Is Ark Innovation’s Cathie Wood Repeating Bill Ackman’s $4 Billion Mistake?

Every few years, a new money manager takes the investment world by storm. This manager rides a previous success or prediction into the headlines. Investors pour capital into his or her funds.

And then, fortunes tend to reverse.

Let’s look at a few examples.

Bill Miller beat the S&P 500 every year while leading a value fund at Legg Mason from 1991 to 2005 – 15 years in a row, an incredible achievement.

Miller received incredible praise in the early 2000s and controlled more than $70 billion at his fund’s peak. But fortunes changed when he doubled down on positions in American International Group Inc., Wachovia Corp., Bear Stearns Cos., and Freddie Mac throughout the 2008 financial crisis.

That year, Miller’s fund lost two-thirds of its value. The Wall Street Journal famously wrote an article on the topic in December 2008, with a headline that read: “The Stock Picker’s Defeat.” Miller would ultimately recover, but the shine had dulled on one of the world’s top value managers.

Then came Meredith Whitney. She earned the name Oracle of Wall Street as she predicted problems at Citigroup in October 2007. After her prediction, Citigroup stock slumped, and its then-CEO Charles Prince resigned.

Investors later handed her gobs of cash for a new fund, and she launched a new research firm. Her next big prediction for the markets came in 2010. She argued that municipal bonds would melt down. The prediction never materialized. Years later, Whitney would shut her new fund with too little fanfare.

Then, there’s Bill Ackman. He generated headlines by earning $2.2 billion on a hedge against a sharp downturn in the market in March 2020. Ackman’s success comes after a bit of a quiet period for the hedge fund manager. A few years ago, he lost roughly $4 billion, doubling and tripling down on a collapsing pharmaceutical company called Valeant Pharmaceuticals.

More on that in a minute…

Today, the “rock star” money manager under pressure is Cathie Wood, the CEO, Chief Investment Officer, and co-founder of Ark Invest. Wood was previously the CIO of global asset firm AllianceBernstein.

In 2014, she envisioned a plan to create an exchange-traded fund (ETF) dedicated to companies that bring disruptive technology to the forefront of the economy.

In a bull market, Wood found incredible success. She was named Manager of the Year in 2020. Over the last year, the Ark Innovation ETF surged nearly 175% from March 2020 lows. But the fund has hit an extremely cold streak.

Since mid-February, shares have plunged from nearly $160 to about $103.

And while the fund’s tech stocks are struggling, Wood is making several questionable decisions with investor capital. These mistakes rival those made by Bill Miller and Bill Ackman when their funds faced similar challenges in 2008 and 2016, respectively.

Simply put, these managers failed to ditch their losers and instead did the unthinkable. They doubled down on weakening stocks.

Today, Wood is taking the same risks.

Tracking Bill Ackman

In 2017, TradeSmith published an essay tracking the performance of Bill Ackman and his ill-advised wagers on the failing biotech giant Valeant Pharmaceuticals (VRX). At the time, Ackman’s fund had more than $10 billion in assets.

He had fallen in love with this biotech firm. Yet, the market had a different opinion. If you take a look at the chart below, Ackman bought VRX stock at $180 in March 2015. Shares promptly surged to more than $260.

When a selloff ensued on VRX in the summer of 2015, Ackman could have sold for a very nice profit, using a tool like the Volatility Quotient (VQ) to determine his exit point on the stock.

TradeSmith would have recommended that Ackman exit the stock at $200. That would have provided a profit of around $1 billion.

But that isn’t what happened. The selloff happened. Then Ackman doubled down. He’d go on to buy even more of the stock when it kept falling.

Ackman made the critical mistake of failing to let his losing stocks go.

In the end, he lost roughly $4 billion. His firm lost 20.5% in 2015.

In 2017, Ackman opened up about his mistake and apologized to investors.

But this was just one stock for Ackman.

In the case of Cathie Wood, her fund has been doubling down on multiple stocks that are flashing warning signs.

I’m worried about some of the fund’s recent moves.

Wood Follows the Same Troubled Path

Cathie Wood has been one of the top managers of the last few years. Bloomberg News named her the top stock picker of 2020.

But the recent downturn in the tech market is weighing on her firm’s flagship ETF and several other ETFs it has created to take advantage of disruptive tech trends.

According to Bloomberg, outflows from Wood’s funds totaled nearly $1 billion. Meanwhile, short interest is rising against her funds, while options indicate that more people are betting against her.

The Ark Innovation Fund ETF (ARKK), as we saw in the chart earlier, is squarely in the Red Zone.

Investors are advised to steer clear of this ETF for the time being.

Given that the Innovation Fund is an ETF, it holds a large number of other stocks. Each of these stocks requires greater examination to understand why the ETF’s price is rising or falling. Using TradeSmith Finance, the warning signs are quite revealing.

Based on the portfolio’s 10 largest holdings, the ETF faces extremely difficult market conditions and extremely high risk in its holdings. Below, you’ll find these 10 holdings, the stocks’ tickers, and the relevant TradeSmith Finance indicators.

As you can see, TradeSmith Finance has raised concerns about risk, momentum, and action to take (buy, hold, or sell) on nearly every stock.

Top 10 Holdings – ARK Invest*

| Company (Portfolio Weight) | Ticker | TradeSmith Finance Indicators |

| Tesla Inc (9.99%) | TSLA | Yellow Zone, Sidetrend, Sky High Risk |

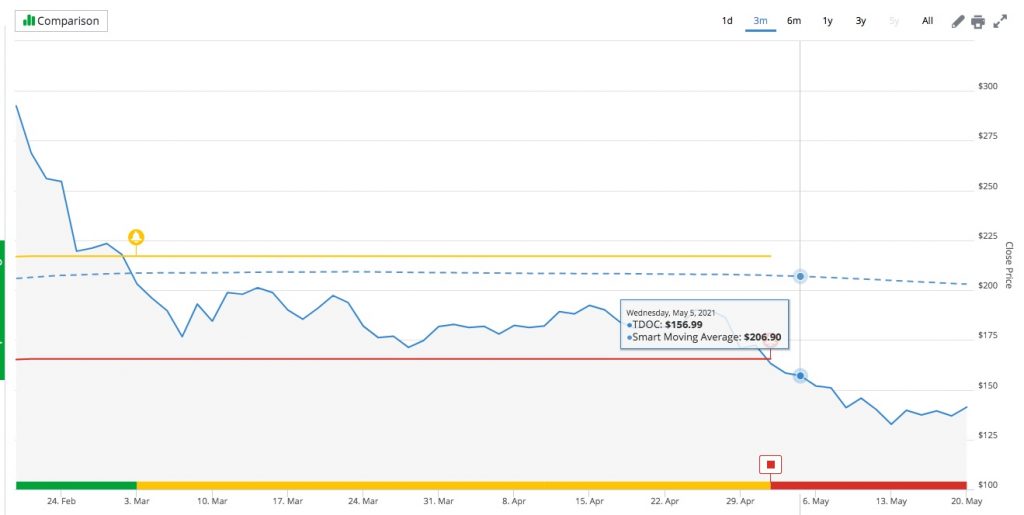

| Teladoc Health (6.02%) | TDOC | Red Zone, Sidetrend, High Risk |

| Roku Inc. (5.73%) | ROKU | Yellow Zone, Sidetrend, Sky High Risk |

| Square Inc. (4.34% | SQ | Yellow Zone, Up Trend, High Risk |

| Zoom Video Communications (4.14%) | ZM | Yellow Zone, Sidetrend, Sky High Risk |

| Shopify Inc. Class A (4.04%) | SHOP | Green Zone, Sidetrend, High Risk |

| Zillow Group (3.51%) | Z | Red Zone, Up Trend, High Risk |

| Twilio (3.47%) | TWLO | Yellow Zone, Up Trend, High Risk |

| Spotify Technology (3.44%) | SPOT | Red Zone, Sidetrend, High Risk |

| Unity Software (3.40%) | U | N/A |

Right now, only Shopify (SHOP) is in the Green zone out of the fund’s top 10 holdings (note, we require more data on Unity Software since it hasn’t been trading long enough to have a Health Indicator or VQ ranking). Teladoc, Zillow Group, and Spotify Technology — all in the Red Zone — comprise more than 13% of the portfolio.

While ARKK remains under pressure, Wood’s funds are still buying more and more shares. Wood even sold off nearly every remaining share of Apple (a Green Zone stock) to purchase additional Tesla shares this week.

Teladoc – An Error in Doubling Down

Despite Teladoc falling beyond our recommended stops, Wood has bought more of the stock. On May 5, Wood purchased another $51.15 million in TDOC stock. Since then, shares have fallen from nearly $157 to about $137 (or 12.7%).

Wood could have avoided that other downturn and misallocation of capital if she had used trailing stops and walked away from this struggling stock. Teladoc hit its trailing stop and fell into the Red Zone two days before she bought the next round of stock.

Wood continues to double down on several companies that are struggling.

Recently, Wood boosted the fund’s position on Coinbase (COIN), effectively doubling down on the flailing cryptocurrency exchange.

Although TradeSmith Finance lacks enough data to fulfill all indicators, it would likely sit in the Red Zone due to the stock’s incredible downturn since its initial public offering (IPO).

The lesson here? As I’ve mentioned before, it’s important to have your exit strategy in place, follow that plan, and resist the urge to invest even more in a stock that has proven to be unhealthy.

On Monday, I want to show you a different way to approach the market. You might think that there are only a few different types of stocks that you can or should own. But I’ll reveal the top class of stocks by market capitalization.

And the returns since the start of the year will surprise you.