We’ve been continuing to dig into the investment ideas of the world’s greatest billionaire investors and looking at how we can leverage their insights to our own advantage.

And this week we’ve found something that I think you’ll find very compelling.

First though, we’d like to continue welcoming the thousands of new TradeStops members who have joined in the past couple of weeks. We’re working overtime and pulling out every tool in our shed to get everyone up to speed. We’re excited to have you.

In these Friday editorials, we like to comment on the markets using both TradeStops tools and other tools that I’ve developed. And today we’re sharing something that surprised even me.

We recently introduced the “Billionaire’s Club” on TradeStops (currently available to Lifetime subscribers). This is a resource that allows us to see what 14 of the world’s most successful investors are buying. Researching their current holdings has been an eye-opening experience.

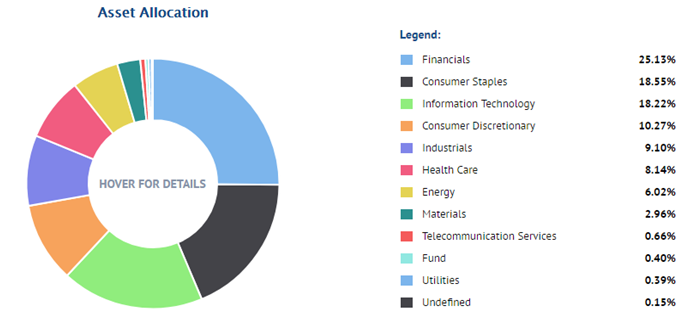

Take a look at the below chart. It’s an asset allocation chart of the consolidated holdings of 14 of the world’s greatest investors.

Across all 14 of the billionaires’ portfolios, the highest concentration of their investments is in one sector – financials. In fact, financials represent about 25% of their collective holdings!

And it’s not just Warren Buffett who famously invests in insurance and bank stocks. James Barrow, Arnold Van Den Berg, Prem Watsa, Bill Gates, and George Soros are also huge investors in financial stocks.

If the billionaire investors – the ones who move the markets – like financial stocks, it makes me want to learn more. And we like what we see.

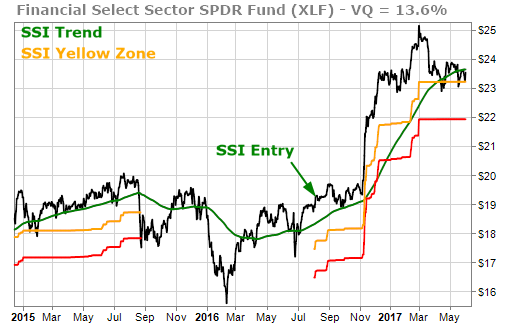

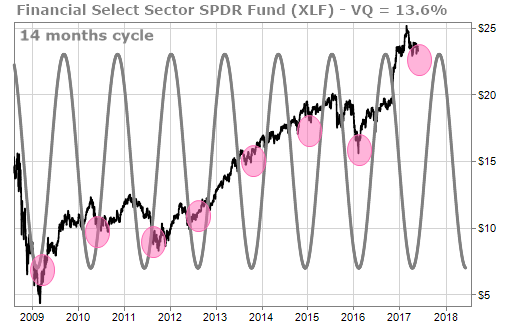

XLF is the S&P Financial Select Sector ETF. It includes all the large US financial stocks including Berkshire Hathaway (BRK.B), JP Morgan Chase (JPM), and Wells Fargo (WFC).

XLF triggered a Stock State Indicator (SSI) Entry signal back in early August 2016. Since its high in March, it has dropped into the Yellow Zone a couple of times, each time bouncing back into the Green Zone.

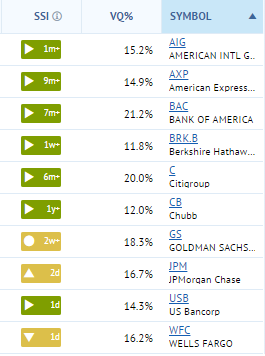

The top ten holdings in XLF comprise more than half of the total ETF. And of these ten, seven are in the SSI Green Zone and three are in the SSI Yellow Zone. There are none in the SSI Red Zone. That’s a sign of strength across the entire sector.

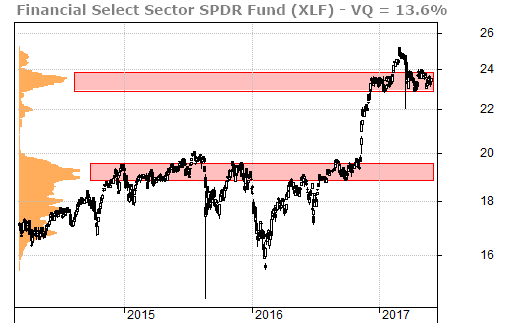

My favorite support and resistance indicator, the volume-at-price (VAP) chart shows that XLF is sitting right on top of very strong support. The left-hand side of the chart shows that the most shares have changed hands right around the $23 – $24 level. XLF is sitting right on top of that level now.

Longtime readers know that I like to use my proprietary time-cycle forecasts to help me determine the likely direction of a stock or commodity. The strongest individual cycle for XLF is the 14-month cycle. And it’s very bullish.

Most of the billionaires make their decisions based on their own fundamental analysis of stocks. If they’re bullish fundamentally, and the technical analysis also supports a likely move higher, then we’re very interested as well.

The fact that we personally feel very skeptical about financial stocks is another positive contrarian indicator supporting financial stocks. We were a bit incredulous when this research first surfaced.

Financials? Seriously? They’re already up 25% since Trump was elected. How much higher could they go?

The world’s billionaires seem to all agree that financials have more room to run. Our proprietary indicators support their convictions.

Looks like money in the bank(s) to me,

TradeSmith Team