Warren Buffett lost 41% on his ill-fated investment in UnitedHealth Group (UNH). That gave us one or two investment ideas for you. Using the tools of TradeStops you could have made 640% or more.

We know it sounds hard to believe, but it’s true.

We’ve recently been conducting research on how individual investors can “beat the billionaires” using the investment ideas of the world’s greatest billionaire investors together with the tools of TradeStops.

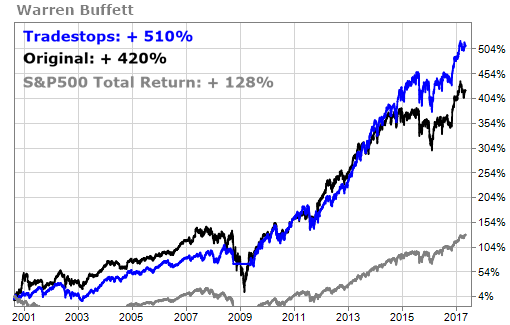

As part of that research we developed a simple system that consistently outperforms many of the world’s greatest investors … using their own investment ideas. We highlighted how that system works with Buffett’s own investments last week.

Here’s the chart that tells that story.

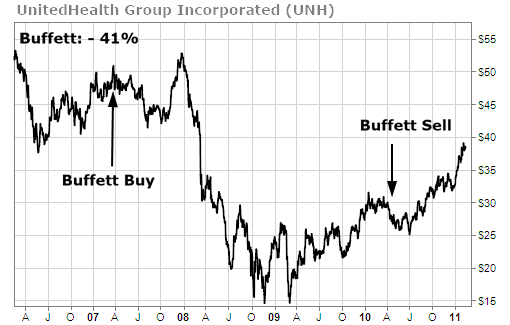

One Buffett investment dramatically illustrates how you can use TradeStops to beat the billionaires. It’s UnitedHealth Group (UNH).

Buffett made his first purchase of UNH at the end of 2006 with the stock trading near the $50 level. He exited the position in 2010 with the stock trading near $30. Here’s the chart showing Buffett’s buy and sell in UNH:

Buffett sold UNH shortly after the passage of Obamacare. At the time one prominent investment analyst speculated:

Health care stocks had been adjusting in anticipation for the bill’s passage, and now that the reforms are law it’s likely that stocks such as UNH and WLP will see their margins and sales slowly eroded by federal health care regulations.

Yeah, right.

The healthcare sector, and UNH in particular, went on to soar hundreds of percent higher after Buffett and others left the sector for dead.

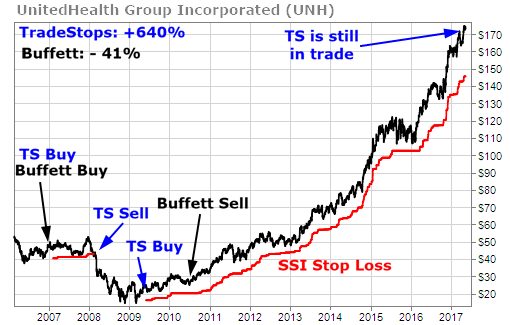

Our TradeStops “beat the billionaires” system is simple:

- You buy when the billionaire buys.

- If the TradeStops Stock State Indicator (SSI) turns red, then you sell.

- If the SSI turns green and the billionaire still owns the stock, then you buy again.

- You sell when the SSI turns red, even if the billionaire sold earlier.

Here’s how that worked on UNH:

Here’s the sequence of events:

- Buffett bought in 2007. The SSI wasn’t red so TradeStops bought too.

- The SSI turned red in 2008 and TradeStops exited.

- The SSI turned green in 2009 and Buffett still owned the stock so TradeStops re-entered.

- Buffett sold in 2010 but TradeStops stayed in … and is still in!

Buffett lost 41% on his trade of UNH, but had he been using the simple TradeStops tools to manage his investment, he could have been holding on to a gain of 640% instead.

That’s the power of limiting your downside AND unlimiting your upside.

TradeSmith Team