There is a global meat shortage going on. Today we’ll cover two strong investment ideas, as this is part of a powerful trend that could shape agricultural markets for years.

A meat shortage might sound funny, but the impacts are deadly serious. The shortage has already become a worst case scenario for China. If the problem is contained within China, that is one thing. If it spreads to other continents and countries, we could have “porkageddon” on our hands.

The trouble is African swine fever, or ASF for short. African swine fever was first observed in Africa in the 1900s. The ASF virus doesn’t hurt humans, but it kills pigs within 10 days or so, and there isn’t any cure.

A new outbreak of African swine fever was documented in Georgia in 2007. That’s Georgia the country in Eastern Europe, not the U.S. state. The ASF virus then spread to various locales in eastern Europe and Russia. Eleven years later, in 2018, ASF made its way to China. And that’s when the serious trouble began.

Arlan Suderman is the chief commodities economist at INTL FCStone. He has 40 years of experience following and analyzing commodity markets, and he has never seen the likes of what’s happening now.

“I have never encountered anything of the scope of African swine fever before,” Suderman told Bloomberg. “This is going to be a big, world story.”

China is the biggest pork producer, and internal pork consumer, on the planet — think 1.4 billion people eating 54 million tons of pork per year. Chinese consumers prefer pork for 60% of their total meat consumption. The world’s total supply of pork exports, on an annual global basis, would not even cover two months of Chinese demand.

Before African swine fever broke out, China had an estimated 430 million hogs. Now that ASF is raging in provinces all across China, commodity experts estimate 30% of China’s hog population could be lost — roughly 130 million animals.

To make matters worse, China has no real means of containing the ASF virus. That is because many of China’s hog farmers are small and local, which means they lack typical biosecurity measures. Chinese hogs are also routinely transported over long distances, which spreads the virus further.

A 30% drop in China’s hog supply will take years to recover from. Much of the breeding stock will be lost, and countless hog farmers will shut their doors forever.

Meanwhile, Chinese consumers are still hungry for pork, with a lot less pork to go around. There may not be enough pork on the planet to close the gap.

And even if the world were open to selling all of its pork production to China, keeping none to consume otherwise, Suderman muses: “I don’t think there’s enough refrigerated ocean freighters to fill that gap even if China is able to buy it.”

The true “porkageddon” scenario will take hold if African swine fever breaks out in earnest in the EU or the Americas, primary sources for the 9 million tons per year of global pork exports. This is not an idle threat, as signs of the ASF have been detected in various countries. Hog farmers in Europe, Canada, the United States, Mexico, and Brazil are very nervous, and governments are taking extra-cautious detection and prevention measures.

What all of this comes down to is a bull market in proteins. That includes all forms of meat that can substitute for pork — such as beef, chicken, fish, or lamb.

Because there isn’t enough pork to go around, and because China is already submitting record-level bids for pork imports, the price of pork is expected to rise 70% in China in the second half of 2019. Various meat prices are on track to rise by double-digit percentages in other countries.

This means consumers will be turning to beef, chicken, and fish to replace much of the pork that becomes too expensive or is simply not available (because it got shipped to China).

Chicken is especially interesting as a substitute play, because chicken is low-cost to consumers (important as prices rise) and chicken producers have the fastest ramp-up cycle. They can rapidly increase their output faster than other meat producers, which creates a profit advantage in the face of a sudden demand explosion.

Nobody knows how long it will take China to get African swine fever under control, and then to rebuild its depleted hog population in such a way as to get things back to normal. Some analysts think it could be three to five years. In the meantime, the supply-demand gap for various forms of protein — not just pork — is expected to intensify, with the worst pain point still a year or more away.

There are two ways to invest in this powerful multi-year trend. The first is JBS SA, a Brazilian-based food processing company with beef, pork, chicken, and lamb operations spanning North America, Europe, and Australia.

JBS is favored by Morgan Stanley analysts who believe (as we do) that it is early days for this shortage-driven bull market in proteins (beef, chicken, pork, and so on).

“JBS’s combination of category and geographic exposure, scale, capacity utilization, and existing access to the Chinese market sets it apart,” says Morgan Stanley analyst Rafael Shin.

|

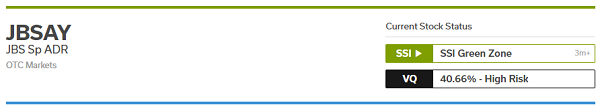

JBS is headquartered in Sao Paulo, Brazil. For U.S.-based investors, the stock trades on the pink sheets via American Depositary Receipt under the symbol JBSAY. It is currently in the green zone with a high-risk VQ (meaning the stock is going to be volatile).

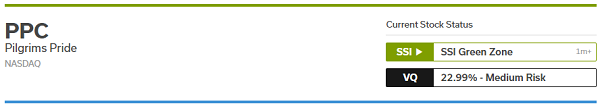

A second way to invest in the global meat shortage is Pilgrim’s Pride, which trades under the symbol PPC on the Nasdaq.

Pilgrim’s Pride (PPC) is related to JBS in that JBS USA Holdings owns more than 78% of the company. But whereas JBS is international and diversified across meat products, Pilgrim’s Pride is a U.S.-based chicken producer, thus offering a pure play on the chicken angle.

|

As mentioned, the chicken business is interesting because chicken output can be ramped up very quickly in the face of surging demand, which gives Pilgrim’s Pride a unique window of opportunity over the next year or two (as consumers turn to chicken to defray the cost of rising meat prices).

With a market cap of less than $7 billion, PPC could also be an attractive takeover candidate for a larger meat producer, with any buyout offer producing an attractive premium to the share price. PPC is currently in the SSI green zone with a medium-risk VQ.