One of our guiding investment portfolio management principles at TradeStops is to consider risk before worrying about profits. Today, we’re going to ignore that advice … and focus just on how quickly we can expect to make a profit … and when to consider throwing in the towel.

We showed you that the Dow Jones Industrial Average (DJIA) has seen its price jump by almost two times its Volatility Quotient (VQ) in the past three months.

To say the DJIA has some “unusual” tailwinds behind it at the moment would be a bit of an understatement. In fact, we’ve seen this kind of move only 3 times in the last 40 years.

It does lead to an interesting question though … how long does it take for a stock to gain 1 VQ on average?

That’s the question we posed to the research team. Here’s what they found…

To answer this question, we looked at our database of 1300 stocks, funds, indices, and commodities going back 20 years and we looked at how long it took each stock to make each 1 VQ of gains on average.

Before we show the results, let us show you an example so you’re clear on the concept.

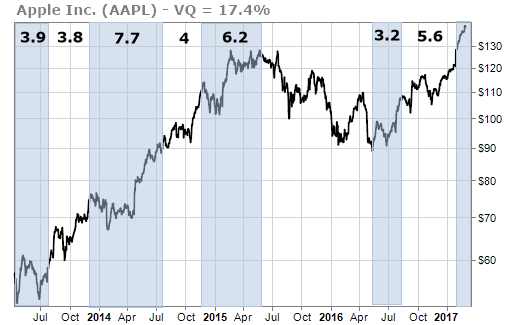

Here’s a chart of Apple Inc. (AAPL) over the past few years. Each vertically shaded / unshaded area shows the period of time that it took AAPL to make 1VQ of gains when it was rallying.

The average time that it took AAPL to gain 1 VQ over the past several years was 4.9 months. That’s (3.9 + 3.8 + 7.7 + 4.0 + 6.2 + 3.2 + 5.6) / 7 = 4.9.

So, on average, it took AAPL less than 5 months to gain 1 VQ when AAPL was rallying.

Now let’s look at the overall results from our study.

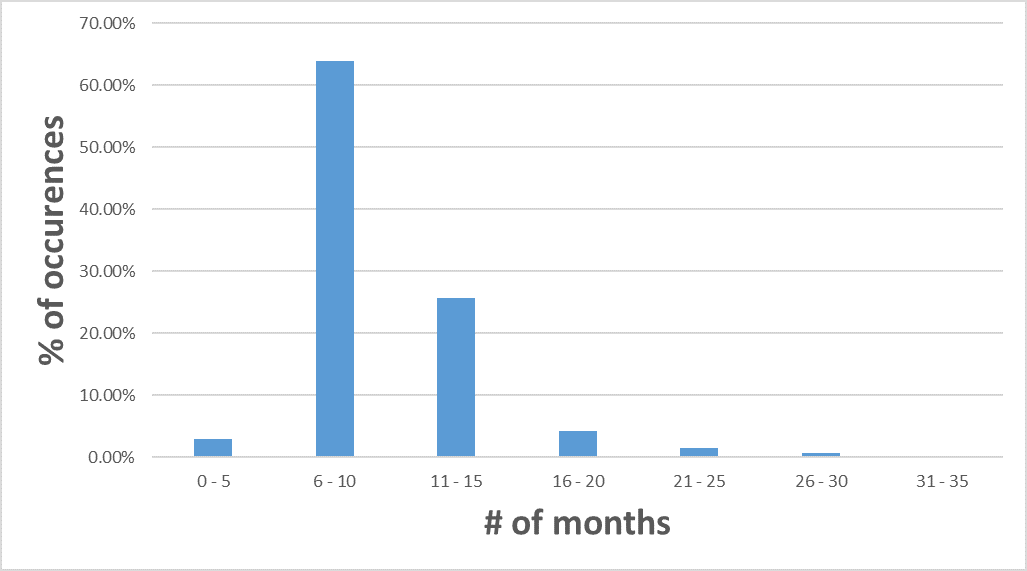

The histogram below shows what percentage of the assets make 1 VQ of gains in 0 – 5 months, 6 – 10 months, etc. The second bar from the left is the big bucket. It shows that that it took 6 to 10 months on average for 64% of the assets we looked at to make 1 VQ of gains after triggering an SSI entry signal.

If you add up the first three bars on the left, that covers 0-15 months of time. It says that fully 92.5% of the signals we examined had gained 1 VQ or more within 15 months.

This research raises an interesting possibility for me personally. It suggests strongly that if a stock that’s in my portfolio hasn’t gained at least 1 VQ within 15 months of me buying it, it may well be time to let it go and find another investment that will perform better for me.

We love ways to prune the weeds from my portfolio … and make room for more flowers.

A time-stop of 15 months makes intuitive sense to me … and this research strongly supports that idea.

For the flowers,

TradeSmith Team