Last week was the 30th anniversary of the 1987 stock market crash. The market dropped 22% in one day. That got us thinking… how could TradeStops have helped?

This was the top-trending topic on Google. We saw headlines such as:

- Could the 1987 Stock Market Crash Happen Again?

- Lessons on the Anniversary of the 1987 Stock Market Crash

- 30 Years After Black Monday, Could the Stock Market Crash Happen Again?

I was curious too. How could TradeStops have helped when the Dow Jones Industrial Average (DJIA) dropped so dramatically in one day?

As usual, there’s more to the story than the headlines let on.

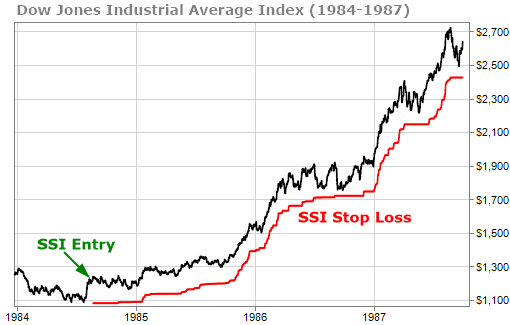

The DJIA triggered a new Stock State Indicator (SSI) Entry signal in August 1984. The DJIA at the time was at 1239.73.

The DJIA moved higher for 3 years, and more than doubled. It started showing signs of weakness two months before the Black Monday crash. The high for the DJIA occurred in late August at 2722.42. The Volatility Quotient (VQ) was around 10.8% at that time (very close to today’s VQ of 9.8%).

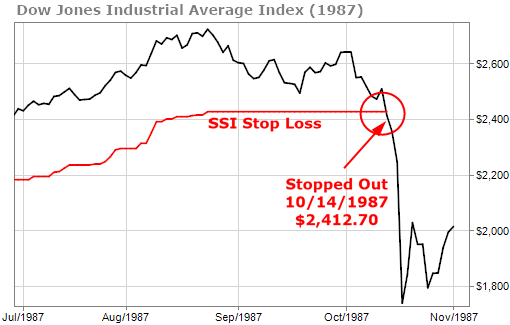

At the beginning of October, the DJIA began moving lower. It triggered a SSI Stop signal on Wednesday, October 14th. The closing price on that date was 2412.70.

The DJIA opened on Thursday, October 15th at the same price as the previous day’s close. Anyone could have gotten out at that price.

We all know what happened next. The DJIA moved lower Thursday and Friday, before plunging more than 22% on Black Monday, October 19th. The closing price on Black Monday was 1738.74.

Had TradeStops been around back then, you would have stopped out of the DJIA with a three-year gain of 95%, avoiding the almost 28% decline in three days’ time.

But, that’s not the entire story.

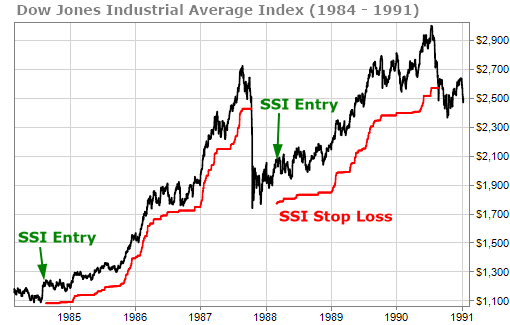

The DJIA triggered a new SSI Entry signal in March 1988. The DJIA had recovered slightly and was trading at 2071.29. It moved higher for the next two years and triggered a SSI Stop signal in August 1990. The price at the time of the stop out was 2560.15. That’s a gain of almost 24%.

A big takeaway here is that the market didn’t just crash from its all-time high in one day. It was an almost two-month period of time from the market high to Black Monday.

The TradeStops SSI signals would not only have helped you avoid a huge loss, but it would’ve also helped you identify the perfect time to get back into the market.

And that’s exactly why I developed TradeStops. Know your volatility. No guessing. Let the SSI signals be your discipline.