Last year, we wrote about comments made by Warren Buffett that individual investors can have distinct advantages over large institutional investors. Here’s what Buffett said:

“The highest rates of return I’ve ever achieved were in the 1950s… I think I could make you 50% a year on a million. No, I know I could… I guarantee that.”

In this year’s letter, he listed the worst 4 periods for Berkshire Hathaway (BRK.A) stock.

| Period | High | Low | % Decrease |

|---|---|---|---|

| March 1973 – January 1975 | 93 | 38 | -59.1% |

| 10/2/1987-10/27/1987 | 4,250 | 2,675 | -37.1% |

| 6/19/1998-3/10/2000 | 80,900 | 41,300 | -48.9% |

| 9/19/2008-3/5/2009 | 147,000 | 72,400 | -50.7% |

Buffett cautions that:

“In the next 53 years our shares (and others) will experience declines resembling those in the table.”

Although Warren Buffett predicts significant declines, he can’t just go to cash. If he told the investing world that he was going to cash, it would probably trigger the largest financial crisis in history and send the economy into the worst depression since the 1930’s.

TradeStops members have the advantage of being small and nimble as Buffett himself was in his early days. We don’t have to hold onto stock and suffer large losses.

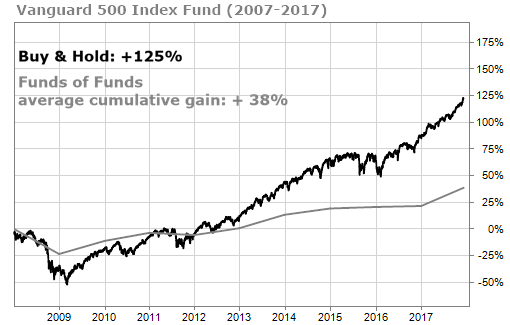

A great example of this is the famous bet that Buffett made with Protégé Partners, an investment firm that invests in hedge funds. In 2007, Buffett bet that holding an unmanaged S&P 500 mutual fund would outperform the best institutional investment ideas that Protégé could find.

Buffett won the bet handily. Here are the results:

Buffett postulated that the outsized fees the hedge funds collect each year would act like a weight to their performance. And he was right. In the shareholder’s letter, he wrote:

“Performance comes, performance goes. Fees never falter.”

But what if you refused to take the large losses that Buffett suffered? You can, you know. That’s what TradeStops does. Let’s take a look at the results of the same Vanguard S&P 500 fund had the TradeStops Stock State Indicators (SSI) been applied.

![TradeStops SSI signals beat the Vanguard fund by 25%]](https://tradestops.com/wp-content/uploads/2018/03/buffets-lessons-for-individual-investors-3.png)

Now that’s an outperformance! By applying the TradeStops SSI signals, you would have beaten the Vanguard fund by 25%!

But, you say, there are costs with TradeStops too, right? Absolutely.

Let’s look at this from the perspective of a $1 million account (the size of the Buffett bet). If you had paid the current price of $4995 for a TradeStops Lifetime membership ten years ago, and your million-dollar account grew to $2.84 million at the end of 10 years, you would have paid less to TradeStops than the .04% annual management fees charged by Vanguard.

TradeStops helps you in two ways. You’ll avoid large losses in bear markets. And you won’t have to pay the ongoing fees that Wall Street charges each year that can hurt your returns.