Last week, I introduced you to our new concept of “Kinetic VQ.” Today we are going to dive deeper into the research and show even more examples of how the Kinetic VQ can help energize your portfolios.

The Volatility Quotient (VQ) is the heart of the TradeStops system. Knowing the normal volatility of any stock or fund is the key to unlimiting your gains and limiting your losses.

The Kinetic VQ strategy looks for stocks with current VQs that have greatly exceeded their average VQ. When this condition occurs, it’s as if the stocks have an extra store of energy to push their prices higher as the VQs return to their normal averages.

Here are the rules for stocks to become candidates for the Kinetic VQ strategy.

- The average VQ must be less than 40%

- The underlying stock must trade more than 100,000 shares daily

- The current VQ must be at least 20% higher than the average VQ

- The Stock State Indicator (SSI) status must be in the Green Zone

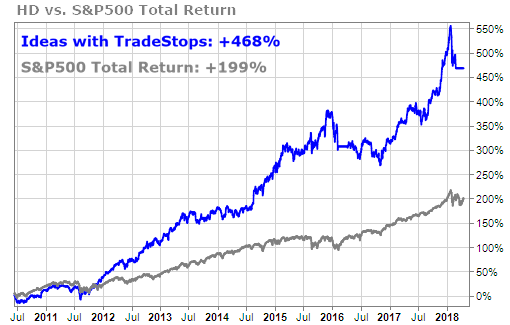

For our testing, we took 936 stocks going back to 1999. We then went back and looked at the history of these stocks since 1991. Overall, there were 829 trades that qualified according to the above rules.

And here are the results. The average gain per trade was 47.5%! Not just the winning trades, that’s a gain of almost 50% per trade.

Overall, 53% of the trades were winning trades with the average winner being well over 100%.

The average holding period was 563 trading days – more than 2 years of holding a position. That’s powerful!

The Kinetic VQ strategy can find stocks that are ready for multi-year runs higher. Here are a few examples we found in our testing.

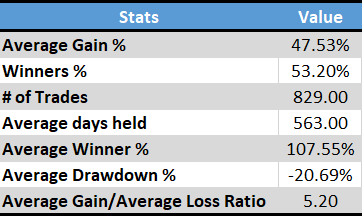

Moody’s Corporation (MCO) saw its VQ rise sharply after the financial crisis. It triggered a Kinetic VQ Entry signal in 2011. After an almost 5-year run higher, MCO stopped out in late 2015 and triggered a new SSI Entry signal a few months later.

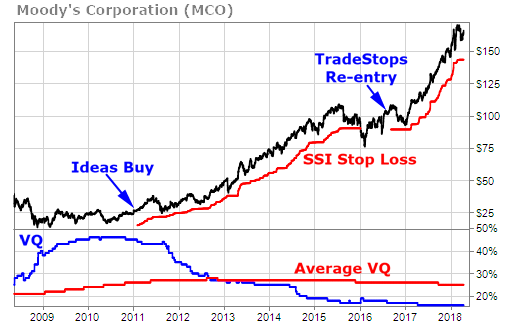

The return on MCO dramatically outperformed the S&P 500 over the same period of time by almost 3-1.

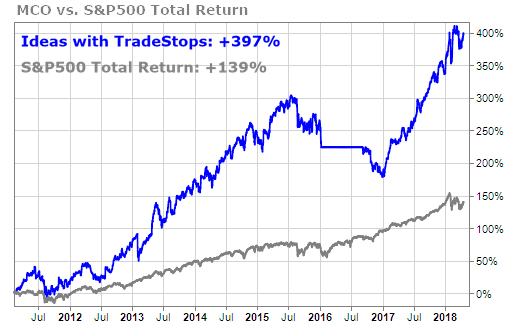

Nobody would ever confuse Home Depot (HD) with a high-flying biotech or internet company. Yet, HD triggered a Kinetic VQ strategy trade in 2009, and it moved higher for more than 6 years before stopping out. Shortly thereafter, HD resumed its upward trend before stopping out this past February.

The total return for HD over this period of time was a stunning 468% which more than doubled the return of the S&P 500.