Who doesn’t want to invest like Warren Buffett, the CEO of Berkshire Hathaway?

From humble beginnings, Buffett – the Oracle of Omaha – has amassed a fortune north of $100 billion.

It might’ve been slow and steady, but his long-term strategy won the race.

Many of the world’s top managers imitate his strategies down to individual stocks.

In the last year, mainstream media outlets have crawled over each other to speculate on what he buys and what he sells.

Come May 1, 2021, Berkshire Hathaway investors will attend a virtual edition of the annual shareholders meeting, known as “Woodstock for Capitalists.”

There will be a lot to cover at this event. Over the last year, Buffett dumped Goldman Sachs and purchased gold. He ditched his Costco and airline stocks and took a bigger stake in Apple.

In May, billions of dollars will slosh around depending on Berkshire Hathaway’s latest purchases.

Will he repurchase airlines? Sell banks? Take a bigger stake in Walmart?

People pay thousands of dollars to travel to Omaha for the live shareholder event.

But what if I said you no longer need to race against other investors to access Buffett stocks?

What if I told you that TradeSmith identified a BETTER way to invest like Warren Buffett?

Trust me. You’re going to love this…

You’re going to get a portfolio of Buffett’s stocks at a 15% discount to the value of his positions and a mouth-watering dividend.

Seriously…

It’s A Secret, Even to Buffett Fans

The Special “Warren Buffett Buy” is a Closed-End Fund.

Let’s do a quick lesson here.

A lot of people avoid closed-end funds because they’re confusing at first.

But by the time you learn about this “Buffett Fund,” you’ll have a master’s education in the alternative investment space.

You could see market-beating returns as a result.

Here’s how they work.

A financial manager starts a new fund portfolio comprising stocks, bonds, and other investments. The fund manager will sell a fixed number of shares (no more can be added or subtracted to the original total).

Investors buy up the shares, which trade on a stock market like any other equity.

Now. Stick with me. I assure you that the Buffett payoff is coming.

Closed-end funds don’t trade like mutual funds and mark their net asset value (NAV) each day.

Instead, they trade on the behavioral psychology of the market. Sometimes, closed-end funds will sell at a premium to the total fund’s net asset value.

Other times, they can trade at a steep discount.

So, let’s say I have a closed-end fund called “Keith’s Fund” that trades for $9.

But, the NAV might be $10. That means the fund trades at a 10% discount.

Now, if Keith’s Fund trades at $11 and has a NAV of $10, the fund trades at a 10% premium.

In times of panic, these funds can experience a steep selloff wholly disconnected from their NAV.

Emotions run high in this area of finance. That was evident when the fund I’m about to unveil traded at a headshaking 20% discount to its NAV during the COVID crisis (and created a massive buying opportunity in the process).

Those irrational emotions can be your gain when buying opportunities emerge.

Let’s look at what TradeSmith is telling us is a top closed-end fund to own, at a steep discount to the NAV.

It Can Be Expensive to Invest in Buffett

Buffett’s Berkshire Hathaway (BRK.A) had a tricky year in 2020.

Class A Shares plunged by 27.5% during the first five months of 2020 in the wake of the COVID-19 outbreak.

But shares have SURGED back, recently reaching all-time highs.

The cost of one Class A share might be hard to swallow…

Today, BRK.A shares trade for $400,000 each. For most people, that’s more than the value of their homes.

There’s a reason for that high price.

Buffett has never split A Class shares stock and has NEVER paid a dividend.

Meanwhile, B shares (BRK.B) are just shy of an all-time high of $267.50.

Yes… investing in Berkshire can be very pricy on the surface.

But dig a little deeper with Tradesmith.

Look at the unique opportunity that recently hit the Green Zone, shows a signal as a low-risk investment, and carries a strong momentum uptrend.

This ‘Buffett-Buffet’ Looks Tasty…

Today’s Green Zone opportunity is the Boulder Growth & Income Fund (NYSE: BIF).

After digging into this fund, I can legitimately say it’s the least expensive way to invest like Warren Buffett.

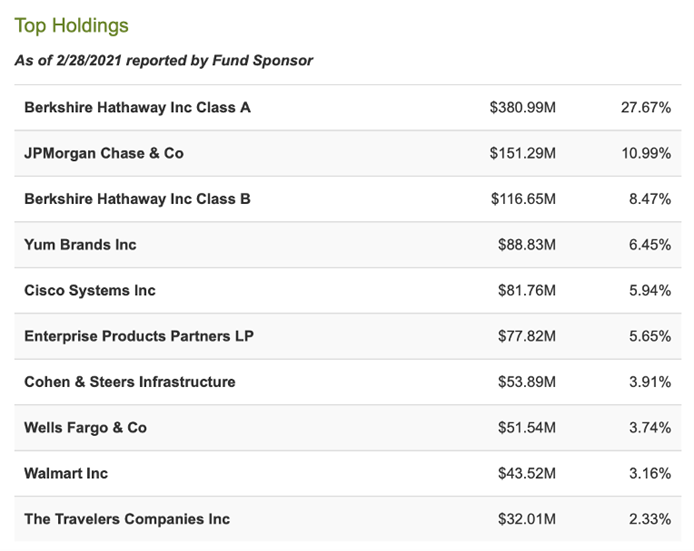

The portfolio fund consists of $380.99 million in BRK Class A stock and another $116.65 million in BRK.B stock.

Look what else is in the portfolio.

A wave of cash-rich companies in Buffett’s portfolio like JPMorgan Chase (JPM), Yum! Brands (YUM), and – of course – Walmart Stores (WMT). Here are the top holdings from February, the last time Buffett unveiled his holdings.

Now, remember, I said that this trades at 85 cents on the dollar.

The fund trades at $12.78 compared to the NAV of $15.19.

And – even more impressive – it pays a distribution (dividend) of 3.19%.

Remember, Buffett’s Berkshire Hathaway famously pays no dividend to investors.

This is an exciting fund, especially with Berkshire stock at all-time highs.

This seems like an exciting long-term investment, especially given the 15% discount. Over time that discount could narrow, offering investors greater upside.

The fund could also shut down or face activist pressure to buy back stock to narrow that NAV gap. That offers additional upside in joining Warren Buffett.

A $13 entry point seems appropriate, according to TradeSmith data.

Remember, Buffett isn’t the only billionaire that TradeSmith tracks.

Tomorrow, I’ll show you three other stocks that billionaires like Buffett have been buying.

Did you know that TradeSmith currently tracks over 20 billionaire investors?

We’ll show you exactly where all those big shots put their money.

Not only that… but we can help you actually improve upon their results.

Imagine beating Buffett at his own game!

Go here to learn how YOU could become the next Oracle of Omaha.