As a rule of thumb, regulation is good for established players. It helps the strong get stronger and the big get bigger, by making it harder to break into a space.

Take data privacy rules around e-commerce and social media, for example. On the one hand, the big players in e-commerce and social media don’t like these rules. They are burdensome, expensive, and add to the cost of doing business.

On the other hand, the giants think these rules are great, because new competitors can’t afford to abide by them. When you have to spend tens of millions of dollars per year, or even hundreds of millions per year, on lawyers, data protection, and server compliance, your scale-based business is protected by a regulatory moat made out of headaches and expenses. Nobody can afford to follow you.

There is a comparable thing happening in cryptocurrency. The cryptocurrency space is not “the Wild West” anymore. Regulatory bodies are increasingly enforcing their authority in the space, punishing lawbreakers and threatening violators with rules and jail time.

This is the digital equivalent of state and federal marshals riding into California gold-rush towns. If you are running a crypto-related business outside the boundaries of compliance — or if you lack the necessary licenses — you are at significant risk of being called out and shut down.

This is good news for Bitcoin, though, because Bitcoin is far and away the dominant cryptocurrency, in a class all its own. Bitcoin is not too big to fail, but rather too big to stop. No government has the reach, or even the unified political will, to shut Bitcoin down.

This wasn’t always the case. For quite a while, Bitcoin was fragile enough to be vulnerable to regulatory action. But the monetary authorities of the world did not act quickly enough to stop it.

You may remember how government bodies in the United States and Europe reacted to Libra, the cryptocurrency project launched by Facebook. The regulators’ attitude was essentially, “Kill it with fire.”

Opposition to Libra was so vocal and visceral it bordered on hysterics. That is because, by the time Libra arrived, regulators had realized the potential implications of Facebook offering a form of global money, accessible to billions of people, in competition with sovereign fiat currency.

If government regulators had recognized the potential of Bitcoin earlier on, they would have had a reaction much like the Libra reaction. They would have gone out of their way to strangle Bitcoin, shutting down exchanges and imposing crackdowns before the Bitcoin network proliferated worldwide.

And now, as Bitcoin builds on its embedded global advantages, it enjoys the advantages of being a one-off incumbent.

No competitor cryptocurrency will follow the path of Bitcoin, in part, because Bitcoin already has a 10-year head start — it takes time to build insurmountable network effects — and in part because government authorities won’t let the Bitcoin phenomenon happen again.

This explains why Bitcoin shrugged at a press release from the U.S. Department of Justice (DOJ) on Oct. 8 announcing a new “Cryptocurrency Enforcement Framework.” U.S. Attorney General William P. Barr said the following in the second paragraph of the release:

“Cryptocurrency is a technology that could fundamentally transform how human beings interact, and how we organize society. Ensuring that use of this technology is safe, and does not imperil our public safety or our national security, is vitally important to America and its allies. I am grateful to the Cyber-Digital Task Force for producing this detailed report, which provides a cohesive, first-of-its kind framework for those seeking to understand federal enforcement priorities in this growing space.”

The release then cited FBI Director Christopher Wray, who added:

“At the FBI, we see first-hand the dangers posed when criminals bend the important technological promise of cryptocurrency to illicit ends. As this Enforcement Framework describes, we see criminals using cryptocurrency to try to prevent us from ‘following the money’ across a wide range of investigations, as well as to trade in illicit goods like criminal tools on the dark web. For example, the cyber criminals behind ransomware attacks often use cryptocurrency to try to hide their true identities when acquiring malware and infrastructure, and receiving ransom payments. The men and women of the FBI are constantly innovating to keep pace with the evolution of criminals’ use of cryptocurrency.”

The Cryptocurrency Enforcement Framework is a hefty 83 pages. You can access it here via DOJ website.

In their zeal to highlight the illegal uses of cryptocurrency, the DOJ and FBI seem to conveniently forget that good old cash — the stuff we all hold in our purses and wallets, or used to anyway — has long been hard to trace and used for secretive transactions.

Nonetheless, the enforcement efforts moving forward are likely to be real and substantial, and many weaker cryptos will be splattered like bugs on a windshield.

We literally saw this coming years ago. In 2018, as we laid out the foundations of a bullish Bitcoin case to Decoder subscribers, we simultaneously warned that the so-called “privacy” coins, and other crypto assets designed to skirt government laws, were an invitation to get busted.

Bitcoin, though, will do just fine — as we first explained years ago — because the Bitcoin use case does not depend on self-styled libertarians protesting against “the man” or criminal transactions in the low four figures.

Instead, the future of Bitcoin — as a sovereign store of value, an inflation hedge, and a global reserve asset on par with gold — is well above board and out in the open, in full compliance with all legal norms.

To put it another way, Bitcoin will not go head-to-head with the existing financial system. It will transform it from the inside out.

The adoption of Bitcoin as a corporate treasury asset — as we recently wrote about with Square — is a clear example of this.

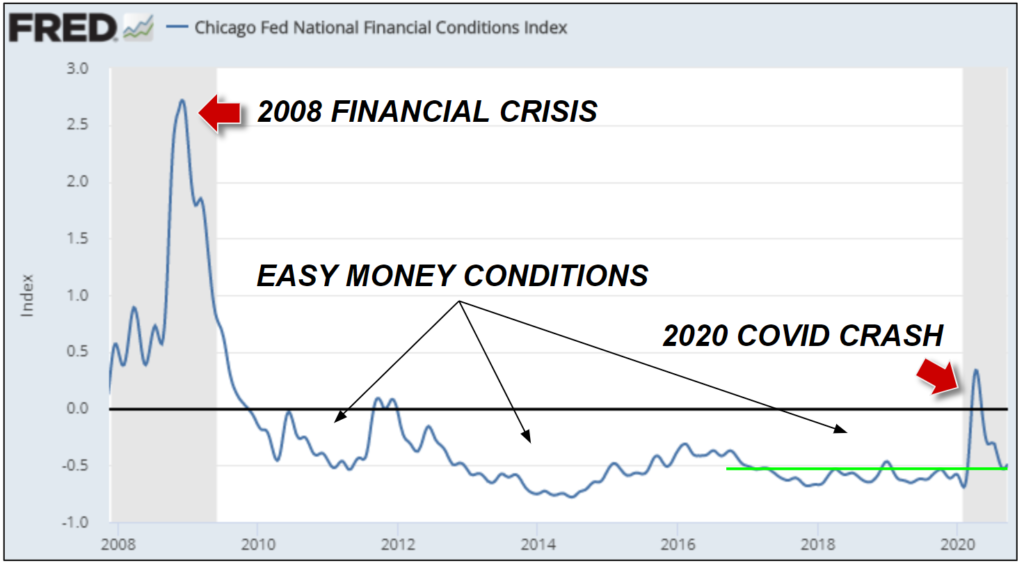

At first, U.S. corporations are likely to hold a single-digit portfolio percentage of Bitcoin, as a fiat currency inflation hedge, while continuing to hold the vast majority of their reserves in fiat-denominated assets. But over time, as the performance of Bitcoin gets better — and the performance of fiat gets worse — the average percentage allocated to Bitcoin will grow larger.

Another milestone we anticipate — and this could happen a year from now, or it could happen tomorrow — is the announcement from a small country’s central bank that, in addition to gold and fiat reserves, Bitcoin has been added to the sovereign reserve mix.

This is the pathway to Bitcoin’s full maturity as a global reserve asset, and it has nothing to do with illegal activity at all. If anything, government enforcement actions to clean up the cryptocurrency space will help speed up Bitcoin’s path to dominance, in the same way top-down law enforcement efforts in California gold-rush towns made them more desirable places to live.

In terms of cryptocurrency investments other than Bitcoin, the key thing to remember is that, if your preferred crypto asset is dodgy or sketchy, or appears to be skirting compliance rules in any way, there are real and rising risks to consider.

The crypto space is being forced to grow up. This is sad, in a way, but also necessary to achieve world-changing scale. Trillion-dollar industries don’t scoff at rules; they help shape and create the rules.

Taking the government head-on is like picking a fight with a 1,000-pound gorilla. It doesn’t make much sense, and never really did.

It is possible, though, to grow strong and powerful in the shadows, sheltered by obscurity for a number of years — and then to challenge the authorities indirectly, in a way they can’t stop. That is what Bitcoin did.

It’s also important to remember that the specific authorities being challenged by Bitcoin — the ones whose power is under threat — are not the Department of Justice or the FBI, but rather the U.S. Treasury and the Federal Reserve — the stewards of the world reserve currency. Bitcoin is an opt-out mechanism for out-of-control debt creation and fiat currency dilution, and a form of peaceful protest against mismanagement of sovereign assets. Those functions can comply with DOJ and FBI guidelines just fine.

And with Bitcoin on a path to institutional adoption at scale, muscular expressions of regulatory enforcement action — like the DOJ’s “cryptocurrency enforcement framework” — will only help it now, by removing questionable competitors and cleaning up the “Wild West” crypto space.