The markets are heading towards “sell in May and go away” territory and the headwinds are picking up. Is it time to step aside?

We told you about a contrarian signal that the CBOE Volatility Index (VIX), commonly known as the “fear index,” was flashing. The CBOE Volatility Index (VIX) measures the short-term volatility of S&P 100 options.

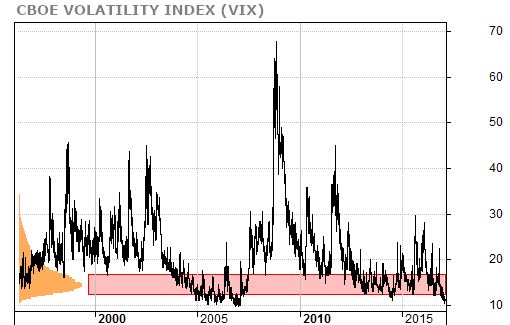

At that time, the stock market was flying higher and the VIX had moved to historically low levels. Here’s the long-term picture showing where things stood two months ago.

The VIX hadn’t seen levels this low since shortly before the 2007 crash.

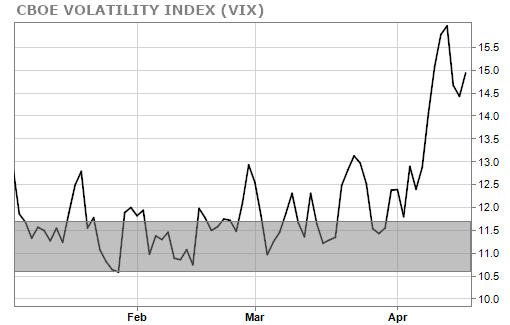

Since we wrote that article, the VIX has been steadily climbing…which is usually a bearish sign for the market. The VIX got as high as 16 last week before moving down below 15 this week.

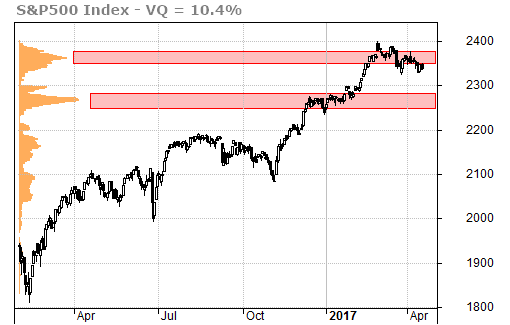

The S&P 500 (SPX) just so happened to put in its recent high shortly after that article and has now been moving lower for the past 7 weeks.

The volume–at–price chart shows this move lower has caused the first area of support to be broken. SPX is very likely heading below the 2300 level sometime soon.

The time-cycle forecast for SPX also shows the path of least resistance is to the downside into the middle of the summer.

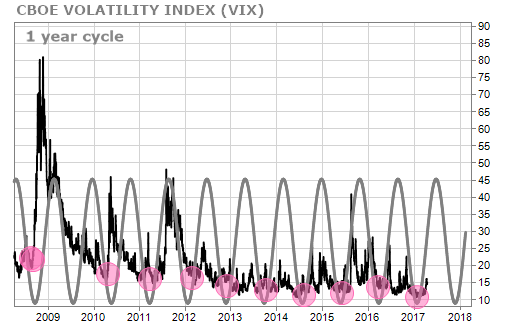

And the strongest time–cycle for the VIX shows that the VIX could head higher into the summer as well … which would be bad news for SPX.

So … does all this bad news for SPX from my favorite indicators mean that we should head for the exits? Should we sell in May and go away?

We don’t think so.

Learning to let my winners run is the single biggest game changer we’ve ever experienced as an investor.

We’re certainly not adding new capital or positions to the stock market right now. We think that there will be better opportunities to do so soon.

But neither am I running for the exits. We’ve got my stops in place. We know what we’ve got at risk and we’re comfortable with it.

Could something go terribly wrong? You bet.

On the other hand, could something go terribly right? Absolutely!

We’re not sticking my head in the sand here but we are making sure that we’re in the game in case there are any upside surprises. Significant upside never comes without the element of surprise.

Prepared to be (pleasantly) surprised,

TradeSmith Team