The more we learn about last week’s blow-up of Archegos Capital Management — a family office that behaved far more like a gunslinger hedge fund — the bigger, stranger, and fishier it looks.

A number of things about the blow-up don’t make sense — unless you factor in actions and motivations like market manipulation, shady dealing, and possibly even straight-up fraud.

At this point, we expect to see shareholder lawsuits against the banks that lost billions in the meltdown (and the losses are apparently huge; more on that shortly). Nor would we be surprised to see civil or even criminal charges.

Even if no fraud occurred and no charges are filed, the situation is disastrously ugly for the banks that ate huge losses from this episode (which may not be over yet).

At minimum, the risk management departments of these banks failed utterly and horribly, which would suggest they learned nothing from 2008, or 2013, or 2018, or 2020, or any other year in which a meltdown large or small led to brutal unchecked losses for overleveraged players.

Then, too, there is a pressing and serious question: How many other hedge funds are using the wildly aggressive derivative strategies Archegos made use of to leverage their portfolio up to the eyeballs?

And how many other funds have insane levels of risk exposure tied to just a handful of stock positions? If we find out these answers the hard way, it could mean another face-melting drop in the Nasdaq and in technology stocks generally (where the nutty behavior seems to be concentrated).

There are so many fishy aspects to this story, it’s hard to know where to start. Perhaps we should begin with the family office angle.

A “family office” is just what it sounds like — an office full of money managers and wealth preservation specialists whose job is to deploy, preserve, and protect the assets that make up a family fortune.

The idea is that, if the fortune of a single individual (or family) grows large enough — say well into the hundreds of millions, or even the billions — it makes sense to create a standalone wealth management unit to run things.

It’s also a routine occurrence to see retired hedge fund managers — individuals who have amassed a large fortune — quit the business of managing outside money, at which point they create a family office to manage their own substantial holdings.

But here is the thing: The No. 1 job of a typical family office is to preserve wealth, not grow it. Adding more money to the pile is of course a welcome thing; but when the pile is already a gigantic mountain, the main focus is on making sure the mountain never disappears.

This makes sense when you consider the degree to which different investors have different objectives. Anyone with a family office is, almost by definition, fantastically rich; as such their primary goal is to maintain that fantastically rich status, not to take crazy risks.

Then, too, if a family fortune is already in the billions, why would someone bet the farm to make even more billions, unless they aspire to be a James Bond supervillain?

It is one thing to grow a multi-billion fortune by increasing the shareholder value of a successful company that has turned into an empire, in the manner of, say, a Bezos or a Zuckerberg or a Gates.

It is another thing entirely to have $5 billion to $10 billion in liquid assets and then trade the funds with such reckless abandon, as if they were a $1,400 “stimmy” allotment in a Robinhood Account.

So the first thing that doesn’t pass the smell test, in regards to the Archegos blow-up story, is the fact that billions were being wagered on an all-or-nothing basis in the first place. Family offices just don’t behave that way, unless the patriarch or matriarch has lost their mind.

The second fishy thing is the stock performance of the stocks involved in the blow-up. While Archegos wound up facing a $20 billion liquidation in multiple names, two of the biggest drops were in ViacomCBS (VIAC) and Discovery Inc. (DISCA).

For VIAC and DISCA, the thing that sticks out like a sore thumb is the price performance of both names prior to last week’s meltdown.

By the third week of March, just prior to the blow-up, VIAC had delivered a more than 170% gain year-to-date. That is one heck of a gain for a media conglomerate with a market cap in the tens of billions.

At the same time, DISCA — another middle-of-the-road media roll-up, which owns cable channels like HGTV and Animal Planet — had climbed more than 156% on the year by the third week of March.

The hot properties in media today are Disney and Netflix, not the keepers of the Food Network and MTV. So why in the world did these stocks act like they had Tesla juice in the weeks before blowing up?

Our hunch — and it is just a hunch — is that Archegos was playing games in these and other names, and the games involved creating artificial run-ups by taking huge positions on margin with the intent purpose of squeezing the share prices.

It seems crazy to think a multi-billion family office would try to squeeze some old media names in a manner so reckless as to generate triple-digit returns over the course of weeks — but then it’s even crazier to see a pool of assets in the $5 billion to $10 billion range generate $20 billion worth of liquidation.

The next thing about the Archegos blow-up that stinks to high heaven is the fund’s use of a derivative called “total return swaps.”

In the Berkshire Hathaway annual letter for 2002, Warren Buffett wrote about total return swaps in relation to Long-Term Capital Management (LTCM), the biggest hedge fund blow-up in history at the time. Here is some of what he said:

One of the derivatives instruments that LTCM used was total-return swaps, contracts that facilitate 100% leverage in various markets, including stocks. For example, Party A to a contract, usually a bank, puts up all of the money for the purchase of a stock while Party B, without putting up any capital, agrees that at a future date it will receive any gain or pay any loss that the bank realizes.

Total-return swaps of this type make a joke of margin requirements. Beyond that, other types of derivatives severely curtail the ability of regulators to curb leverage and generally get their arms around the risk profiles of banks, insurers and other financial institutions. Similarly, even experienced investors and analysts encounter major problems in analyzing the financial condition of firms that are heavily involved with derivatives contracts.

When Charlie and I finish reading the long footnotes detailing the derivatives activities of major banks, the only thing we understand is that we don’t understand how much risk the institution is running.

The derivatives genie is now well out of the bottle, and these instruments will almost certainly multiply in variety and number until some event makes their toxicity clear… Central banks and governments have so far found no effective way to control, or even monitor, the risks posed by these contracts… In our view, however, derivatives are financial weapons of mass destruction, carrying dangers that, while now latent, are potentially lethal.

What Buffett said about total return swaps nearly two decades ago is still true today, as evidenced by the Archegos blow-up.

Archegos apparently used total return swaps — along with another form of derivatives known as Contracts for Difference, or CFDs — to establish huge leveraged positions in various names (like DISCA and VIAC) without having to disclose the fact it had a position at all.

Here is the quick version of a how a total return swap works:

- A hedge fund calls up its prime broker — which is typically the unit of a big bank — and says “we would like to have ownership exposure to XYZ without owning it on the books.”

- The bank says “sure, we can do that — we’ll buy XYZ on your behalf, and keep it on our own books, and create an agreement by which your account sees the gains or the losses.”

- The bank then buys XYZ on behalf of the fund, and holds the stock on its own books, while assigning the profit or losses to the fund.

- The bank collects a fat fee for providing this service. The fund gets to own a position without anyone knowing that they own it — because it’s on the bank’s books, not theirs — and typically completes the transaction with huge leverage.

In most cases, investors have to abide by Regulation T, which says that you can’t buy stocks in your brokerage account with leverage greater than two times.

Also in most cases, if a fund has a stock position above a certain size, they have to report the ownership of that position to the Securities and Exchange Commission (SEC) in something called a 13-F filing, which is then made available for the world to see.

And yet, total return swaps completely avoid those rules. With a total return swap, you can assume the risk of a huge position with no disclosure of the fact you are long or short — and the SEC says this is okay because, technically, the bank is the beneficial owner, not you.

Then, too, you can use total return swaps to take on ridiculous amounts of leverage — because it is a derivative contract designed by the bank — which means instead of Regulation Leverage, you can pile on as much leverage as you want, or rather whatever the bank allows.

In the Archegos blow-up, the positioning in VIAC and DISCA and other names was taken via total return swaps and contracts for difference (CFDs), which explains why the leverage was so high — and also explains why nobody knew what Archegos was holding, other than the banks themselves.

But wait, the story just keeps getting murkier.

It is normal for a large fund to have multiple “prime broker” relationships. A prime broker is like a normal brokerage account except on steroids; prime brokerage is a special service set up by big banks to cater to the whims and needs of large funds.

A prime broker will do much more than just execute the trades for an account. They will also write custom derivatives contracts (like total return swaps), help identify and manage exotic investment opportunities, provide research, and do a number of other things for the client. It is a very lucrative business for the bank, to the extent an active fund can sometimes pay tens of millions per year in commissions and fees.

The reason it is normal for a fund to have, say, two prime broker relationships is because one acts like a primary and the other serves as a back-up; it is not unlike having a back-up generator for a building in case the electricity goes out.

But this is where things get weird for Archegos: The fund apparently had not one or two active prime broker relationships, and not three or four, but rather six or seven at least.

Who needs half a dozen more prime broker relationships? To a certain extent, the services these banks offer are much the same; that level of redundancy makes no sense. It is like not only having a back-up generator for the building, but a third…and a fourth… and a fifth and sixth and so on.

There is a reason, however, why Archegos might want to collect prime broker relationships like baseball cards: It may have helped them get more leverage.

Let us say that prime broker A gives Archegos a whole bunch of leveraged exposure to a handful of stocks via total return swaps. The risk management department says it is fine; the risk is within tolerable limits according to their numbers.

Then let us say Archegos goes to prime broker B — without telling them about the leverage obtained via prime broker A — and gets a similar loaded-leverage position in the same group of stocks.

Then Archegoes goes to prime brokers C, D, E, and F, and so on, each time adding more leverage (via the equity derivatives Buffett once called “weapons of mass destruction”) without letting the other prime brokers know it is building a Godzilla-sized position.

The picture we are painting, so far, is one of shady dealings and market manipulation in which Archegos was deliberately building hugely leveraged positions — to a far greater degree than the banks realized — in a handful of positions, in order to drive the stock price of said positions sky-high, which would help explain why VIAC and DISCA had seen 150 to 170% gains in a short period of time before the blow-up.

There is one last thing: In order to pull off the kind of maneuvers we are describing, not just at small scale but at multi-billion scale, the mastermind of Archegos would have to be sophisticated — you don’t just pick up these tricks on the internet — and would also likely have a history of shady dealings.

Well, guess what: The man behind Archegos, Bill Hwang, was a former protege of Julian Robertson and Tiger Management, one of the most successful equity hedge funds of all time prior to its shutdown in March 2000.

As a high-profile money manager, Hwang also had run-ins with the SEC. In 2012, Hwang was forced to close Tiger Asia — his successful spin-off hedge fund that had been founded with seed money from Robertson — after admitting to insider trading charges.

After the insider trading scandal, Hwang had even been barred from doing business with top-tier banks like Goldman Sachs, likely as a result of operations risk and reputation risk.

But eventually Goldman Sachs relented and accepted Hwang’s new family office fund, Archegos Capital, as a client — because Goldman couldn’t resist tens of millions per year in lucrative fee-based business.

The last thing that is shady — and kind of amusing — is the manner in which losses were distributed among the bulge bracket banks who had Archegos as a client.

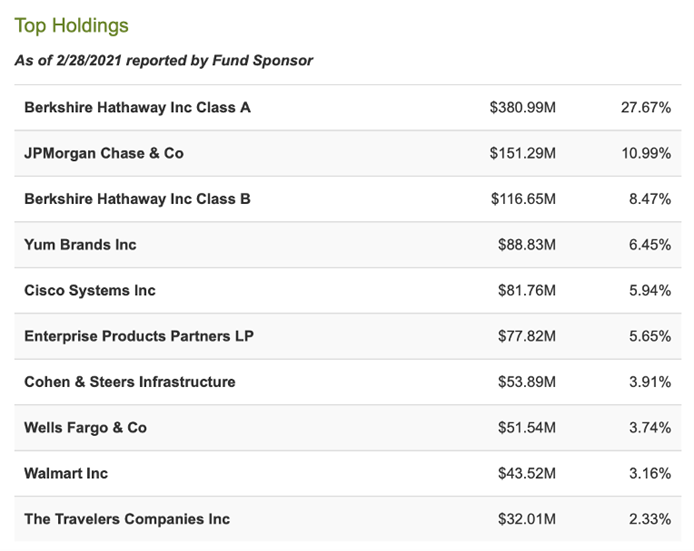

According to analysis from JPMorgan, the Archegos hit to bank balance sheets — for the unlucky banks not fast enough to get out of the way — could be as much as $10 billion.

Not only does this make Archegos the largest hedge fund blow-up in history — leaving LTCM in the dust — it is perhaps the first time a multi-billion hedge fund was not just rocked by its losses but completely zeroed out. (Even with LTCM and others, the losses were not greater than 100% — there was at least 10 cents on the dollar left.)

Two of the biggest losers in the Archegos spectacle appear to be Credit Suisse and Nomura, with Credit Suisse set to lose as much as $4 billion.

And yet, at the same time, Goldman Sachs had Archegos as a prime brokerage client, too — and Goldman has said its expected losses in the Archegos meltdown will be “immaterial,” meaning not enough to worry about.

So Archegos blows up completely, banks like Credit Suisse and Nomura eat billions in losses, and Goldman Sachs — who had comparable prime brokerage exposure — doesn’t lose anything worth noting? How does that work?

There is a wonderful movie from 2011 called Margin Call. It actually captures the situation perfectly.

Warning, spoilers ahead: The plot of Margin Call revolves around a Wall Street bank that realizes, to its horror, that the bank has billions of dollars in toxic derivatives positions on its books.

What the bank decides to do is sell out its toxic position as fast as possible in order to avoid getting burned; that in turn means burning the customers and counterparties whom the positions are sold to.

It sure looks like that is what Goldman Sachs did in relation to Archegos.

Our hunch is that Goldman realized the game Archegos was playing in terms of building up hugely concentrated equity positions through multiple prime brokers without disclosing its total exposure; decided to liquidate and get out of its Archegos positions as fast as it could; and then dumped its Archegos-related positions on the market in an emergency fire sale.

By moving so quickly, Goldman thus likely avoided the avalanche of losses that buried the likes of Credit Suisse, Nomura, and others; but by conducting the fire sale as fast as it could, Goldman may also have been a primary cause of the avalanche in the first place.

As mentioned, we expect investigations galore to come out of this, and shareholder lawsuits aplenty, and possibly even a congressional review of rules relating to total return swaps. And as we said, there might even be criminal charges.

But for investors, the relevant question is: How many other funds are out there with Archegos-style positioning?

And what happens if all the banks on the street now start looking at their total return swap exposures — particularly in concentrated tech stock positions — with orders from the top to either dial it back or shut it down?

At the end of the day, pigs get fat and hogs get slaughtered. It’s the same old Wall Street.