A few weeks ago, we published updated statistics for our Stock State Indicator (SSI) signals. Our test presented what would have happened if someone had bought a stock when the SSI Entry signal was triggered on the upside and exited that stock when the SSI Stop signal was hit on the downside.

Very simply, using the Stock State Indicator signals over the 22-year period of time gave us 56% winning trades! And the winners continued to outperform the losers by a 5–1 margin.

We were thrilled with the results. To have 56% winning trades with the winners outperforming the losers by a 5–1 margin is fantastic.

That got me thinking. Our test covered 1,300 tickers, including stocks, indices, funds, commodities, and currencies. There was no consideration at all to the fundamentals of the underlying tickers.

We measured over 1,000 stocks. There had to be fundamentally sound and fundamentally awful stocks in our testing. Of course, we don’t measure stocks by fundamentals at TradeStops. But we know who does.

The billionaires in the TradeStops Billionaire’s Club spend all their time looking at fundamentals. They only buy stocks that pass their intense scrutiny.

What if we limited our universe of stocks to include only those that the billionaires own? If we applied the TradeStops SSI signals to the billionaires’ stocks, would it be possible to have a winning percentage that’s greater than 56%?

I’ve got great news …

We found 2,602 trades that at least one of our 14 billionaires held. These trades had a winning percentage of 55.23% — very close to our original winning percentage.

But what if two or more billionaires owned the same stock?

There were 305 trades where there were at least two billionaires that owned the same stock. Those trades had a winning percentage of 60.33%.

And there were 61 trades where at least three billionaires owned the same stock. That’s a small number of trades, but the winning percentage wasn’t small. Those trades had an outstanding winning percentage of 63.93%!

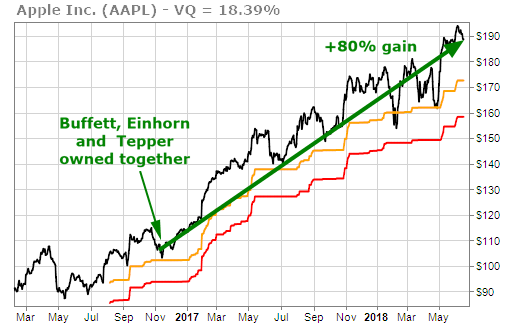

One such trade is Apple (AAPL). Warren Buffett, David Einhorn, and David Tepper have all owned AAPL for the past 18 months. That’s a lot of buying that fueled the stock to new all-time highs and close to the first trillion-dollar valuation.

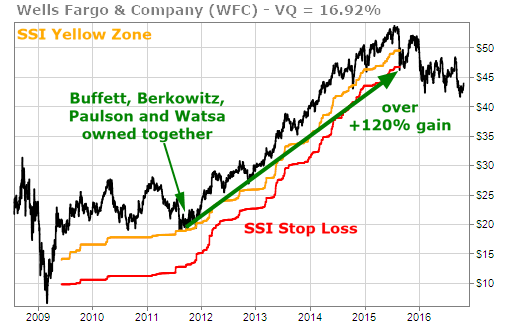

Wells Fargo (WFC) was owned by four billionaires, including Buffett, Bruce Berkowitz, John Paulson, and Prem Watsa.

They got in close to the bottom in 2011 and held for four years as WFC moved from $20 to $50 before stopping out.

Fundamentals can tell you if a company is a potentially good stock to own. TradeStops‘ SSI signals can tell you when it’s the right time to buy fundamentally strong stocks.

And when two or more billionaires agree on a stock, there’s a good probability that you’ve got good fundamentals on your side. Combine that with TradeStops‘ SSI signals and your odds of success look pretty good.