“The investor’s chief problem — and even his worst enemy — is likely to be himself.”

— Benjamin Graham

I’m going to give you a statistic that makes no logical sense.

Ready?

According to a 2018 study by AAA, 73% of people believe they are above-average drivers.

Do you see the problem with this number?

Even though about 90% of accidents are caused by human error, about three-quarters of people believe they are better-than-average behind the wheel.

If you put these people on a bell curve, 50% of drivers would have to be below average.

The other half would be above average.

This skew results from an interesting and damaging bias in economics, finance, and human psychology: Overconfidence Bias.

This week, I’m digging deeper into human behaviors and biases that can and will affect your money.

Let’s explore the phenomenon of Overconfidence Bias and lay out best practices to help you mitigate it.

The Risks of Overconfidence

What does it say that 65% of people believe they have “above-average intelligence”?

Again, this is impossible since only 50% of people could be smarter than the mean IQ.

As an investor, this factor matters greatly.

Dr. Daniel Kahneman, who won the Nobel Memorial Prize in Economic Sciences, calls overconfidence “the most significant of the cognitive biases.”

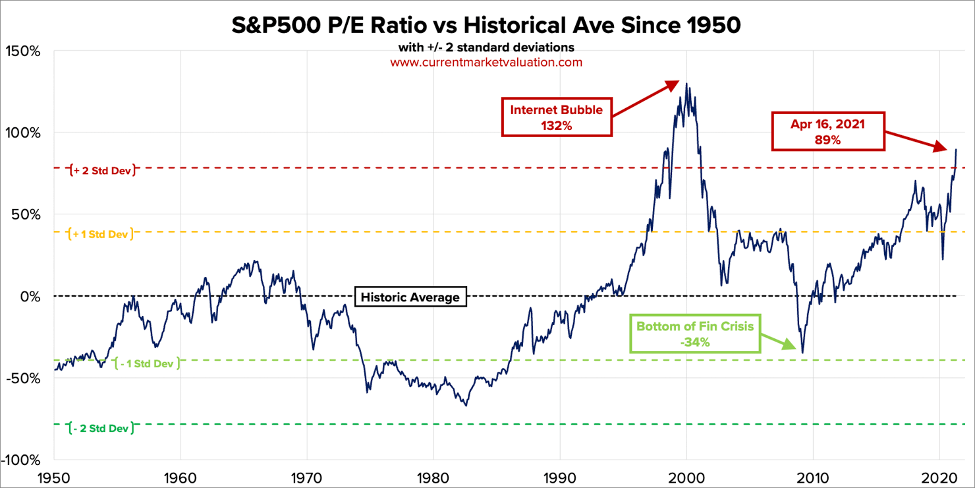

People drastically overestimate their understanding of the financial markets and investments. As a result, investors might engage in more risky behaviors that they believe can outperform the market.

But it’s not just retail investors like you or me who can fall into this trap.

Behavioral economist James Montier conducted a 2006 study of 300 fund managers and asked a simple question. Are they better than the average analyst in their abilities? As you might expect, the number who deemed themselves a better-than-average analyst was higher than 50%.

The tally was 74% of money managers saying they were above average.

Meanwhile, of the other 26%, most of these respondents said they were “average.”

Very few people said they were “below average.”

It’s amazing how this overconfidence is consistent across many professions and levels of financial expertise.

Overconfidence Breeds More Errors

Overconfidence is also a lethal bias because it can accelerate other behavioral errors that can cost you money.

Steven Pressman, an economist who studies financial fraud, determined that overconfidence bias is a primary reason why so many investors are susceptible to Ponzi schemes and other scams.

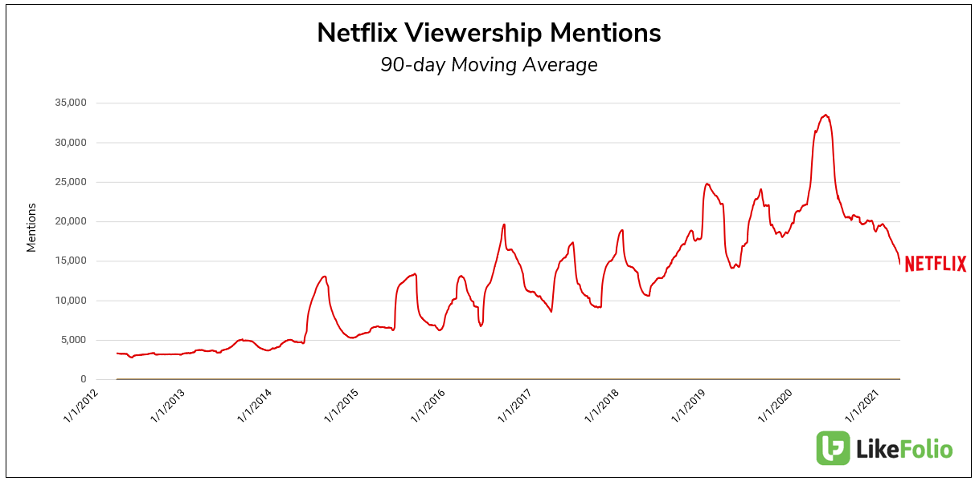

Overconfidence can also fuel an urge to engage in too much trading. Despite evidence that over-trading can impact performance and reduce returns, this bias has accelerated a self-attribution bias when a trader succeeds or fails.

Investors will attribute their success to their research but blame financial losses on things outside their control (like the Federal Reserve or public policy).

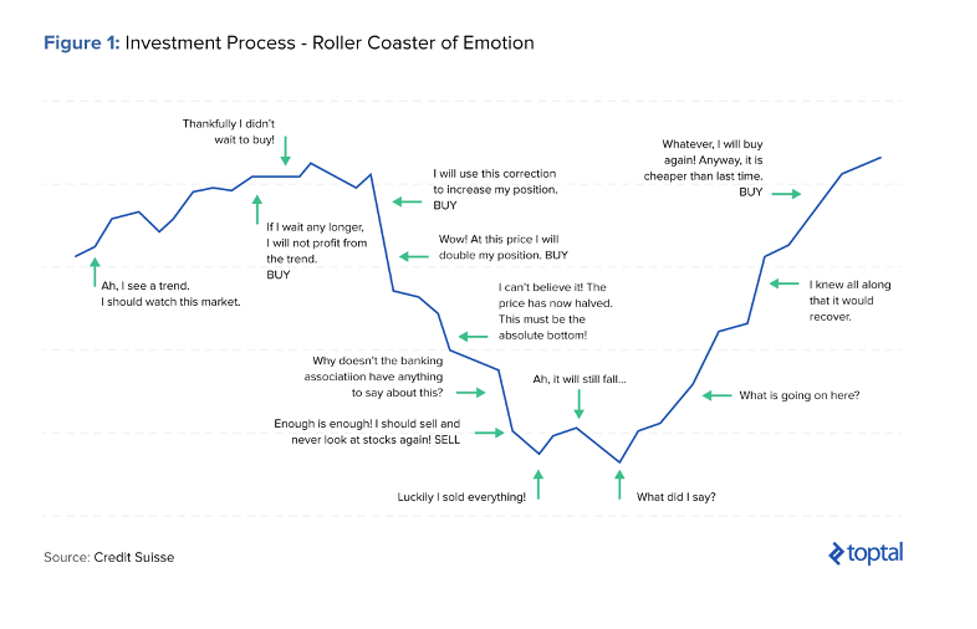

This cognitive process will create a feedback loop that drives them to engage in more risky behavior while failing to recognize the source of any underperformance (their confidence).

This can also compound overconfidence in their ability to time the market and the illusion that they have greater control of the markets than they really do.

How to Overcome Overconfidence

Many economists and psychologists argue that overconfidence bias is the single most challenging bias to overcome.

Why? Because we can regularly spot overconfidence and risk-taking in other people’s behaviors.

Yet, we commonly fail to recognize it in ourselves.

Even when other people tell us that we are taking unnecessary risks, we might ignore them or try to justify our behavior.

It’s very difficult to eliminate our biases because our subconscious primarily drives them.

However, there are three practices that we recommend to limit this specific bias.

The first is to understand the power of more information.

It’s absolutely critical that you have an open mind when evaluating investments. Before putting your money to work, it’s valuable to assess the investment from all sides.

When you can combine a wealth of different tools, you can expand your conviction. When your conviction is backed by multiple fundamental, technical, and behavioral strengths, the better your probability for success.

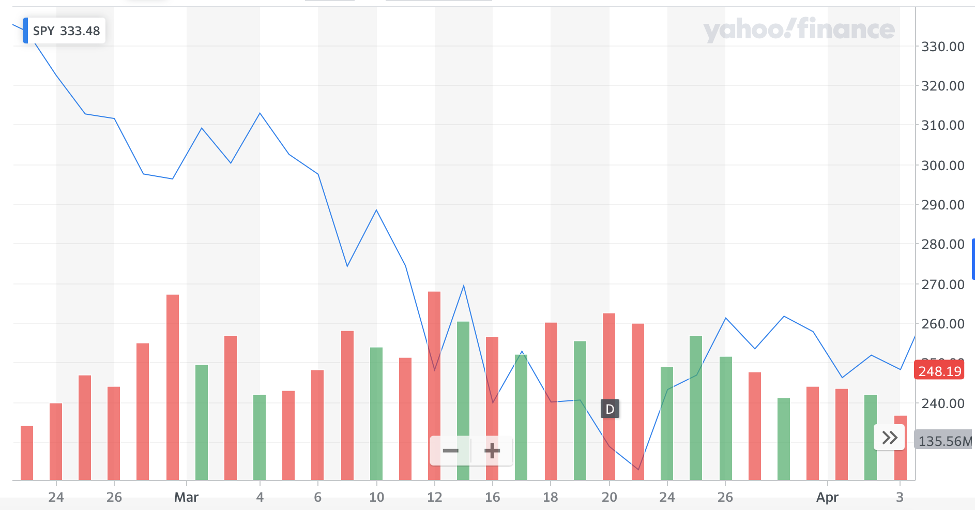

Second, evaluate your performance on an annual basis. If you have built a concentrated portfolio, it’s important to compare it against a benchmark like the S&P 500. If you are regularly underperforming the market, consider using exchange-traded funds (ETFs) or other more passive investments that might better mirror market-based returns.

Third, consider trading less and investing more often.

This practice means you take a less active approach to the markets with a longer timeline. You must remember that active trading puts you up against a wealth of market actors like high-frequency traders, hedge funds, and other actors who have significantly more resources than retail investors.

At TradeSmith, we build technology that helps investors better control their emotions.

Our Green/Yellow/Red Health Indicator zones offer a proven system that tells you when it’s safe to own a stock and when you should sell.

We are also adamant about using customized trailing stops to eliminate the emotions linked to every investment.

Trailing stops can give you the confidence to “set it and forget it” and eliminate the temptation to jump in and out of positions.

Finally, we know that many of you are regular newsletter readers. You must have confidence in the experts. But consider maximizing your conviction and confidence in each pick by checking each position’s health before buying a stock.

It would look something like this …

You get an alert (yes, our system does this) that tells you your favorite newsletter writer released a new “buy up to” stock recommendation.

You click on that and log into our system. There, you can then see whether that stock is red, yellow, or green.

You could choose to buy it no matter what, but maybe your new rule is you want “confirmation” in our system, too.

That means you only buy if it’s green in our system.

Then, you look at how risky it is and use our Position Size Calculator to help you take on just the right amount of risk when buying that stock.

That’s real confidence and conviction. It’s how I like to buy my stocks, and I think you should, too…

Because it can mean the difference between devastating portfolio losses…

Or knowing the exact day to enter any stock for massive gains.

You can start overcoming your Overconfidence Bias today by going here.

In the meantime, I’ll be back to discuss other biases during a very busy earnings week.