I used to think the Kaplan family was abnormal …

Every night, it’s the same thing.

“What do you want for dinner?”

“I don’t know. You?”

“How about pizza?”

“Nah, I’m not in the mood for that. Burgers?”

Ugh … and it keeps going.

But I learned this is pretty common. I bet you have that same conversation a lot!

Think about how you make decisions.

Think about buying a TV or taking a vacation. Or even how you ponder dinner.

It’s all gut feeling and a mix of research, depending on what we’re talking about here.

But, in terms of personal finance and growing wealth and retirement…

Why do people (I’m talking to you) make the decisions they do with their money?

That is a central question to the study of behavioral finance.

Don’t get caught up in the word “behavior.” It’s not as dull as it sounds.

You see, for decades, economists and academics thought the markets were rational.

But human beings… we know they aren’t rational.

The ability to keep your emotions in check is very challenging with investing.

It’s much harder than picking stocks and engaging in research.

But I have a plan for you.

Once you master your emotions and master your behavior, you can exploit the misbehavior and the irrationality of markets and other investors.

Today, I’m kicking off a six-part series that we’ll revisit over the course of the next few weeks on cognitive bias, behavioral finance, and mastering emotions.

This is important for you to understand. We are not different.

In the past, you may have heard me describe myself as “the world’s worst investor.” But I’m far from that now – because I’ve got a proven, backtested system to help me overcome my emotions as an investor.

And you can do it, too.

Behavioral Finance 101

Let me ask a few questions.

Do you find yourself checking your investing accounts 15 times a day?

Are you jumping in and out of stocks in a frenzy?

Do you see it go up and say to yourself “I’m selling to lock in my profits …”

Or the stock goes down, “I have to buy more to break even. You know, it’s coming back up for sure.”

Have you ever bought a stock at an all-time high – promising that you’ll own it for years – only to sell it at a 5% to 10% loss a week later?

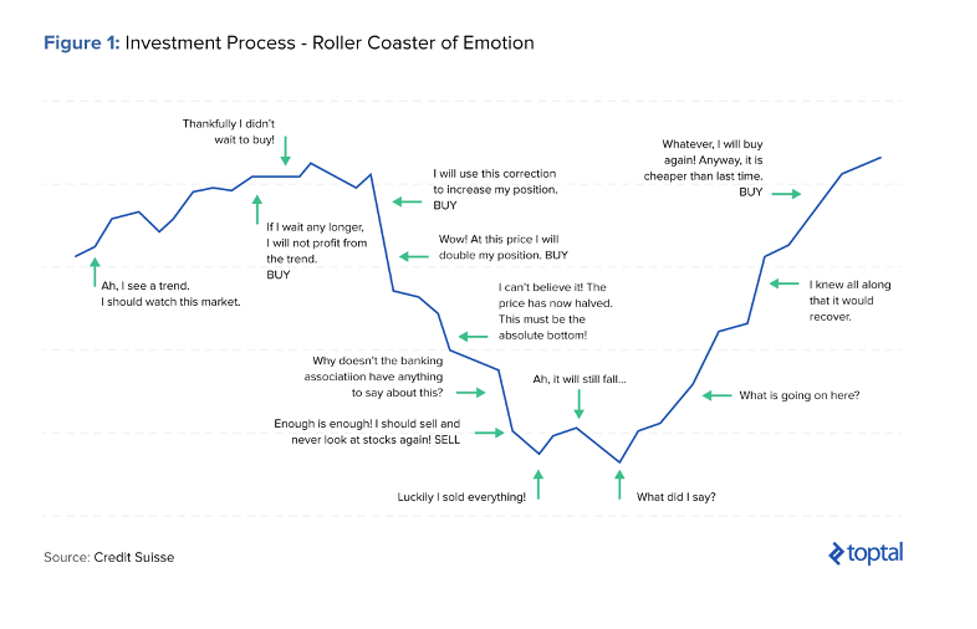

Does this chart from Toptal and Credit Suisse feel familiar to you?

I’ve been there. A LOT!

All of these questions and ensuing actions are rooted in human bias and emotion.

There is something in our brain that makes us irrational when it comes to money.

Great minds are studying this at the Ph.D. level, and even they will admit that they can’t get to the fundamental reason we behave this way. There are theories. There are arguments.

But we’ll probably be living on Saturn before we truly understand ourselves.

Our cognitive bias forces many of us to make fundamental mistakes with our investments.

We kick ourselves when we buy high and sell low. We doubt our ability to manage our own money because of mistakes that we essentially make as novices.

And this happens to legendary investors, billionaires, and hedge funds. There are humans everywhere and they’re always pacing in their minds around money.

Before we dive into this, I want you to know two things.

First, you can manage your own money better than a so-called expert.

You simply need to overcome these behavioral challenges.

Second, everyone makes these mistakes in their lifetimes.

It doesn’t matter if you’re a new investor or a person with three master’s degrees in economics and finance.

Dr. Daniel Crosby is a renowned behavioral finance expert and author of The Laws of Wealth: Psychology and the secret to investing success.

His research shows that wealth advisers typically do an excellent job of educating their clients on managing cognitive bias.

However, wealth managers fall into the same behavioral traps as retail investors when it comes to their money.

Crosby notes that the best financial advisers are great at giving advice, but they’re terrible at following their own.

This should give you some comfort in knowing that we’re all human.

But it should also motivate you to take a step back and discover how you can improve.

So, let’s take a look at some prevalent cognitive biases that can impact your money.

As I said earlier, I’ll dive into each of these concepts in depth over the next few weeks.

Not only will I talk about three subcategories of each topic, but I’ll offer you some tips to help you overcome these behaviors. I’ll also show you how our technology can help you mitigate them.

The Basics on Bias

When it comes to human bias, these are the four categories that require deep inspection.

Overconfidence – Perhaps the most dangerous human bias, overconfidence, stems from a fundamental belief in our ability to control time and outcomes. I will talk more about something called the desirability effect. This is the belief that something will happen simply because we want it to occur. For example, think about the person who tells you that a stock trading at $50 is going to $100 but has offered zero fundamental, technical, or rational insight into how or why that will occur. Would you buy that stock? Many people would just buy a stock due to the confidence of the person offering that information.

Portfolio Construction – It’s very common for investors to jump in and out of stocks. It’s also very common for people to only buy what they know. How often do people tell you to go out and buy the stocks of the products that you buy, like Coca-Cola? The desire to buy “familiar” stocks is an extraordinary bias that limits your universe of opportunities and returns. At TradeSmith, we want to beat back this bias and show you a world of companies that present lower risk and higher upside potential. You might never know what these companies even do, but our Green Zone stocks present true profit potential based on our algorithms. I’m also going to talk about the issues of Framing, Mental Accounting, and Familiarity Bias.

Loss Aversion – This is the tendency for investors to focus more on preventing losses than making profits over the long term. Ask around. I bet your friends and family would rather not lose $1,000 than make $2,000. Human beings are terrified of losing, and the more losses they experience, the more loss-averse they will become. This is the reason why people sell low regularly. When I discuss this in more depth, I’ll show you the straightforward tool that can help you overcome this bias.

Information Breakdown – Perhaps you’ve heard of the gambler’s fallacy. This the belief that patterns are common in gambling and investing. If you flipped a coin, what is a more likely outcome? Heads-Heads-Heads-Heads or Heads-Tails-Heads-Tails? If you answered the former or the latter, you made an error. Both are just as likely to occur. That’s not the only informational bias that exists. There is attention bias, which fuels a desire to purchase a stock that Jim Cramer is yelling about. When I break down information bias, I’ll show you how to separate the signal from the noise.

Finally, we’re going to beat back all of these biases and show you the exact tools you can use to ensure you can invest with confidence.

TradeSmith is designed to help you sleep better at night.

What we offer is more than just a set of tools. It can be a life enhancement.

What would you do if you weren’t checking the market 15 times a day?

What else would you do with your time if you didn’t spend it worrying about your retirement?

What if you could be less active in the markets?

If any of that sounds good to you, why wait?

Let us help you overcome these biases together.

Over the weekend, try to think about the types of rationalization you make for buying and selling stocks. Document it and even send us an email at [email protected] about it!

Give me a few weeks, and I assure you, you’re going to have far more faith in yourself and your money than ever before.