Knowing what the billionaires are investing in is a huge advantage. Here’s how to observe rich and famous investors and make that information work in your favor.

Richard Wyckoff was one of the first to study cognitive biases in the stock market. In 1933, he published this quote:

Three men came to Wall Street. The first always knew what was the best buy. The second knew why it was the best to buy. But the third knew neither of these things; he only knew when to buy. He made the most money.

Wyckoff could have been talking about TradeStops. We are the third man.

It’s been almost two months since we introduced the “Billionaires Club” to TradeStops. The Billionaires’ Club tracks over 500 stocks owned by 14 of the world’s largest and most successful investors.

All of these stocks have been studied in great detail and the billionaires know, based on their own criteria, that these are good stocks to own for a long time.

It’s like having hundreds of MBAs working for us. We get to know which stocks are the best ones to own. And then we can apply our “third man” advantage to these stocks.

Using the TradeStops Stock State Indicators (SSI), we can know when is the best time to own these stocks and when is the best time to exit these stocks.

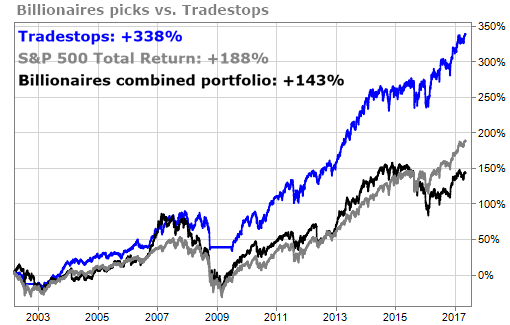

The results speak for themselves.

Over the last 15+ years, investing in the same stocks that the billionaires own and using the tools of TradeStops to know when to buy and when to sell could have handed you a huge advantage over the billionaires and their investments.

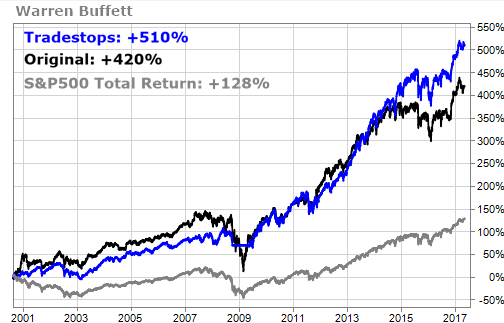

Even Warren Buffett, with his reputation as the best investor on Wall Street, couldn’t beat the “third man” approach.

Buffett’s team picks the best stocks, but TradeStops knows the best time to actually buy and sell those stocks.

It’s really pretty simple.

We are using the best fundamental analysis of the billionaires and their teams to know what are the best stocks to buy. The billionaires also tell us why they want to own them.

And then we’re using the TradeStops technical analytics to know when is the best time to own these stocks.

We also know the right amount of risk to take in each position.

Knowing the best stocks to buy and the best time to own them is a formula for long-term investing success.

It’s an approach that Wyckoff would appreciate.

TradeSmith Research Team