Ah, the eternal allure of the IPO…

- Starbucks returned a 10 bagger to early investors in just 3 years

- Yahoo! did it in just 2 years

- Amazon did it in 1 year

- Ebay did it in just 6 months!

1000% gains in a short period of time certainly capture the public’s imagination. But is investing in an IPO always a sure thing?

Not by a long shot.

In the TradeStops Stock State Indicator system we have a special color for these “early” opportunities – gray.

When you see a gray-colored SSI signal it means that we don’t yet have enough data to tell if the stock should be green, yellow or red. It takes 2 full years of historical data for us to be confident enough to assign a definitive SSI color.

In our “Beat the Billionaires” system, we avoid any investments that have gray or red SSI’s. We’ll only buy in to a billionaire’s investment thesis if we have a green or yellow SSI.

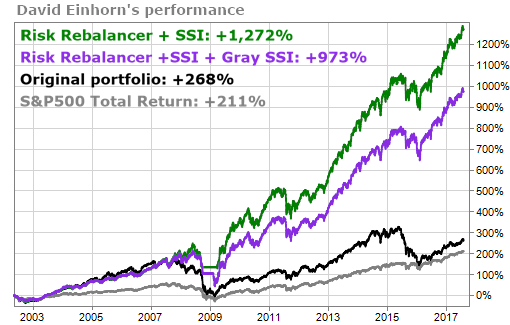

Just last week, we saw how famed billionaire investor David Einhorn didn’t do himself any favors by getting in early on IPO type investments. The green line in the chart below shows the mind-boggling impact of our beat-the-billionaires system on Einhorn’s investing ideas. The purple line shows how allowing our system to invest in investments with a gray SSI significantly reduced the overall gains.

It turns out that Einhorn isn’t the only billionaire investor that has trouble with being early.

Across all 12 billionaires that we’ve analyzed, using the TradeStops SSI and Risk Rebalancer tools could’ve more than tripled their results. However, adding in the stocks to the performance with a gray SSI, hurt their performance by about 7%.

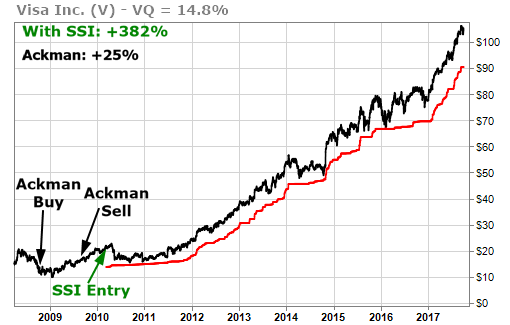

A great example of a billionaire investor failing to maximize profits on an IPO is Bill Ackman and Visa (V). Ackman bought Visa near the bottom in late 2008, about 6-months after their March 2008 IPO … and after Visa had declined nearly 30% from its IPO price.

Who knows why, but Ackman decided to sell Visa about a year later for a gain of 25%.

If Ackman had only been a little more patient and waited for our Green SSI signal, however, he could still be long Visa today with gains of 382%!

There are 1 or 2 out of the 12 billionaires who do seem to be pretty good at identifying early investment opportunities. I’ll be sharing those opportunities with you in this Tuesday column next week.

I’ve returned to the office after a whirlwind couple of weeks on the road. We had the opportunity to meet many TradeStops members and welcome dozens of new members into our family of individual investors.

We heard from many people whose lives have been changed by TradeStops. It’s always gratifying to hear these comments and know that TradeStops is making a difference in thousands of lives across 3 and even 4 generations.

Our development team continues to work hard for you to make TradeStops even more effective in helping you become better investors.