It’s time to take a hard look at gold stocks. If the gold price does what we think it will, gold stocks could enter a powerful bull trend. We are already seeing early signs of this.

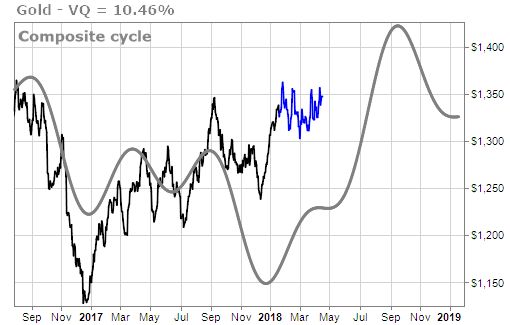

First let’s take a look at gold. Our time cycle forecast for gold is bullish, as you can see via the chart below. If our time cycle forecasts continue to be accurate – and in the crypto space they have been absolutely uncanny! – that suggests big things ahead for the yellow metal.

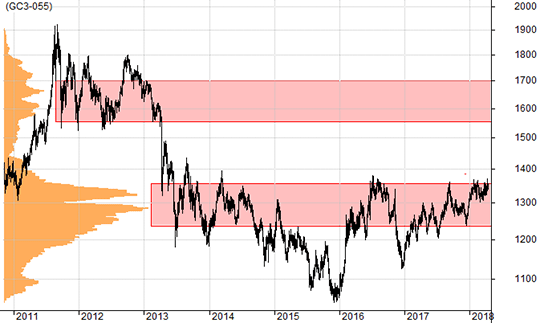

The long-term chart for gold also hints at powerful possibilities. Look at gold’s overall pattern dating back five years or so, from mid-2013 into 2018. This looks like a five-year bottom, with late 2015 registering the absolute lows.

If gold can break above its current five-year resistance ceiling, it will be blue skies ahead. With no overhead supply to speak of, gold could then be off to the races.

Gold stocks are not as strongly positioned as gold, but they are showing signs of life with a possible new uptrend already developing. As the chart below shows, GDX, the bellwether gold stocks ETF, may have completed a rounding bottom over the past few months.

And here is the thing about gold stocks. If the price of gold rockets higher, gold stocks will almost certainly follow. That is because a higher gold price directly impacts gold miner profits. For example:

- If a gold miner has an average mining cost of $900 per ounce, and the price of gold is $1,300 per ounce, each unhedged ounce of gold is worth $400 of profit ($1,300 minus $900 = $400).

- If the price of gold rises to $1,700 per ounce, all else being equal, the miner’s profit margin would go from $400 to $800 per ounce. That would be a 100% increase in profits.

- This explains why even a modest increase in the price of gold can have a substantial impact on gold miner profit outlooks. Gold stocks have significant leverage relative to the gold price.

So if our time cycle forecast is right, and gold breaks out, then gold stocks could follow.

But there is yet another reason to be bullish on gold stocks… and it has to do with debt and inflation.

For the past ten years, investors haven’t really worried about inflation. Now those worries are starting to return.

Why is this happening?

This is happening in part because the United States, and the world, are awash in debt. Over the past ten years, the world has built up more debt than ever before.

The Congressional Budget Office (CBO) estimates that the United States will have a trillion dollar deficit by 2020, which is two years earlier than previously estimated (and less than two years away).

The United States is expected to spend more than $7 trillion over the next decade, which is almost $60,000 per household, just to make interest payments on the debt.

By the year 2023, the International Monetary Fund (IMF) estimates that the US debt load will be worse than Italy’s (relative to output and GDP).

And it’s not just the United States. The whole world is awash in debt. Global debt rose to a record $237 trillion in the fourth quarter of 2017. That’s an increase of more than $70 trillion in the past ten years.

Investors are starting to worry about all this debt. Because when the next crisis hits, with all this debt weighing on us, central banks will be tempted to hit the panic button and start printing currency.

And that would be a very bullish thing for gold, which is historically the only form of alternative currency not subject to a printing press.