Last week, we told you that the stealth rally in gold was gathering steam. Just yesterday, gold made a new 52-week high and it’s only a few dollars away from its most recent high in July 2016. The $1,400 level is about $40 away. Gold hasn’t been above $1,400 since May 2013.

This rally has legs. A move past $1,400 and up to the $1,500 level looks to be in the cards.

Gold itself is a low-risk investment. It has a Volatility Quotient (VQ) of only 10.6%. That’s about the same VQ as the S&P 500 which has a VQ of just 9.6%. Since January 2016, the price of gold is up 23%.

Sometimes, taking more risk in a related investment makes sense. And this is one of those times.

A great way to profit from this huge momentum in gold is to invest in the companies that mine for gold – like GDXJ, the ETF for the junior gold miners.

Why GDXJ and why now? Since hitting its low in January 2016, gold is up 23%. During the same period of time, GDXJ is up 108%! And we believe there’s more to come.

GDXJ triggered a Stock State Indicator (SSI) entry signal in April 2016. It was trading in the SSI Yellow Zone for most of last year. It came close to stopping out in December, but has been rebounding as gold has been moving higher.

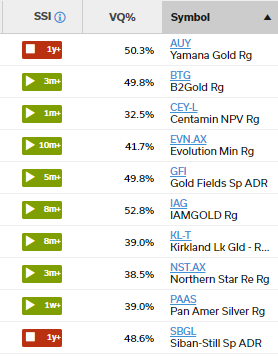

Of the top 10 holdings in GDXJ, 8 are in the SSI Green Zone and only 2 are in the SSI Red Zone. This bodes well for future strength in GDXJ.

Investing in the gold mining stocks is much riskier than investing in gold itself. Just take a look at the VQs of the stocks listed above. The advantage of investing in an ETF such as GDXJ, is that its VQ of 37.7% is lower than almost any of the individual stocks that make up the ETF. GDXJ is still a high-risk investment, but you’re spreading the risk throughout the 72 different holdings that make up this particular ETF.

There are a couple of additional factors working in favor of GDXJ as well.

The price has recently broken above a long-term downtrend line dating back to the August 2016 highs. The breakout was also part of a descending wedge pattern with lower highs and higher lows. This type of pattern often suggests consolidation of shares as they move from weak hands to strong hands.

The declining US dollar is another strong tailwind for the price of gold… and hence the junior gold miners. The chart below speaks for itself.

The US dollar was remarkably weak all throughout 2017. Now the dollar’s decline seems to be accelerating, or even heading into free fall. The weaker the dollar gets, the more that sentiment shifts in favor of gold and gold stocks.

A weaker dollar means gold is more attractive when priced in dollars. That means potentially higher profits for gold miners. Weak dollar fears also contribute to inflation worries … another form of wind in gold’s sails.

One last thing which could be significant. If the market becomes convinced a new bull market in gold is at hand, the miners could take off on improved earnings forecasts.

This is because miners have relatively fixed costs to pull gold out of the ground… and when gold itself rises beyond a certain price threshold, that goes directly to the miners’ bottom line.

Say, for example, gold miner XYZ has an average extraction cost of $800 per ounce. If the gold price goes from $1,350 to $1,750, the miner’s cost of extraction – about $800 per ounce – stays roughly the same. That extra $400 per ounce becomes pure profit.

This gets the Wall Street analysts excited, which attracts more attention and money to the miners in a kind of snowball effect.

We like gold… and we like the junior gold miners. Just remember that the junior gold miners are volatile. An ETF like GDXJ can limit some of that volatility but whatever you do, make sure you use smart position sizing.