“More return with less risk ” is a key goal for TradeSmith. That is what our software is meant to help you achieve. This is really important, too — more important than ever, in fact — in the context of retirement goals.

Retirement should be a happy time in life. The word “happy” is used literally here, as numerous studies have shown people grow happier with age.

In 2016, Deborah Netburn of the Los Angeles Times reported on a wide-ranging happiness study conducted in San Diego, CA. The study surveyed 1,500 San Diego residents, ranging in age from 21 to 99.

The findings were that “people in their 20s were the most stressed out and depressed,” Netburn reported, “while those in their 90s are the most content.”

“The consistency was really striking,” said the senior author of the study. “People who were in older life were happier, more satisfied, less depressed, had less anxiety and less perceived stress than younger respondents.”

Another study, conducted 10 years earlier at Duke University, compared 30-year-olds and 70-year-olds. They found the 70-year-olds had more happiness than the 30-year-olds.

This pattern shows up so broadly and universally, it seems to be a part of human nature. General happiness levels have a U-shape. They tend to bottom out in mid-life (mid-40s to early 50s), and then rise again to ultimately peak in old age. In general terms, the old are happier than the young.

But it’s hard to enjoy the golden years if retirement needs aren’t taken care of. That is where the five risks of retirement come in. These are the concerns you need to be aware of — whether you are 30 or 70 or anywhere in between — as your retirement years stretch out ahead of you.

In a nutshell, the five risks of retirement are:

- Longevity

- Inflation

- Volatility

- Expense

- Solvency

These conveniently form an acronym, LIVES, as in “a cat has nine lives.” You could also rearrange them into EVILS, as in “the evils of a bad retirement,” if that helps you remember them better. Let’s look at each one.

Longevity Risk: 30 Years Without an Income

Retirement is a relatively new idea. 150 years ago, people simply worked until they dropped, with a handful of rare exceptions. That changed with the rise of life expectancy, the invention of social assistance programs, and the invention of corporate pensions. The combination of those three things made retirement a standard concept in the Western world.

In the 21st century, it is reasonable to expect a stretch of 25 to 30 years in retirement — a period of time without job income. Even if you are 70 years old as you read this, it’s very conceivable you could live until 95.

The average U.S. life expectancy, which is just under 79 years old as of this writing, is exactly that — an “average” — which means there is real potential to go far beyond that. Steady advances in medical technology are also pushing life expectancy forward.

As medicine improves and early detection and prevention techniques get smarter, it is possible we could even see a radical jump in life expectancy in the next 20 years. That would further increase the odds of living well into one’s 90s.

Getting the chance to be happy at age 95 should be a prize, not a punishment. But it’s called “longevity risk” because living for that long increases the risk of running out of money.

Some will say “no problem, I won’t retire. I’ll just keep working.” But depending on external factors like the state of the economy, your area of skills and expertise, and the impact of technology and competition, you may have no choice but to retire.

So, the first real risk to consider is how you, and possibly your spouse or partner, are going to fund a potential stretch of 25 to 30 years without job income. This is a plausible scenario for which you need to be prepared.

Inflation Risk: Sharp Increases in the Cost of Living

Inflation is another big risk for retirees. When inflation takes hold, goods and services become more expensive. The price of everything goes up, including unavoidable costs like basic necessities, property taxes, and medical care.

The United States has enjoyed a multi-decade period with little to no inflation, at least according to government statistics. Over the past 20 years, most of the inflation Americans experienced was pushed into asset prices, driving up valuations for equities and real estate and fine art. And in terms of interest rates, inflation has been falling even longer.

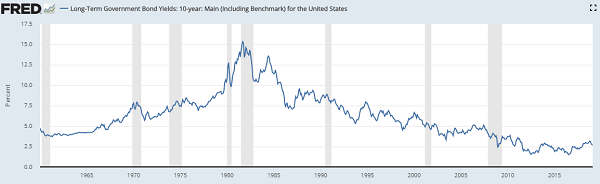

For example: The interest rate on the 10-year U.S. treasury note peaked in 1981, and then declined for an incredible 35 years (until 2016) as the St. Louis Fed chart shows below.

|

The decline of inflation and interest rates has been great for investors and asset valuations. But if there is one thing we know about markets and human nature, it’s that everything moves in cycles.

Just as recessions can’t be banished — they are a part of the natural business cycle — inflation can’t be banished forever either. After long periods of dormancy, it always comes back again.

That means, at some point in the future, we can expect a return of inflation comparable to the 1960s and 70s. It won’t be exactly the same, but in some ways, it could be worse. The return of inflation will be a challenge for retirees to manage, first and foremost due to sharp increases in the cost of living.

A return of inflation could also wreak havoc on the stock market, causing some industries and asset classes to soar and others to plummet.

We aren’t there yet, but we know how cycles function: Cycles of boom and bust, cycles of building up debt and paying down debt, cycles of low inflation and high inflation.

High inflation will return at some point, and it will make retirement more expensive when it does.

Volatility Risk: Psychological Stress and Drawdown Costs

Volatility risk is another important concept for anyone in retirement, or anyone thinking about how to approach retirement. The basic rule of thumb is: The less cushion you have, the less volatility you can handle. This is true both psychologically and mathematically.

On the psychological side, if you have saved “just enough” for retirement, and markets then become extremely volatile for a period of months or quarters, the safety of your retirement nest egg will feel threatened.

If you don’t have a well-designed plan, this could keep you from sleeping well at night.

Anxiety and stress levels will rise in periods of high market volatility, just as passengers on a cruise ship will be more anxious in a storm than when waters are calm.

Volatility risk also makes it harder for a portfolio to recover from drawdowns.

In the absence of job income, most retirees will rely on the market to generate additional returns year after year. These ongoing returns help replenish their pool of retirement savings, even as they withdraw money for living expenses.

But periods of high volatility are a risk here because, if the size of a nest egg is reduced sharply by market volatility, and the retiree has to keep withdrawing funds anyway, the size of the nest egg will struggle to recover.

That is because, as the size of an asset pool shrinks, the compounding effect works in reverse. You can see it with this example:

- 10% return on $100 in assets = $10

- 10% return on $50 in assets = $5

- 10% return on $20 in assets = $2

The same percentage return gives less bang for the buck, in absolute dollar terms, as the pool of assets gets smaller.

What this means in practice is that, if the size of a portfolio gets too small — due to a combination of volatility and regular payouts for expenses — the same 10% or 20% return that would have regenerated health in prior years now has a smaller impact.

And so, when a slowly shrinking asset pool has to fund regular expenses, the cost of volatility becomes greater with the passage of time.

This is true mathematically, and it filters through to the psychological level because retirees are able to sense it, even if they haven’t worked out the math.

Expense Risk: The Reality of Inevitable Events

Expense risk touches on the need to pay for unknown life events. Something will come up, it always does — especially over a long span of retirement years.

Every so often, something goes wrong, or a spouse or close family member needs help, or something big and unexpected has to be paid for. The same pool of retirement assets that covers routine costs will have to absorb these occasional big-ticket items that come up out of the blue.

Medical costs are a big factor here. The cost of general medical care is already sky high, and it is only going higher. As people grow older, the likelihood of illness increases, along with specific maladies and caregiver needs relating to old age.

The good news is that astonishing advances in medical technology are enabling better treatments on a constant basis, which in turn increases the odds of a good quality of life at age 95.

The bad news is that these new treatments are unbelievably expensive, and in some cases, nobody knows the costs yet — other than knowing they could be astronomical. Just as a quick example pulled from the headlines, on April 6, Bloomberg reported the following:

“Dozens of revolutionary gene therapies that mend faulty strands of DNA are on their way, bringing the power to eliminate lethal childhood diseases, rare blood disorders and other severe illnesses.

Beneath the excitement about these potential cures lies an important catch: No one knows how much to charge for them…”

So, a fortified pool of retirement assets not only has to budget for a very long period of retirement (25 to 30 years as a conservative estimate) while considering sharp cost-of-living increases due to future inflation, it has to make room for hefty expenses, too (and in particular, medical ones).

Solvency Risk: When the Funding Isn’t There

The final risk has to do with outside sources of income, like social security and pensions. A great many retirees rely on social security for a significant portion of their income; a great many also rely on a pension plan, funded either by a private corporation or a state or local government.

Sadly, income sources like this need an asterisk, or perhaps a big red question mark, when laying out a budget for retirement planning over a 25- to 30-year timeframe.

That is because there is a high risk — though of course not a guarantee — that such income sources will not be there in the future, or just won’t be worth as much.

We can look at the long run cost of entitlement programs and openly wonder how the U.S. government will fund all these obligations. This is nothing new, as many observers have sounded the alarm bell over the years.

But it’s important to think about these income sources from a retirement perspective, and to be aware of how unreliable they are.

Then, too, local and corporate pensions may appear more stable than social security — but this could actually be wrong.

Depending on where you live, or the company that provided your pension, these income sources could actually be at a far greater risk. That’s because the United States is headed into a slow-rolling retirement crisis coupled with a long-brewing multi-trillion pension fund crisis, due to a mass wave of Baby Boomer retirees that could “break the system” over the course of the 2020s.

We should note, too, that solvency risk feeds back to inflation risk in a very simple way: The U.S. government will never actually “run out of money” to fund its multi-trillion entitlement obligations, because the U.S. government owns a printing press.

So, if Uncle Sam has to print oceans of new dollars to meet future entitlement obligations, or to bail out state and local governments in a pension hole by writing giant government checks, then that is what will happen. But that would overwhelm the system with a supply of low-value dollars, which, in turn, would fuel 1970s-style inflation or worse.

So, in some ways, inflation risk and solvency risk are two sides of the same coin: When an entity with a printing press (the U.S. government) becomes de facto insolvent, you don’t get literal debt default; you get pseudo debt default through inflation. Retirees feel the brunt either way.

It’s not the cheeriest of topics. But the good news is there are ways to mitigate these risks.

With planning and foresight and preparation — and perhaps the help of great software — it remains possible to plan for and enjoy the stress-free retirement you deserve.

A toast to health and wealth, and to living our best lives at age 95!