, State Street Global Advisors analyst Michael Arone predicted a 30% rise in buybacks this year. He expects about $800 billion going back to shareholders through these purchases.

Why Buybacks Matter

A lot of people might speculate that huge cash hoards on balance sheets would be better used to buy other companies.

But in the post-pandemic world, I’d argue that firms are trying to determine what the future holds.

What will this economy look like in 18 months?

Yes, they probably should have a lot of cash set aside for a rainy-day fund. Airline companies are notorious for buying back their stock and never having cash flow for emergencies.

But corporate boards expect a lot of regulatory changes.

There is talk of higher taxes on corporations, and thus their shareholders. The Biden administration is proposing a big hike on corporations. To pay for a $2.3 trillion infrastructure package, the White House wants to hike corporate taxes to 28%.

And many executives do receive bonuses based on the performance of their stock.

So, right now is the time that many firms will put that cash to work and give it to the shareholders.

This trend will likely push the S&P 500 higher. And we’re not going to get in the way. As I said Friday, I’m happy to let this market run higher. Valuations might be stretched, but buybacks are just another way that stocks can continue this rally.

I sleep better at night knowing I can eke out additional gains and have my trailing stops in place in the event that it all goes sideways. I’ll be back tomorrow to talk about a big trend in the auto sector, and a new momentum play.