Today we’re wrapping up our three-part series on leveraging TradeStops technologies to maximize your retirement finances. In part 1 and part 2 we looked at how critical it is to avoid catastrophic mistakes as you build your nest egg.

In part 3 we’re going to focus on how to help ensure that the nest egg you’ve built up can last you throughout your golden years.

Last week, we showed how TradeStops strategies could have easily turned a reasonable investment of $500,000 into a retirement nest egg of $3,500,000 using just the S&P 500.

We also drove home the point that this particular strategy is one even the most conservative investors could have easily lived with since the highs weren’t too high and the lows weren’t too low.

Example

So let’s say that you did indeed manage to build up a $3,500,000 nest egg and you’re ready to retire. Now how do you go about living off your nest egg for the next 20 to 30 years?

You’re going to have to withdraw funds to live on, of course. Even if you only pay yourself a modest annual living expense, that $3.5M is going to evaporate quicker than you might think.

Especially if you’re not also continuing to build up the principle and making sure to avoid any disastrous mistakes.

If you pay yourself, for example, $70,000 per year and a 5% annual cost of living increase to make sure that you stay ahead of inflation, how quickly would you burn through your $3.5M? You’ll run out of money in just 26 years. Take a look.

Inflation

Inflation may be relatively benign for some segments of the population, but it certainly isn’t for seniors. With medical costs skyrocketing, for example, the amount you withdraw in the later years won’t buy nearly as much as it did the first couple of years. If there’s some sort of catastrophic illness, it’s possible that your funds might just last a handful of years.

You can clearly see the need for your funds to continue growing. Furthermore, they’ll still need protection from a crippling bear market. During retirement, a bear market can have the same devastating consequences on your savings as it had while you were still working.

Fortunately, the same core rules for building your retirement nest egg can also help ensure that your nest egg lasts as long as you need it to.

Here’s how it works.

- Stay invested in the S&P 500 while it’s in the Stock State Indicator (SSI) Green and Yellow Zones.

- Move the portfolio to cash when the S&P 500 hits the SSI Stop signal and moves into the Red Zone.

- Re-invest the portfolio into the S&P 500 when a new SSI Entry Signal is triggered.

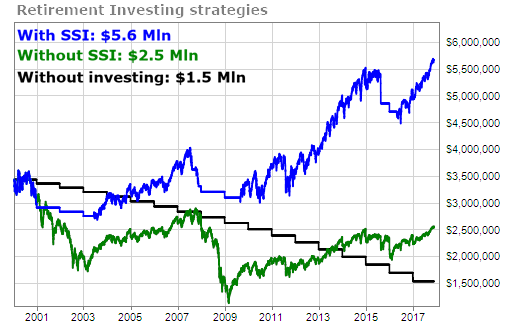

The chart below shows three different scenarios for managing your retirement nest egg had you retired in the year 2000 and started withdrawing living expenses as discussed above.

The Takeaway

The big problem with big drawdowns during retirement is that you are continuing to withdraw your living expenses while the market is down. When the market does finally recover, you’ve got less capital in the market because of those withdrawals.

That makes it that much harder for your portfolio to recover as the market recovers, which is what you see in the green line in the chart above.

Now you can see why avoiding big multi-year drawdowns during retirement is even more important than avoiding big multi-year drawdowns while preparing for retirement.

Another bear market is on the horizon; we just don’t know when it’s going to hit. By using the TradeStops signals during your retirement as you did while building up your retirement savings, you give yourself the best opportunity to accomplish what you want during your retirement. And hopefully have something left to pass to your heirs.