We’ve been patiently bullish for the past year on oil, and it looks like our patience is paying off. Our oil-related investment ideas are already up 10% in the past 6 weeks and there’s plenty more to come.

We wrote about our reasons for being oil bulls at the end of July – and we showed you a couple of ETFs that could benefit from higher oil prices.

The case is even stronger today.

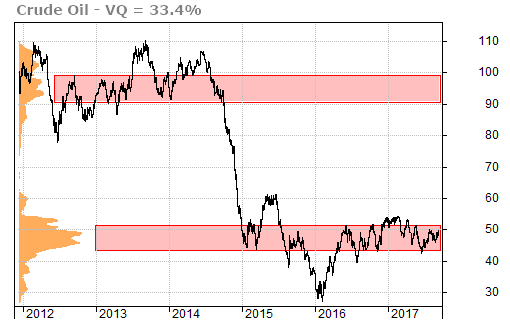

Crude oil triggered a new Stock State Indicator (SSI) Entry signal in late October 2016. Though oil has been trading in a narrow range, it hasn’t even touched the SSI Yellow Zone since June, and it has been slowly climbing. The price moved up past $50/barrel this week.

The volume-at-price chart shows how oil has been in a very narrow trading range for the past 18 months. It’s unusual for oil to stay in a narrow trading range for such a long time. A breakout, when it happens, could be very strong. A sustained breakout above $54 should propel oil to the $60 range.

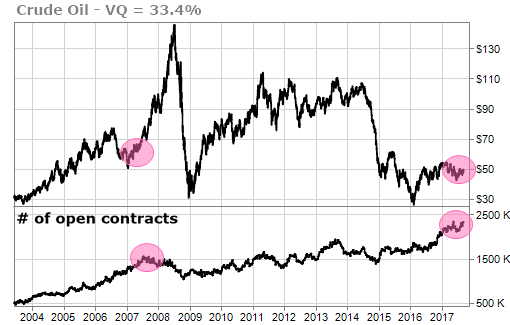

Another bullish sign for oil comes from the futures markets. The open-interest is rising to record levels. This means that more contracts are being traded which is a bullish sign.

The commercial traders of oil, many of whom are the companies that actually produce oil, have an expected net negative position. They are sellers of oil because they “make” the oil.

However, this negative position is not at record levels, and that means the producers are holding out for higher prices that they see coming.

Back in July, we shared our favorite 8-year time-cycle in oil. It suggests that oil will rise (off and on, of course) through 2020. Our shorter-term time-cycle forecast is now also bullish on oil with a projected rise through 2018. We don’t know how high oil will go, but we know that the path of least resistance is to the upside.

The two ETFs that we believe could benefit from a rise in oil prices are – RSX (the ETF for Russia) and EWZ (the ETF for Brazil). Both of these ETFs are 10% higher since we first brought them to your attention six weeks ago. We’ve been waiting for the gusher in oil to occur. The signals continue to be in our favor, and it looks as if our patience is being rewarded.

Patience is the key word when it comes to investing in the oil patch… and knowing how much you can afford to risk and how much wiggle room you need to give different oil investments.

Your patience has also been something that we’ve very much appreciated this past week as we’ve worked through the visit from Irma this past Sunday night. I’m happy to report that our Brooksville office is now back up and running.