Financial conditions are tighter right now than they’ve been in years.

That might sound surprising. After all, the Federal Reserve, and the U.S. government, have taken unprecedented measures in 2020.

The Federal Reserve has expanded its balance sheet by trillions, made a promise to support the corporate bond market, and said interest rates will stay near zero until 2023.

The U.S. government, meanwhile, has spent trillions of dollars on fiscal relief.

And yet, financial conditions are still tight. We can see this by looking at the National Financial Conditions Index (NFCI), a benchmark created by the Chicago Federal Reserve.

To determine whether financial conditions are tight or loose, one has to consider more than just interest rates. There are factors like the total volume of loans being originated, whether borrower requirements are strict or relaxed, how much credit is flowing through the shadow banking system (lenders outside the traditional banking sector), and so on.

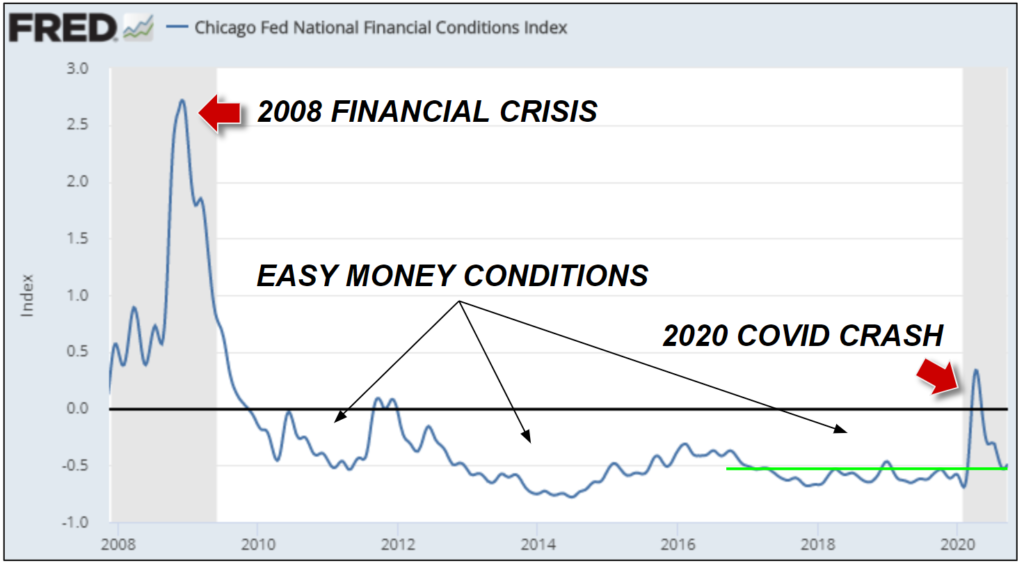

The NFCI combines multiple inputs, like the ones described above, to come up with a numeric score. If the NFCI score is above zero, financial conditions are tighter than average. If the score is below zero, financial conditions are looser than average.

We can see how this works in the NFCI chart below, dating back to 2008.

In the chart, the giant spike in 2008 represents a near-fatal tightening of financial conditions.

That spike came immediately after the collapse of Lehman Brothers, a highly leveraged Wall Street investment bank, at a point when the global banking system teetered on the brink of failure.

At that point, the banks were afraid to lend to anyone, or even transfer funds back and forth, because nobody could tell who was solvent and who was not.

After the 2008 crisis, the NFCI fell below zero, noted by a black line on the chart. This was a result of easy-money policy and the eventual implementation of Quantitative Easing (QE) by the Federal Reserve.

As the chart shows, the U.S. economy has seen an extended run of easy-money conditions that has lasted more than a decade, first kicking off in late 2009.

In 2020, though, the NFCI saw another significant spike as the chart also shows. That was the 2020 COVID-19 crash, coupled with lockdown-related stress on the banking system.

The Federal Reserve and the U.S. government acted immediately after the 2020 crash, responding much more quickly, and with far more monetary and fiscal firepower, than they did in 2008. That response caused the spike to reverse, and financial conditions to immediately loosen.

Here is the thing, though. As of September 2020, financial conditions are still tighter now than they’ve been for the past several years.

The bright green line on the chart shows a rough ceiling that has held, most of the time, since 2017 on. Today the NFCI is still above that line, showing that looser conditions existed for most of the past three years.

This is a concern because the U.S. economy is still incredibly vulnerable right now.

U.S. home sales are at a 14-year high — a genuine bright spot for the economy — but U.S. retail store closings hit a record in the first half of 2020, and bankruptcies and liquidations are on pace for a new annual record.

At the same time, mortgage standards have tightened dramatically, reducing access to credit or cutting it off completely for most Americans. Banks are still willing to lend, to some degree, but only to the top tier of borrowers as judged by credit risk.

“Despite another interest rate drop, demand for refinancing and purchasing mortgages fell last week,” CNBC reported today (Sept. 30). This is likely because the pool of qualified buyers is shrinking. Housing demand is strong, but fewer Americans are qualifying for loans.

This is one of the reasons the Federal Reserve feels maxed out in terms of monetary policy impacts. Financial conditions, already tighter than the past few years, could tighten further as more businesses close, more loans go into default, and more Americans see their credit scores drop.

One possible source of market optimism this week was news that House Speaker Nancy Pelosi and White House Chief of Staff Mark Meadows feel “hopeful” about the prospects for a new fiscal package.

House Democrats released a modified plan this week with a $2.2 trillion price tag, and House Speaker Pelosi and Treasury Secretary Steven Mnuchin have resumed negotiations.

If the new fiscal package gets through, markets could take that as a significant positive. If not, though, a persistent tightness of financial conditions could mean more pain ahead.