The financial headlines this week focused on the new healthcare bill in congress and what it could mean for healthcare stocks. That’s old news if you’re a TradeStops member. If you want to know how to find the best healthcare stocks to invest in, you’ve come to the right place.

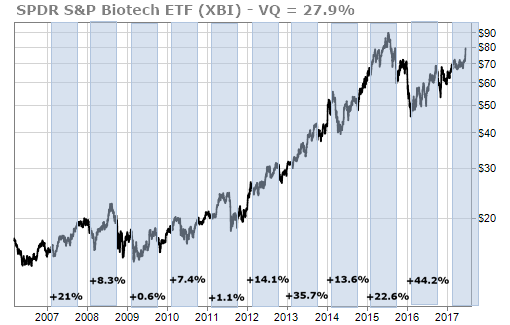

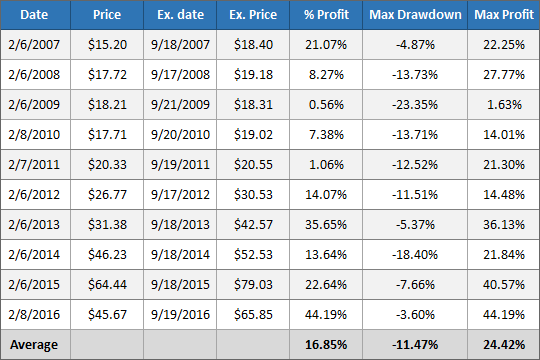

Two months ago, we told you about a pattern in the biotech sector that has a 10-year track record of being 100% profitable.

XBI is the S&P SPDR ETF for the biotech industry. It is composed of 96 biotech companies. XBI has a 10-year track record of being profitable from February through September, even during the bear market of 2008.

At the beginning of February, XBI was trading just below $65. It closed yesterday at $79.20. And there’s still room for biotech to rise.

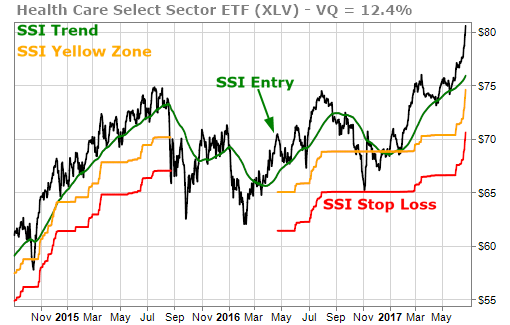

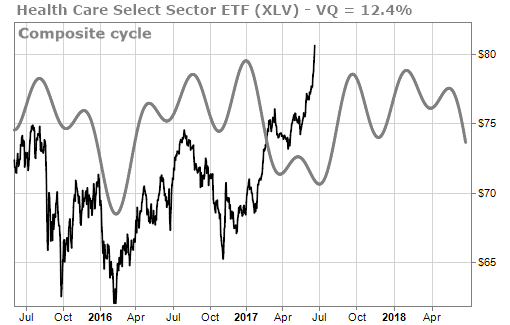

The biotech industry is part of the overall health care sector. XLV is the Health Care Select Sector SPDR ETF. XLV and XBI are positively correlated and both tend to trade up or down together.

XLV first triggered a Stock State Indicator (SSI) Entry signal in April 2016. It dipped into the SSI Yellow Zone in October, but came back to the SSI Green Zone in November and has been climbing higher since then. Yesterday it made a new all-time high.

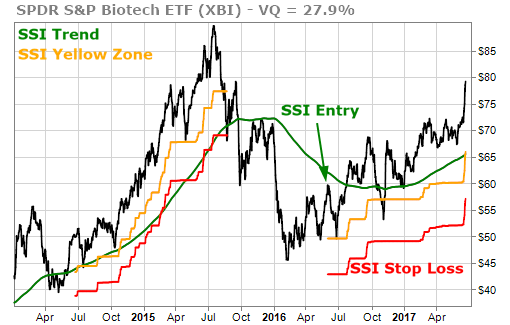

XBI has a similar chart with an SSI Entry signal being triggered in May 2016. It also made a new near-term high yesterday and is closing in on its all-time high that was set in the middle of 2015.

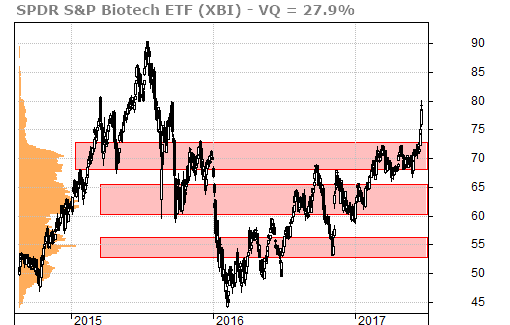

The volume-at-price (VAP) chart shows that there is very little resistance to the upside and a new all-time high could occur in the near future.

My proprietary time-cycle forecast for the health-care sector is bullish into the middle of September which is historically when the time-frame for the annual biotech industry uptrend closes.

There’s a good likelihood that XBI could see a new all-time high this summer if these conditions continue to hold.

The average gain for the 10-year history of the XBI uptrend is almost 17%. The past 3 years, the average gain is more than 26%.

From the beginning of February, the uptrend is now up more than 21% which is still less than the recent 3-year average.

Don’t forget that biotech stocks are risky. The ETF XBI has a Volatility Quotient (VQ) of 27.9% and many of the individual biotech companies are much higher than that.

There’s still time to take advantage of this uptrend even though it has already moved up more than 20%. If XBI makes a new high this summer, that would translate into a gain of an additional 14% from here.

I always like to have as much wind to my back when looking at historical price movements and this uptrend in XBI still has full sails.