Today, I want to tell you about the top strategy of the top hedge fund of all time. The money manager who came up with this approach, Ray Dalio, calls it his “Holy Grail of Investing.” You can use it, too, through a new feature we’ve implemented in TradeStops.

Last year was a tough one for hedge funds. According to data from Barron’s and LCH Investments, the top 20 hedge fund managers generated $23.2 billion in gains in 2018 (after management and incentive fees).

But the rest of the hedge fund space — all the ones not in the top 20 — lost a cumulative $64.2 billion, and total hedge fund assets shrank in 2018.

The most profitable hedge fund in 2018, Bridgewater Associates, saw an $8.1 billion net gain on its main strategies. Pure Alpha, its flagship strategy, saw a 14.6 percent gain, its best performance in five years.

Bridgewater is also the most profitable hedge fund of all time in absolute dollar terms, with a cumulative $57.8 billion in gains since its founding in 1975.

Seven years ago, in an interview with Jack Schwager, the author of the Market Wizards series, Bridgewater founder Ray Dalio explained how his fund manages such huge amounts of money successfully ($150 billion at last count).

During the interview with Schwager, Dalio walked over to a board in his office and drew a chart by hand. “This is a chart that I teach people in the firm,” he said, “which I call the Holy Grail of Investing.”

The chart was a very simple downward-sloping curve. It showed that the greater the number of uncorrelated investments you have, the lower your standard deviation will be. That, in turn, means lower volatility, and lower risk for the portfolio on the whole.

Dalio explained that, if you add assets with 60% correlation, “the risk will go down by about 15 percent as you add more assets, but that’s about it, even if you add a thousand assets.”

But if the assets have zero correlation, Dalio further explained, “then by the time you diversify to only 15 assets, you can cut the volatility by 80 percent.” In this manner, Dalio said, “I can improve my return/risk ratio by a factor of five through diversification.”

Diversification through non-correlated assets is a truly foundational principle for Bridgewater. As Schwager pointed out in his introduction, Bridgewater has “a near zero correlation to traditional markets” and “a very low correlation to other hedge funds.”

Another interesting thing about the Bridgewater strategy: They aren’t active traders, and they don’t take an unwieldy number of large positions.

Bridgewater participates in all manner of liquid markets all around the world, but they “change their positions slowly,” according to Dalio, with the average timeframe for switching from net long to net short about 12 to 18 months. “At any given time, we probably have only about 20 or so significant positions,” Dalio told Schwager, “which account for about 80 percent of the risk and are uncorrelated to each other.”

The “Holy Grail” strategy of looking for uncorrelated trades has certainly been good for Dalio, swelling his net worth into the $18 billion range. His hedge fund, meanwhile, is only open to central banks, pension funds, and other large institutions.

But now you can benefit from the same principles behind this approach, through a new algorithm feature in TradeStops.

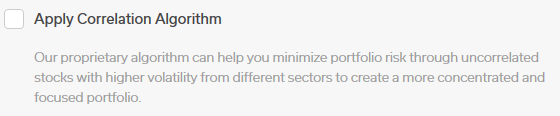

If you are one of our Platinum or Lifetime members, when you click on the Pure Quant tab in the Research section of TradeStops, you will see the following button:

|

Using concepts from Modern Portfolio Theory — in the spirit of Ray Dalio’s “Holy Grail of Investing” — our new Correlation Algorithm can potentially help you maximize reward and minimize risk by automatically filtering the candidates in your customized Pure Quant basket.

It’s another way we’ve found to help investors use theory and software in their pursuit of more return with less risk. And as Ray Dalio’s investors can confirm, the concept has worked nicely for 40-plus years now!