Warren Buffett is one of the top billionaire investors we follow. We track Buffett’s activity via his famous investment vehicle, Berkshire Hathaway.

(As a side note to Berkshire Hathaway fans: Buffett will release Berkshire’s annual shareholder letter on Saturday, February 24th.)

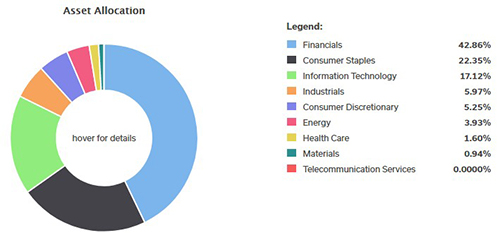

At the end of the fourth quarter in 2017, which you can see below, the asset allocation breakdown for Berkshire Hathaway was similar to the third quarter.

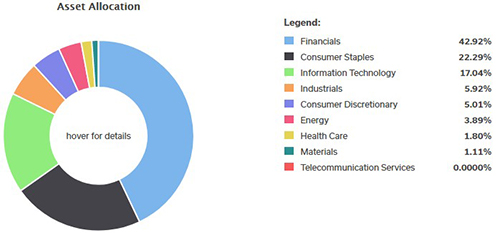

As you can see from the third quarter breakdown (featured below), there didn’t appear to be a lot of changes. But looks can sometimes be deceiving, as a significant change took place in the technology area.

During the final quarter, Berkshire Hathaway sold almost 100% of its holdings in International Business Machines (IBM). This is notable, as it is fairly rare for Warren Buffett to sell out of a position. (As Buffett has stated on multiple occasions, his favorite holding period is “forever.”)

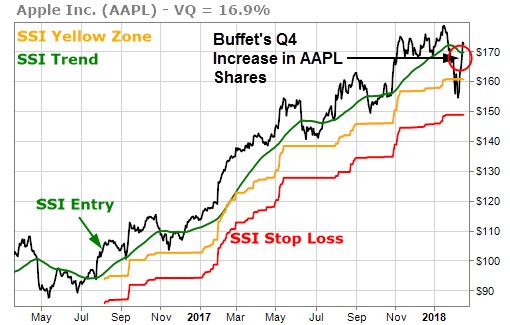

And yet even as Berkshire Hathaway sold IBM, there were significant additions to an already large position in Apple Inc (AAPL). These additions make the position one of Berkshire’s largest holdings.

Not surprisingly, Warren Buffett’s implied vote of confidence in AAPL has helped the stock climb back to striking distance of new all-time highs.

Below is a list of Berkshire Hathaway’s largest position changes in the fourth quarter of 2017. Most of the stocks in the portfolio are in the SSI green zone. Besides AAPL, the other two positions that saw notable add-ons were BK and MON.

| Symbol | Name | VQ% | SSI | Sector | Portfolio % | Q4 change |

|---|---|---|---|---|---|---|

| AAPL | Apple Rg | 16.82 | Green | Information Technology | 14.96 | 23.30% |

| BK | Bank of NY Mello Rg | 16.44 | Green | Financials | 1.79 | 21.08% |

| GM | General Motors Rg | 20.09 | Green | Consumer Discretionary | 1.09 | -16.67% |

| MON | Monsanto Rg | 14.39 | Green | Materials | 0.74 | 31.95% |

| IBM | IBM Rg | 13.54 | Green | Information Technology | .17 | -94.47% |

| LBTYA | Liberty Global Rg-A | 22.19 | Red | Consumer Discretionary | 0.13 | -63.59% |

| TEVA | TEVAPHARMIND SP A | 27.91 | Green | Health Care | .21 | new |

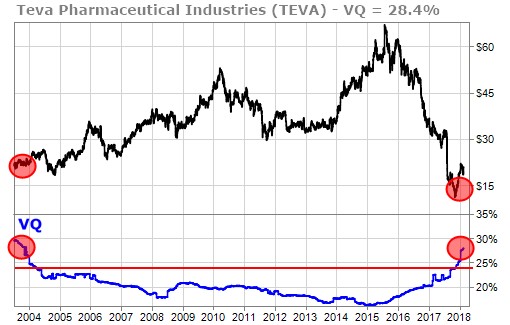

The last line of the position changes table also caught our eye, as Berkshire Hathaway opened a new position in Teva Pharmaceuticals (TEVA). Teva Pharmaceuticals is a generic drug manufacturer headquartered in Israel.

TEVA hit a TradeStops Stock State Indicator (SSI) sell signal back in October of 2015, entering the red zone in the neighborhood of $55 per share. TEVA then entered a multi-year downtrend and finally appeared to have bottomed in October of 2017. Just 10 days ago, a new SSI buy signal was triggered.

TEVA has the potential for an extended upside run. Besides the vote of confidence from Buffett’s Berkshire and the SSI entry signal after a long downtrend, another favorable factor is the historical Volatility Quotient (VQ).

When TEVA went into sell mode in October 2015, the VQ was just above 17%. Today, the VQ is meaningfully higher at 28.4%. As we have pointed out in the past, this type of situation can lead to substantial upside gains. The gains happen when the VQ, at a heightened volatility level, reverts back toward its lower long-term level.

This is what we saw in the early 2000s. From a point of heightened VQ comparable to what we’re seeing now, TEVA went on to enjoy a decade-long uptrend.

It’s always a good thing when the moves of a stock-picking legend, like Warren Buffett, align with bullish buy signals from our proprietary TradeStops indicators.