For two weeks, I’ve been sharing cognitive biases that can negatively impact your investing.

Bias drives underperformance in the markets.

It stunts our ability to discover new opportunities.

And it makes us frustrated.

When we fail to tame our biases, the odds of us making the same mistake increase.

Today, I want to talk about a sensitive topic.

If you’re serious about making money in the markets, we have to talk about confirmation bias.

Defining Confirmation Bias

We all have deeply held beliefs. They might be political. They might be personal. They might be a set of rules we follow.

They might shape our worldview.

One of the most important things to remember is that other people don’t think the way you do. They process information differently.

They adhere to other beliefs, structures, and biases.

Market participants do the same.

Confirmation bias describes how people favor information that conforms to their existing beliefs.

What happens here is simple when it comes to money.

Investors tend to seek specific information that “confirms” the things they believe or want to happen. They will ignore any information that refutes these beliefs.

For example, imagine that you’re convinced that a trend is inevitable.

An excellent example of this is “The Death of Physical Retail.”

For years, media outlets and financial newsletters have warned about Amazon. They’ve repeated time and again that malls are going out of business.

Some so-called “experts” have warned that brands like Abercrombie & Fitch (ANF) and Gap Inc. (GPS) might find themselves filing for Chapter 11 one day.

Based on the media reports, you might be steadfast in a belief that both will go bankrupt in the future.

As a result, you might search for news or information that confirms your bias.

You read bearish analysts and bearish articles on both stocks.

You seek information that backs up your belief that both retailers will go out of business.

And, you ignore the articles that suggest these companies are healthy.

You miss positive sales reports. You ignore optimism about the reopening trade. You ignore news from their landlords that they’ve been paying rent.

What happens as a result?

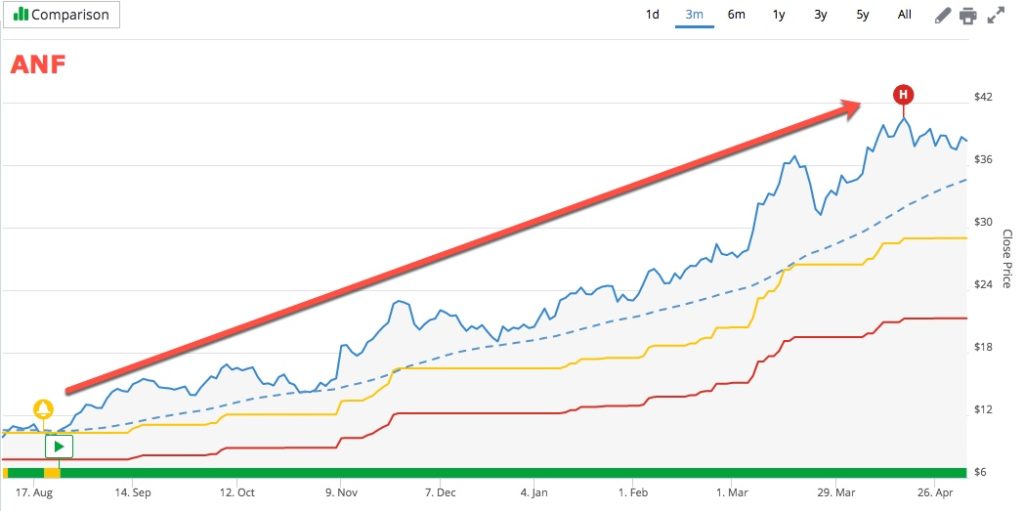

You miss out on a 106% return on Gap Stores since Sept. 8, 2020. And a nearly 200% gain on Abercrombie & Fitch since June 9, 2020.

Why these returns and these specific dates? These were the dates when both stocks entered the Green Zone within TradeSmith Finance.

Here’s How to Tackle Confirmation Bias

If you’re very opposed to investing in a company because you’re opposed to its business practices or mission, that is OK. Or maybe the company took a political stance you didn’t like, or it sells a product that offends you.

But I want to explain that the markets will never give us the satisfaction of morphing to our views.

This lesson can be hard to learn.

But an action plan to address this bias is quite simple to employ.

First, if you’re conducting research, you must broaden your horizons beyond one or two voices.

Everyone has their expert. And it’s essential – especially if you read newsletters – to find someone you want to read. There are many voices out there, and finding someone who meshes with your risk and investment strategies is very special.

But you need more than one person. TipRanks, for example, is a helpful platform that gives you a breakdown of many different voices.

It will tell you the price targets and recommendations of every analyst that covers a stock. It will offer insight into what that company’s executives are doing (in terms of buying or selling the stock). It will disclose which hedge funds own the stock. And it provides a mix of different tools to measure the technical and fundamentals of each company.

Of course, there are also several well-respected newsletters and gurus that we partner with too.

Follow many voices. Get your hands on analyst reports. And recognize the difference between analysis and hype. Anyone who says that a stock “WILL GO” to a specific price should be ignored.

No one can predict the future.

Next, you need to have systems in place that can help override those cognitive biases. Something as simple as TradeSmith Finance, which eliminates all the noise.

The platform brings it down to a clear signal: Green Light, Yellow Light, Red Light.

Buy, Wait, Sell.

You saw it with Abercrombie and Fitch and Gap. Anyone who believed that these companies would collapse missed out.

Finally, take a little time today and examine your portfolio. I want you to really think if any stocks you own have been shaped by confirmation bias.

If so, start doing research. Read the investor presentations. Read more than two blog posts with rosy headlines. And check to see if the stock is still trading in the Green Zone on TradeSmith Finance. Even if it’s rated a sell, the good news is that the markets are at elevated levels.

So you should see good returns if you’ve been holding anything in the sell zone.

I’ll be back tomorrow to wrap up our insights on cognitive bias.

And we’ll be looking for more opportunities as we move deeper into May.