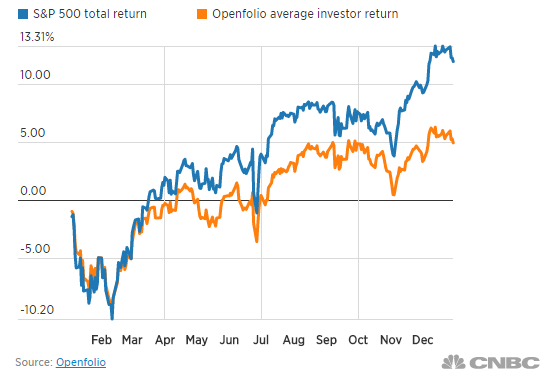

The headlines from CNBC shout, “Most Investors Didn’t Come Close to Beating the S&P 500” in 2016. Why not?

According to an article on the CNBC website, individual investors underperformed the S&P 500 again in 2016.

And the underperformance was huge. The S&P 500 gained almost 12% in 2016, yet individual investors gained less than half of that.

Even though individual investors have access to more information than ever before, more quickly than ever before, their results continue to dramatically underperform the markets.

We hate to say it, but we’re not surprised.

Investors are never going to be above average until they learn the right way to think about investing … and how they routinely think about investing the wrong way.

Recently, at an investor presentation, we began by talking about basic 25% trailing stops … and how even a simple trailing stop strategy can limit losses. Very quickly into the presentation, an attendee asked if we use a 20% gain to lock in my profits.

It was at that point that we began explaining that there is something even more essential than limiting losses. Investors must learn to un-limit their gains.

We explained that many investors zero in on a specific percentage that they believe is reasonable for their profits and sell when the stock hits that target. In other words, they unconsciously act against their own best interest by limiting their potential gains.

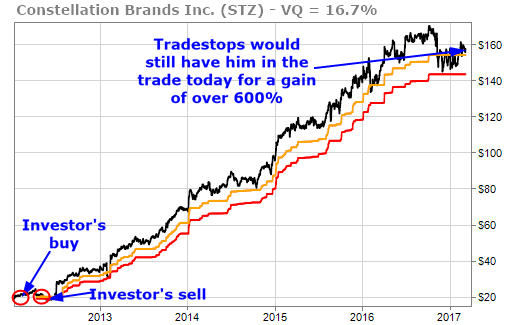

Here’s a great example of that.

This investor bought into Constellation Brands (STZ) in late 2011 when the stock was trading at $20.73. After a nice run-up, the stock moved down and the investor got scared and exited the position for a 6.8% loss just 5 months after he bought the stock.

We see this kind of situation all the time. An investor gets some decent paper gains … about 20% in this case … and then hits a rough patch, panics and bails.

In this case, however, STZ didn’t fall 25% from it’s high. It came very close … but the stop loss didn’t get hit. The investor didn’t need to panic.

Instead, he could have unlimited his profits and held onto the position for several years with gains of over 600%!

We never know when a stock will become a huge winner. But if you limit your thinking then you limit your gains and you’ll never know the joy of having a 6-bagger in your portfolio. You’ll remain part of the group of “average” investors that chronically underperform the market averages.

Unlimit your thinking. Unlimit your gains. Take the brakes off your winners … and never settle for being average,

TradeSmith Team