How many stocks trade publicly on U.S. markets?

You’d be surprised by the number.

Some people think “the markets” are limited to the Dow Jones 30, the S&P 500, and the Nasdaq 100. But these are the indexes that create most headlines.

Apple and Microsoft both comprise a large percent of the weight on all three of them. You don’t hear too much about the stocks that aren’t part of these fraternities.

So, let’s try again.

I’m talking about the number of companies on any exchanges or over the counter (OTC). The Nasdaq Exchange, the New York Stock Exchange, the American Stock Exchange, and the other ten U.S. exchanges.

Various estimates exist. TheGlobalEconomy.com states that 4,397 public companies traded in 2018. However, that figure doesn’t include OTC stocks.

FinViz, a financial visualization tool that I use for charts and graphs, measures 5,739 stocks across different market capitalizations.

Today, I want to break down the various classes of stocks (six in all) and explain why each category is essential.

I think you’ll be surprised to find that the largest class of stocks in the market – which drives the S&P 500 and Dow – aren’t the top performers this year.

Defining Asset Sizes

In the financial market, there are six classes of equity assets based on their size.

Here’s what you need to know about each.

Mega-Cap Stocks (24 companies): Despite representing the smallest number of companies, 24 mega-cap stocks compose roughly $16.67 trillion in market capitalization (*all market cap numbers from FinViz are as of May 21, 2021). These stocks have market capitalizations of at least $200 billion and carry significant weight on the performance of the largest indexes. Today’s largest mega-cap stock is Apple (AAPL), with a $2.1 trillion market cap. The stock also comprises 5.2% weight of the S&P 500 and 11.1% on the Nasdaq 100. Other examples of mega-cap stocks include Visa (V) and Mastercard (MA).

Large-Cap Stocks (648 companies): Large-cap stocks represent the largest classification by market capitalization. As of May 21, these 648 contained a total market cap of $34.7 trillion*. These stocks tend to have market capitalizations ranging from $10 billion to $200 billion. Large-cap companies tend to offer a wealth of benefits. They typically provide significant transparency to investors, provide dividends, and have reached the peak level of their business cycle. Large-cap stocks are also more stable and provide more predictable revenue and profit expectations every quarter. Examples of large-cap stocks include Boeing Inc. (BA) and Uber (UBER).

Mid-Cap Stocks (1,047 companies): Representing a total market cap of $7.38 trillion*, mid-cap stocks typically represent companies with capitalizations between $2 billion and $10 billion. These companies generally are at the center of their growth curve. They are actively fighting to expand their profits and their market share. Yet, they come with slightly more risk due to their singular focus. These companies tend to focus on a niche in a target market. Examples of mid-cap stocks include H&R Block (HRB) and Legg Mason (LM).

Small-Cap Stocks (1,804 companies): Representing the largest share of companies on the market, small-cap stocks typically have a market capitalization between $300 million and $2 billion. Small-cap stocks usually aim for higher growth rates. They are typically more targeted by retail investors than large institutions, which might have restrictions that limit their ability to own a large percentage of a company. In addition, small-cap stocks tend to have far less coverage from Wall Street analysts. Examples of small-cap stocks include Gogo Inflight Internet (GOGO) and Sturm, Ruger & Co. (RGR)

Micro-Cap Stocks (1,429 companies): Microcap stocks typically have a market capitalization between $50 million and $300 million. These stocks are typically riskier than traditional large-cap and mega-cap stocks. Typically trading at lower price levels, these stocks offer greater profit potential and greater growth potential. But buyers should beware because volatility is a hallmark of these stocks; they don’t trade on the major indexes. Examples of micro-cap stocks include retail clothing company Express (EXPR) and Lakeland Industries (LAKE).

Nano-Cap Stocks (795 companies): Finally, nano-cap stocks typically have a market capitalization of up to $50 million. Like micro-cap stocks, this category has high growth and profit potential that must be weighed against volatility. Nano-cap stocks are typically categorized as “penny stocks” and should be reserved for investors who have higher-than-average risk thresholds. These stocks are more opaque, less liquid, and very speculative. Examples of nano-cap stocks include SandRidge Permian Trust (PER) and Gulfport Energy (GPOR).

This Class is Crushing the Market in 2021

If you polled investors on which class of stocks by market cap has offered the best returns in 2021, I’d bet that most people will say the mega caps. After all, companies like Apple, Amazon, Alibaba, and Johnson & Johnson generate the bulk of headlines across CNBC, the Wall Street Journal, and other channels or publications.

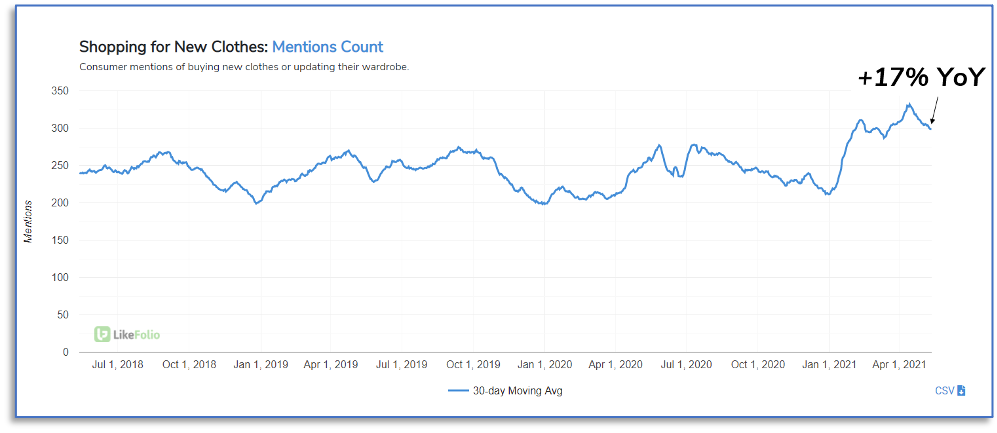

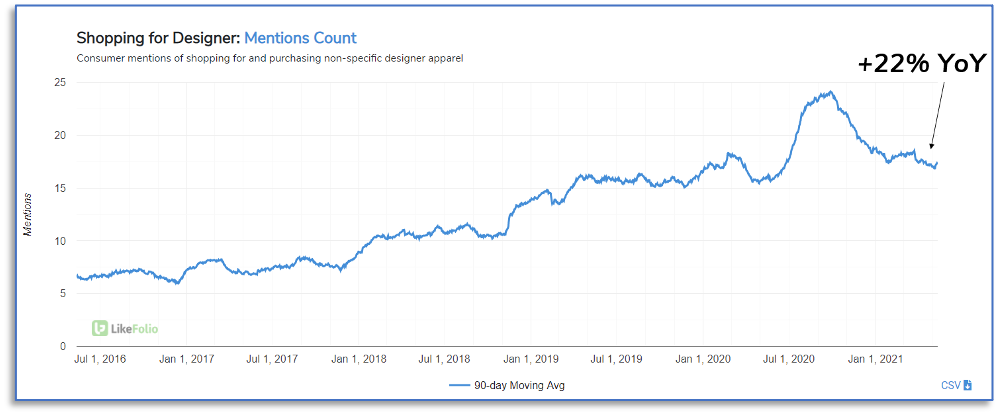

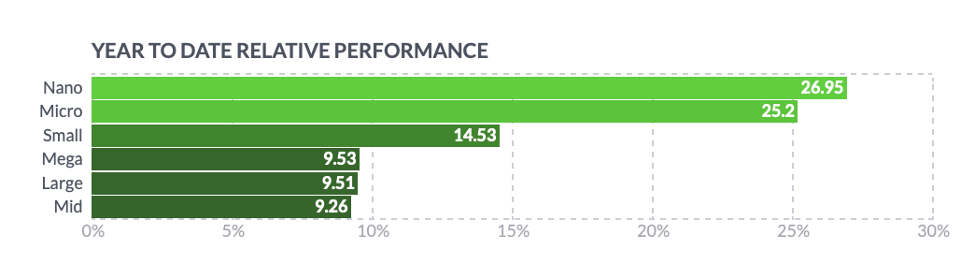

The top performers so far this year have been the class of nano-cap stocks, which were up 26.95% year-to-date through Friday. Meanwhile, micro-cap stocks added 25.2% through Friday. Mid- and large-cap stocks have largely lagged their smaller rivals since Jan. 1.

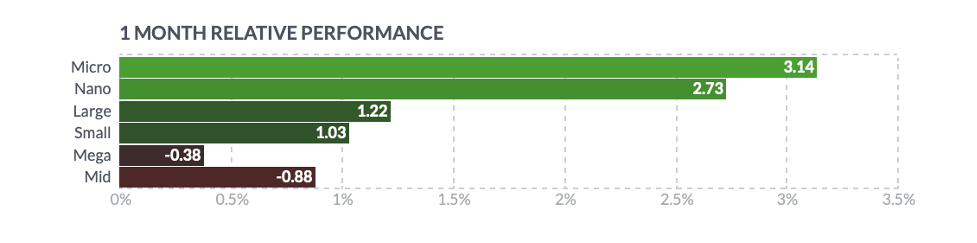

And over the last month, micro-cap stocks have been the top performers. Meanwhile, mega-cap and mid-cap stocks have been in negative territory in the previous 30 days, as seen in the chart below.

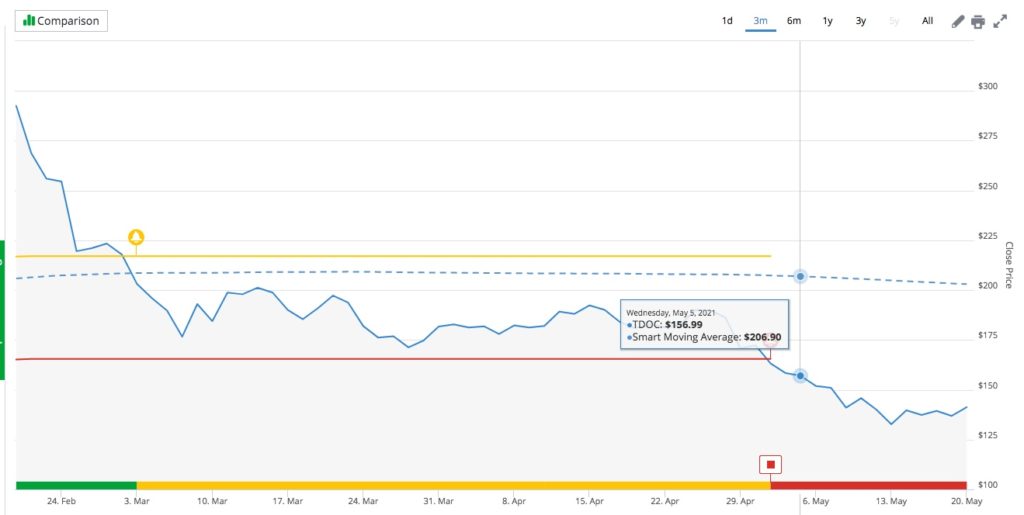

At TradeSmith Finance, we typically measure market momentum by what is happening with the S&P 500 as reflected in the SPDR SPY. But that doesn’t provide the clearest indicator of what is happening at the other end of the spectrum. The S&P 500 does represent trillions of dollars in value. And when it falls into the Red Zone, we move to cash.

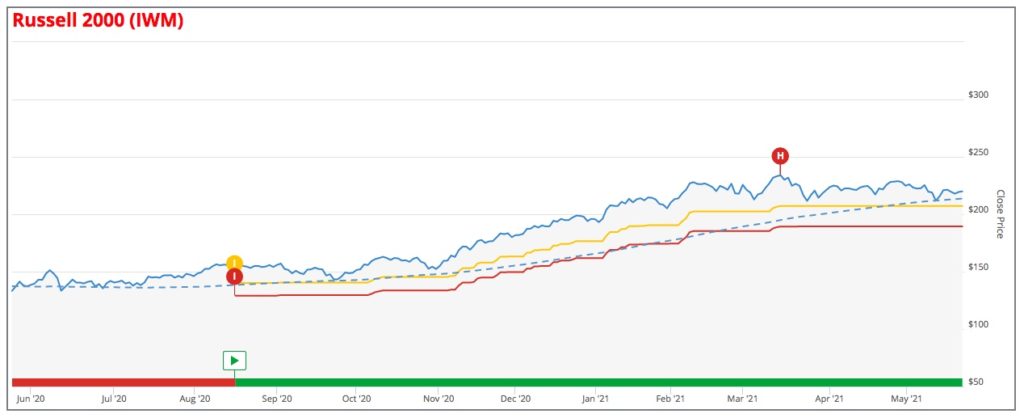

But you can track the performance of small-cap stocks by following or investing in the Russell 2000 ETF (IWM). These are the higher fliers with more volatility and price action. You can use the same indicator and trailing stops to track or trade the IWM.

Or, you can go even deeper with the iShares Micro-Cap ETF (IWC).

This ETF will provide you a broader insight into the health of the entire market. This index selects the smallest 1,000 stocks on the Russell 2000. It’s a crucial indicator and helps you understand what retail investors are doing with their money.

Right now, the SPY, IWM, and IWC are healthy and sitting in the Green Zone. This reading implies a green light for the markets and allows us to dig deeper for investment opportunities.

Tomorrow, we’ll dig deeper into micro-cap stocks and talk about a few companies that offer unique upside in the months ahead.

Enjoy your day.

P.S. Remember, TradeSmith Finance does track micro and nano-cap stocks, assuming enough historical data exists to prescribe trailing stops. You can type in the stock and find the related indicators to determine if you should buy, hold, or sell any stock, ETF, or other tracked asset.