On Monday, the Dow Jones Industrial Average (DJIA) rose 670 points in a huge one-day rally. The news that the US and China were negotiating gave hope that there would be no trade war. News outlets hailed the move. The President even tweeted about it.

The day’s huge gain made me nervous. Especially after having done this research.

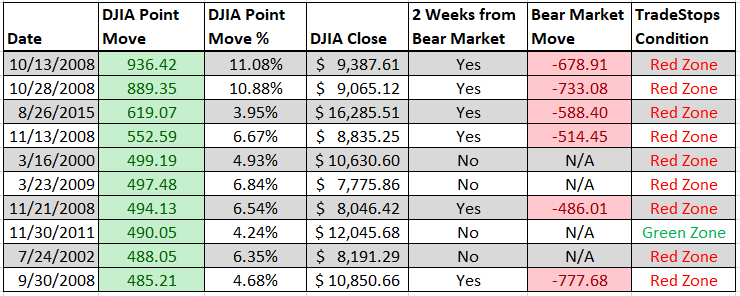

Nine out of ten times in this century, the largest up days in the market occurred when the DJIA was trading in the Stock State Indicator (SSI) Red Zone.

That means these large up days happened after the DJIA had already fallen by more than its normal volatility.

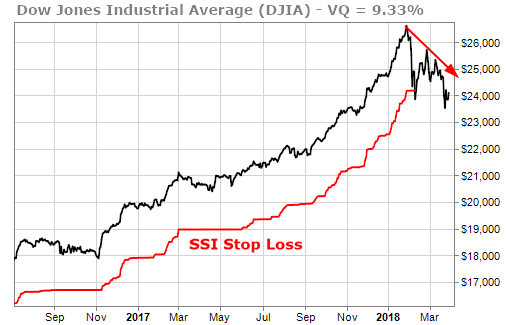

Make it 10 out of 11 now. The DJIA triggered its SSI Stop in early February. Though it has bounced back higher on two occasions, you can see that the recent trend of lower highs and lower lows seems to be developing.

In light of the above, I want to expand on a single sentence from our previous piece on Wall Street’s misleading advice:

“Put another way, most of these big up moves were dead-cat bounces in the middle of brutal bear markets”

It’s an interesting phenomenon to understand.

Wall Street’s “best days,” as defined by gigantic single-day up moves, tend not to happen when things are calm and markets are doing well. They tend to happen when things are violent and volatile and things are going badly.

Why is this the case? It makes sense if you think about investor psychology.

When markets are bullish and healthy, investors are mostly relaxed. This creates conditions where stock prices gently rise day after day.

When markets are volatile and frightening, on the other hand, investors tend to be emotionally on edge. They veer from optimism to pessimism and back again. They have surges of fear, which are replaced by surges of optimism, and then back to fear again.

The “best days” where point moves surge, are thus usually coupled with the pain of having faced volatility, fear, and extreme pessimism just beforehand.

As such, it is the overall environment that creates the “best day” phenomenon that we should be wary of.

When conditions produce huge point swings, even on the upside, it suggests investors have lost control of their emotions. They are running wildly hot and wildly cold in alternating currents.

Those are not good conditions in which to invest. Historically speaking they are dangerous conditions in which to invest! Our research bears that out (no pun intended).

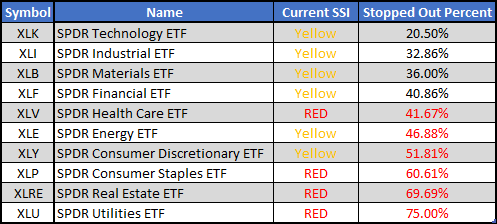

Underneath the surface, there’s more concern. The nine SPDR Sector ETFs that are part of the TradeStops Sector ETF Strategy are showing weakness. Here’s a table of their current SSI condition and the condition of the individual stocks that make up the sector (i.e., what percent of the component stocks of each ETF are also stopped out).

Things are getting uglier by the week.

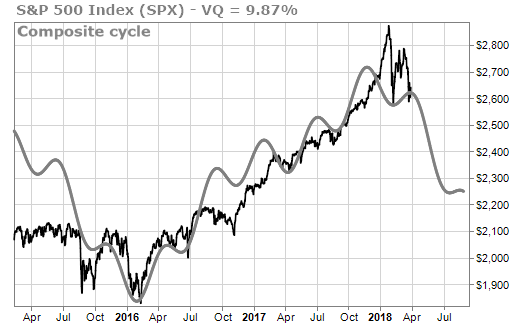

My proprietary time-cycle forecasts are showing that this market downturn could continue for the next few months with a low occurring sometime in July.

Though the above are negatives for the markets, there are other market signs that are not as bad.

Here are the ETFs that represent the major market averages. The DJIA and S&P 500 are in the SSI Red Zone, but the ETFs for the other three indices are still in the SSI Green and Yellow Zones.

XLK, the technology ETF, has a chart that’s very similar to QQQ, the ETF for the Nasdaq 100 Index. There is strong support where XLK is currently trading. The lower edge of the support channel is around $62, which coincides with the SSI Stop signal.

I want to keep an eye on the ETFs that are currently not in the SSI Red Zone. If they do move lower and hit their SSI Stops, the risk for a prolonged downturn will be increased.

Another point of concern: Last week we said that “If the Nasdaq-Dow Divergence Resolves Bearishly, Extreme Caution is Warranted” Unfortunately, that appears to be what’s happening. The Nasdaq 100 Index has not just retreated from its recent highs but fallen sharply with bellwether names like Amazon and Facebook losing tens of billions in market value.

Social media, self-driving cars, and e-commerce were three big drivers of investor optimism in tech. Due to recent events, investor psychology is turning fearful in all three of those areas. This increases the odds of the Nasdaq following the Dow lower. Given what’s happening in Silicon Valley, I’m watching the Nasdaq even more closely now.

Nobody knows what’s going to happen in the future. As for me, I prefer to follow the SSI signals. If the market does move higher from here, then I won’t have lost anything by moving to cash, and I can get back in when new SSI Entry signals are triggered.

But if the markets move lower from here, then my capital will be protected from a move into bear market territory. This is my “winning by not losing” strategy.

The markets might make me nervous, but I don’t trade on feelings. I trade on signals. You should too.