One year ago, in April of 2017, we introduced “The Billionaire’s Club” to Lifetime TradeStops members.

In the Billionaire’s Club (which Lifetime members can access from the newsletter section of the TradeStops site), we track the equity portfolios of sixteen different hedge fund and investment companies, each one helmed by an investing billionaire.

The real power of The Billionaire’s Club comes from combining the fundamental stock- picking skills of these wealthy gurus with the performance-enhancing power of our proprietary TradeStops tools.

Each Billionaire position we track shows the TradeStops Stock State Indicator (SSI), the Volatility Quotient (VQ), the SSI Stop Price, and the SSI green-yellow-red status box.

These tools help us “Beat the Billionaires” by enhancing their already formidable stock-picking performance.

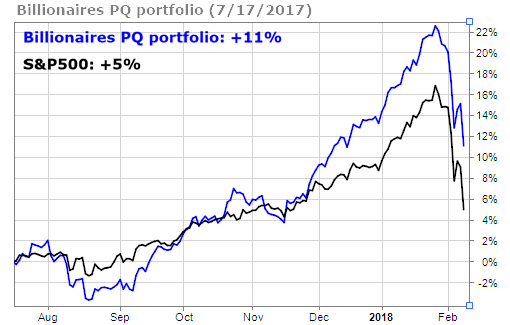

In July of 2017, we constructed a “Billionaires’ Club portfolio” and shared it with members. This portfolio used our algorithms to concentrate on the best picks.

How did we do? In only 8 months, the portfolio we constructed more than doubled the return of the S&P 500, even during the recent downturn.

There were some excellent winners from this group. Let’s take a look at a few…

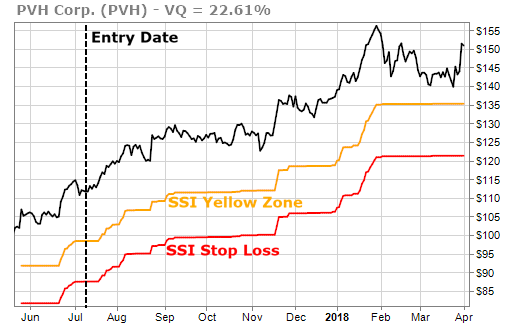

The best performing stock from the group has been PVH Corp (PVH). The price when we entered the position was $113.51.

Yesterday’s closing price was $150.92 which is a gain of almost 33%. That’s more than five times better than the S&P 500.

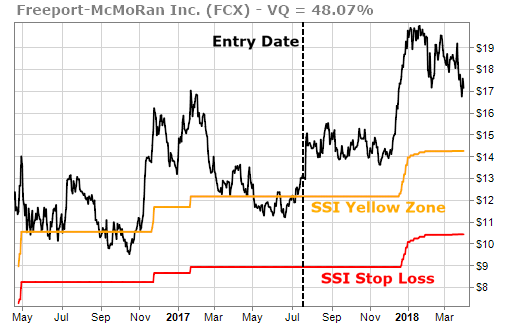

Another great performer was Freeport McMoran (FCX). The price on July 17th last year was only $13.00. Yesterday’s closing price was $17.14 which is a gain of almost 32%.

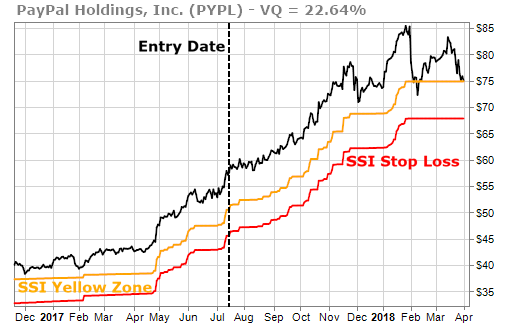

Finally, PayPal Holdings (PYPL) has given us a gain of over 30%. We entered the trade at $57.58, and PYPL had a recent close of $75.00.

Why does the Billionaire approach work so well?

Because it combines excellent stock-picking skills (supplied by the billionaires and their brilliant investment teams) with the overlay of our TradeStops tools, which help take the emotion out of investing, to enable smarter decisions.

It’s all about holding onto the best performing names in your portfolio… while trimming away the weak performers and being consistent in position sizing and rebalancing… in order to maximize performance.

This is true for Billionaires too, which is why TradeStops can potentially help almost anyone (regardless of the dollar size of the portfolio).

Nobody’s perfect, and we’re all human. We’ve noticed certain quirks with the Billionaires too, like some of them being consistently “early” to invest in a promising stock idea.

By waiting for the Stock State Indicator (SSI) to enter the green zone before buying, we have a better chance at avoiding the doldrum periods that some of these “early bird” Billionaires tend to hold through because they spotted an idea so far ahead of its time.

Other Billionaires have another quirk: They tend to hold on to their losing positions a bit too long or will sometimes give back large profits on a position instead of selling in a timely way when it turns south. Once again, our indicators and algorithms help with this by giving a clear indication of when it’s time to cash out of an investment.

Again, the concept here isn’t complicated: Combine great stock-picking (from the billionaires) with great tools to help take the emotion out of investing. It doesn’t have to be rocket science. The best ideas and the biggest breakthroughs are often simple.