Wednesday, Oct. 17 was the big day. At the stroke of midnight, stores in provinces all across Canada opened their doors, ready to sell legal marijuana products.

Eager customers waited for hours in lines that were hundreds deep.

As Canada became the second country in the world to legalize marijuana across the board — and the first G7 country to do so — there were comparisons to America’s repeal of prohibition in the 1930s.

There are still strict rules in place. Edible marijuana products won’t be available for another year. And Canada’s largest province, Ontario, has delayed the opening of physical stores until April, though pot is available online or through the mail.

Nonetheless, the big day has come. There are 129 licensed cannabis producers in Canada, and the legal cannabis market is forecasted to be worth tens of billions worldwide in less than a decade. The United States alone is on track to do $11 billion in 2018, and that is with legalization in only nine U.S. states.

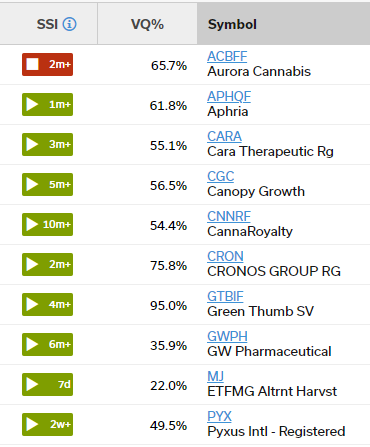

Below is a sampling of popular cannabis-related stocks (along with MJ, a U.S.-traded pot stock ETF). You may notice something about these names: Volatility (VQ) on average is high, and the Stock State Indicators (SSI) are almost all green.

The stock market has had a rough ride these past few weeks and there have been few places to hide. The S&P 500, the Dow, small caps and even the once-bulletproof FANG group of tech stocks were all hit.

But weed stocks have held up well with bullish chart patterns and resilient price action. Investors seem to be saying, “In cannabis we trust.”

There are some big caveats here though. For example: No self-respecting value investor would buy a pot stock because the valuations are insane.

What’s more, most of these names are not turning a profit; they are almost all burning cash. Worse still, in the absence of a price-to-earnings ratio (because the earnings don’t exist), many pot stocks are trading at hundreds of times sales.

Cannabis stocks are trading at wild valuations because they are a true growth story. As we’ve explained, the legal cannabis market has the potential to be worth tens of billions, or even hundreds of billions, on a global scale over the next few decades. We are seeing a kind of marijuana gold rush.

Growth stocks with nosebleed valuations can maintain those lofty levels for years or sometimes even decades. For proof of this, just look to Amazon.com and the entire biotech sector. To maintain the excitement, it helps to have news flow and a powerful narrative — interesting stories and a steady stream of compelling blue-sky press releases to keep investors engaged.

Cannabis stocks have this in spades. The possibilities around the marijuana space are truly eye-opening.

Consider the research angle, for example. Very little high-grade botany research has been done on cannabis plants. Compared to tomatoes, corn, or wheat, there are decades’ worth of catching up to do.

For cannabis researchers — who are now seeing huge inflows of funding from both the private sector and various levels of Canadian government — this creates the potential for major advances in a very short space of time. The press releases on such advances could keep investor sentiment booming for years.

Changes to the plant genome have the potential to dramatically increase crop yields, and research in molecular genetics means scientists could soon be engineering entirely new properties into cannabis plants. There is potential to make the “high” far more potent, develop specialized strains for medical use, or any number of other things that could change the game for cannabis companies.

Possibilities like these — plus a truly global market that is only now opening up — have the potential to keep investors riveted, which could keep valuations high.

Then, too, there is the commercial potential — especially in the United States. For instance, it’s estimated that the market for cannabis-infused drinks, which ranges from wellness to alcoholic beverages (think weed-based beer), has the potential to be worth $600 million by 2022.

There are reasons to be cautious though. The cannabis sector is not just priced for growth at the moment; it is priced for hydroponic hypergrowth. This could lead to challenges down the road, or severe share price haircuts if profit margins do not materialize in the manner expected.

Take the marijuana black market for example — the illegal channels by which Canadians had already been buying billions of dollars in recreational weed for years.

If Canada’s black market is harder to kill than some might expect — or if retail prices fall hard due to intense competition and heavy overinvestment — some of the stocks listed above may not live up to expectations. Others may never turn a profit at all.

And then there is the waiting juggernaut of U.S.-based competition.

Some analysts think that, while Canada has an obvious and powerful head start on the legal weed market, it is only a matter of time before American companies muscle in, armed with bigger advertising budgets and stronger commercial instincts.

American politicians are already hammering on the door. Sen. Ron Wyden of Oregon said the following in a prepared statement: “Now that our neighbor to the north is opening its legal cannabis market, the longer we delay, the longer we miss out on potentially significant economic opportunities for Oregon and other states across the country.”

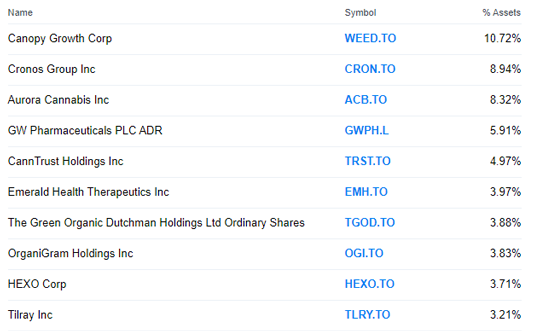

If you want fast and easy exposure to cannabis stocks, take a look at the Alternative Harvest ETF (symbol MJ). It’s an exchange-traded fund primarily composed of Canadian pot stocks, the top 10 holdings of which are shown below (via Yahoo Finance):

Our sense is that, due to the extreme valuations and hypergrowth orientation of cannabis stocks, these names may better serve as medium-term trading vehicles, rather than long-term investments.

This means keeping an eye on the cannabis industry for buying opportunities created by short-term pullbacks or temporary bouts of pessimism in the space, creating attractive entries on a return to bullish trend.

Ideas by TradeSmith, our algorithm-based stock selection software tool, offers the Low Risk Runner screen designed for identifying exactly these kinds of opportunities.

You wouldn’t want to buy cannabis stocks as a set-and-forget retirement play; there is far too much embedded volatility and uncertainty for that. But for the bold and the nimble, there could certainly be opportunity here.