“Buy and hold” investors brag about having better returns. But there’s something more important than the buy and hold investing strategy that they don’t talk about.

Last week, Jack Bogle, the retired CEO of Vanguard and number one proponent of using buy and hold strategies, in an interview on CNBC, went so far as to suggest that investors not even look at the statements of their retirement accounts. “…when you get your retirement plan statement every month, don’t open it. Don’t peek…. It’s the market return that’s going to be your best investment for a lifetime.”

Jack must not remember the bear market of 2008. Unfortunately, many real people remember it. And not fondly. Their lives were dramatically changed.

We’ve talked to many people who have similar stories. They were about to retire and the stock market dropped 50% or more. Their retirement portfolios were devastated. Their dreams became nightmares.

They were confronted with making a choice between having to work much longer than they originally planned or lowering their standard of living.

Millions of people were forced to make this choice. If you aren’t managing risk intelligently, this could be you the next time the market crashes.

And there will be a next time.

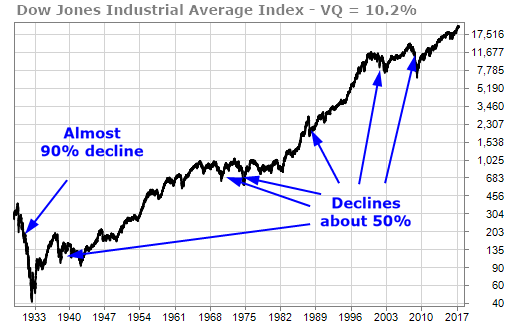

Over the past 60 years, the largest drop in the Dow Jones Industrial Average (DJIA) was 53.8%. That was during the recent 2008 financial crisis. But that was hardly the only large drop that the market experienced. Even ignoring the 90% drop of the 1929 crash at the outset of the Great Depression, there have been several drops of 50%.

Each horizontal gridline in the log-scaled chart of the DJIA below represents a drop (or gain) of 50%. It makes it easy to see that there have been 5 drops of nearly 50% in the DJIA going back to the 1960’s … nearly once per decade.

And we haven’t had a major correction in over 8 years now.

So how can you protect yourself from being another victim? Intelligent risk management using the TradeStops Stock State Indicator (SSI) system.

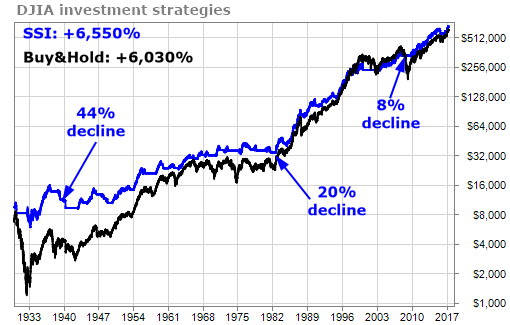

You saw that the largest drop in the DJIA in the last 60+ years was more than 50%. What if, on the other hand, you had used the SSI system to limit your downside in the markets?

The largest drop using the TradeStops SSI system during the last 60 years? Only 20.8%. And that was over 30 years ago. During the financial crisis of 2008, the loss was only 8%.

An 8% loss vs. a 50% loss.

Would your retirement portfolio have been devastated by losing 8%? Would your lifestyle have changed by losing 8%? Probably not. You would have lost money, but your dreams would have remained intact.

Buy and hold investors are going to suffer more shocks in the future. Controlling your risk is the only way you can be successful in preparing for retirement and managing your portfolio during retirement.

Refuse to take large losses that will damage your investment results. And let TradeStops help you achieve your goals.

TradeSmith Team