In this current stock rally, the Dow Jones Industrial Average (DJIA) has risen an astounding 18.37% in the last three months. The talking heads in the media are telling us that the market is strongly overbought. It has to take a break. Right?

Wrong.

The DJIA has risen over 3000 points since the beginning of November. That’s what I call a “2 VQ” move … meaning that the DJIA has gained nearly two times its current Volatility Quotient (VQ).

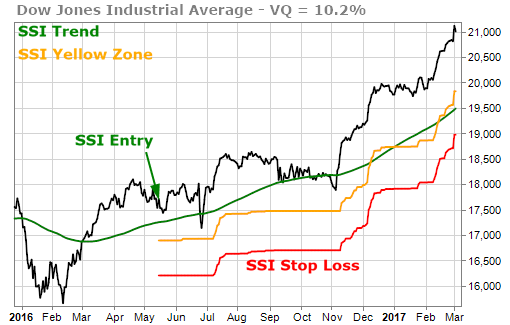

Here’s the current Stock State Indicator (SSI) chart for the DJIA. It shows that the current VQ for the DJIA is 10.2%. Since triggering an Entry signal in May of 2016, the DJIA has moved from 17,500 to over 21,000 … a gain of 20% or 2 times the current VQ … and most of that move has been in the past 3 months.

Has this rally come too far to fast? We know that’s what most people are thinking, myself included.

Rather than trust to my own “intuition,” however, we like to look at history.

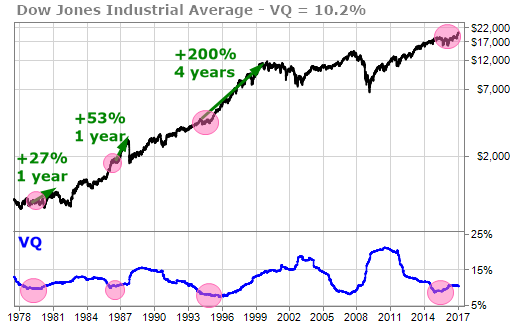

Going back 40 years, we were able to find 3 times when the DJIA moved up nearly 2 VQ’s over just three months. It’s a rare event for the DJIA to move that far that fast.

Did the DJIA correct shortly thereafter? Nope.

The below chart shows the three times from the past that the DJIA gained 2 VQs in a three-month period … and what happened next. Significant upside follow through over the next 1 to 4 years is what followed each time.

Moreover, as you can see in the bottom of the chart above, the VQ of the DJIA was at a relatively low level each time … a level similar to where it sits today.

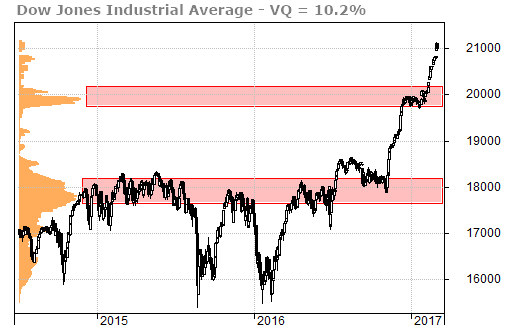

The volume-at-price chart on the DJIA shows that we’re in uncharted waters and there is no significant overhead volume to serve as likely resistance.

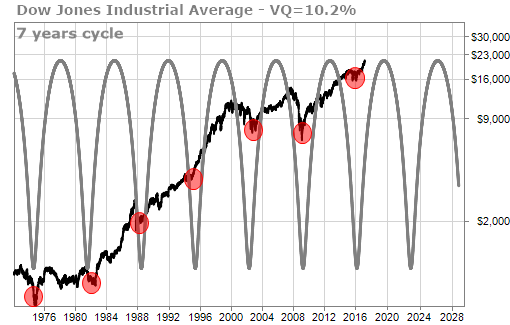

Finally, my favorite long-term time cycle on the DJIA, the 7-year cycle, also suggests that the DJIA has more room to run.

We’ve been concerned about a stock market correction. We continue to feel very nervous about this rally.

TradeSmith Team