As CEO of TradeSmith, I’m on the road a lot.

I speak at conferences. I join panels at tech events.

I also receive many, many emails.

Questions are common across all platforms. I’m always happy to answer them.

You’d think that as CEO of a stock-tech firm, I’d get tons of questions about various stocks like Apple.

Or what technical indicators I like to use when looking at different equities.

Nope. Not even close.

Let me disclose the most common question I receive.

Then I’ll give you the answer.

I assure you: it will give you greater peace of mind as you start trading this week.

“What if…”

More retail investors than ever are actively trading stocks and options.

According to Vanda Research, retail trading flows peaked out at $1.2 BILLION PER DAY in February.

The wave of multiple rounds of stimulus has more Americans trading in the market.

No doubt, the GameStop swoon and the popularity of stocks like Tesla played a part, too.

We can also factor in the financial/stock research industry, which is booming on the retail side.

If you’re reading TradeSmith, you likely follow independent research names across the internet.

Or maybe you get access to Wall Street analysts’ reports or watch CNBC in the evening.

Many analysts have free or paid newsletters. These market analysts provide stock recommendations, crypto recommendations, options trades, and other forms of education and insight.

Sometimes the analyst recommendation has a price point with each Buy or Sell rating.

Other times it has a “buy up to” recommendation.

And they might include a “trailing stop” if the trade goes sideways.

People want to know how those recommendations align with TradeSmith’s powerful technology and technical analysis.

I’m asked all the time:

“What should I do if the expert I follow makes a recommendation that IS NOT in the Green Zone” on the TradeSmith platform?

I have two answers for this scenario.

And my first answer consists of two words.

“Be Patient”

At TradeSmith, our algorithms and quantitative analysis create real conviction on every public stock in the market.

Our Health Indicators consist of three signals.

And we make it very easy. Red, yellow, and green.

When the stock is in the Red Zone, you wait.

When the stock is in the Yellow Zone, you prepare to buy.

When the stock moves into the Green Zone, this is your “All Clear” (aka buy) signal.

You can buy the recommendation with confidence when it’s Green.

Let’s Look at an Example

Perhaps you read a newsletter from an analyst named James Jackson (I’m making him up).

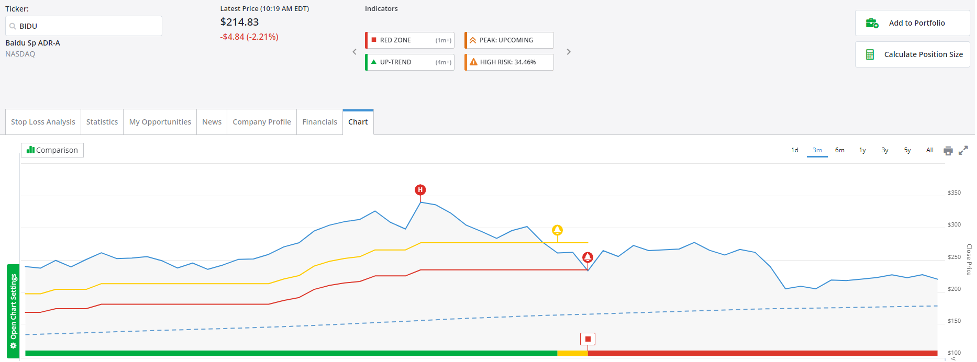

Let’s say James recommended Chinese e-commerce giant Baidu (NASDAQ: BIDU) on Friday.

James might argue that the recent pullback in BIDU stock makes it a buying opportunity.

He might offer some incredible insight into the expected growth of Chinese e-commerce as a catalyst.

He might say that this is the ultimate contrarian play in the market while everyone else is selling.

And right now – given the current political climate and questions about the Chinese economy – it could fit all of those boxes – on a qualitative level.

But it’s better to be certain than risk the threat of additional downside for this stock.

TradeSmith’s Green-, Yellow-, and Red-Zone indicators are based on the Risk (also known as Volatility Quotient) to determine a stock or fund’s health. [For a refresher on VQ, go here]

When a stock is in the Red Zone, it has moved more than one VQ from its most recent top. At this point, the stock has exceeded normal volatility, and a stop loss has been triggered.

Right now, Baidu is squarely in the Red Zone.

When the stock is in the Red Zone, it does not have a Buy signal. You will want to see the stock move back into the Green Zone as a sign of improving technical and momentum signals.

So, if your analyst makes the recommendation, put it on your Watch List.

Then, when you check your Watch List, buy the stock if new data and price movement sends it into the Green Zone.

If the stock is in the Yellow Zone, you’ll follow the same rule. The Yellow Zone signals that the stock has moved more than halfway from its recent top to its suggested trailing stop loss.

And if Baidu eventually moves into the Green Zone, then buy James Jackson’s recommendation.

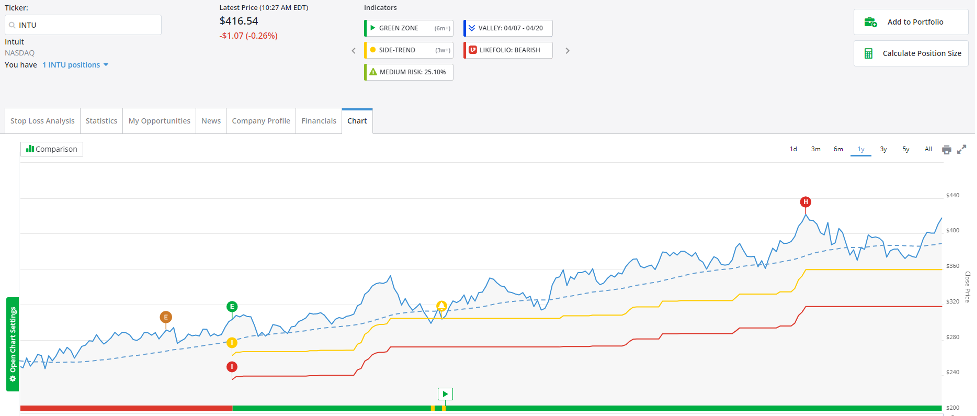

Meanwhile, let’s look at Intuit (NASDAQ: INTU).

This stock has received Buy ratings from several investment gurus and stock upgrades from various Wall Street analysts in recent weeks. The combination of strong fundamentals, technical, and the tailwind of tax season makes this a compelling play, right?

Let’s see what TradeSmith has to say.

The stock entered the Green Zone on Sept. 24, 2020.

Intuit also falls into our Ideas by TradeSmith trading strategies, including Best of the Billionaires and Sector Selects.

These various factors provide increased conviction about the recommendation and the outlook of the stock.

Plus, you can track your newsletter subscriptions and favorite experts in one place, including their performance.

It’s called My Gurus, and it tracks the top recommendations, newsletters, and strategies that can make your investing more profitable.

We built TradeSmith with risk management in mind. Using the recommended trailing stops on TradeStops, you can set it and forget it as a long-term investor.

And that leads me to the second answer I give …

If you really want to buy a stock — meaning, you have maximum conviction — then go ahead and buy it.

However, this time, set a trailing stop equal to the Risk (VQ) of that stock.

Finally, I promised my favorite economic reopening stock last week.

But I got so excited about Citizens Bancshares and the opportunity it presented.

So, tomorrow, I’ll finally show you why I love this “Big-Eared” entertainment giant.