The movie “The Social Network” offers a dramatic representation of the early days of Facebook.

In 2002, Mark Zuckerberg founded Facebook inside his dorm room with a few of his then-friends.

The antagonists – if you want to call them that – in the film are two brothers who claimed that Zuckerberg stole the idea for Facebook.

Cameron and Tyler Winklevoss were two young entrepreneurs who had teamed up with friend Divya Narendra to create a social network at Harvard called ConnectU. They hired Zuckerberg to build their site.

He didn’t follow through on the ConnectU project. Instead, he created Facebook.

Zuckerberg, who would later pay the Winklevoss brothers $65 million in cash and stock to settle a lawsuit around the “idea,” would go on to become one of the wealthiest people on earth.

The Winklevoss brothers, meanwhile, have still done very well for themselves.

They became thought leaders in the global cryptocurrency space and founded Gemini, a regulated crypto exchange that has gained popularity.

Back in 2014, the Winklevoss brothers gave an incredible presentation about the history of money. I bet it will transform your understanding of how money works and why cryptocurrencies will be critical investments for your portfolio.

Survival of the Fittest “Money”

On Nov. 3, 2014, the Winklevoss brothers gave a presentation called “Money is Broken; Its Future is Not” at the Money20/20 conference.

The brothers started with a basic argument.

They argued that money is very poorly understood as a technology.

Money itself was created to store value when people could not directly barter on a one-to-one level.

If you have two bushels of corn and I have a wheel of cheese, this might make for a good trade, the brothers argue. But if I don’t want your corn, there is nothing in place to facilitate a transaction.

Money is needed in society to ensure that people can do more than just barter.

For money to exist, it must have nine qualities to ensure its viability, according to the Winklevoss presentation.

It must be scarce, divisible, storable, durable, fungible, verifiable, portable, hard to counterfeit, and widely acceptable.

But in a pre-industrial world, where fiat currencies were not the norm, human beings had minimal options. And this is where the story gets interesting.

Back to Eighth-Grade Science Class

If you think about gold, it has long been a store of value. It was widely used in coin form for thousands of years – from as early as 550 B.C. through approximately 1933.

But what fundamentally is significant about gold?

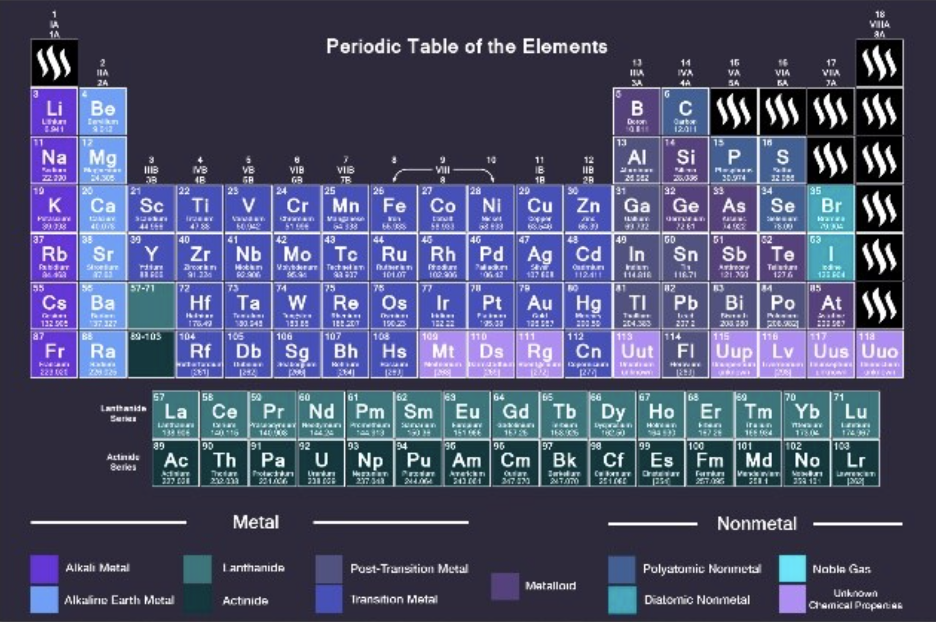

Let’s go back to eighth-grade science class. Gold, it turns out, is just one of a few elements on the periodic table that fit those nine classifications of money.

As the Winklevoss brothers explained, money cannot be a gas. It would vanish into the air. That eliminated 11 elements from our current periodic table.

Source: Winklevoss Presentation: “Money is Broken; Its Future is Not.”

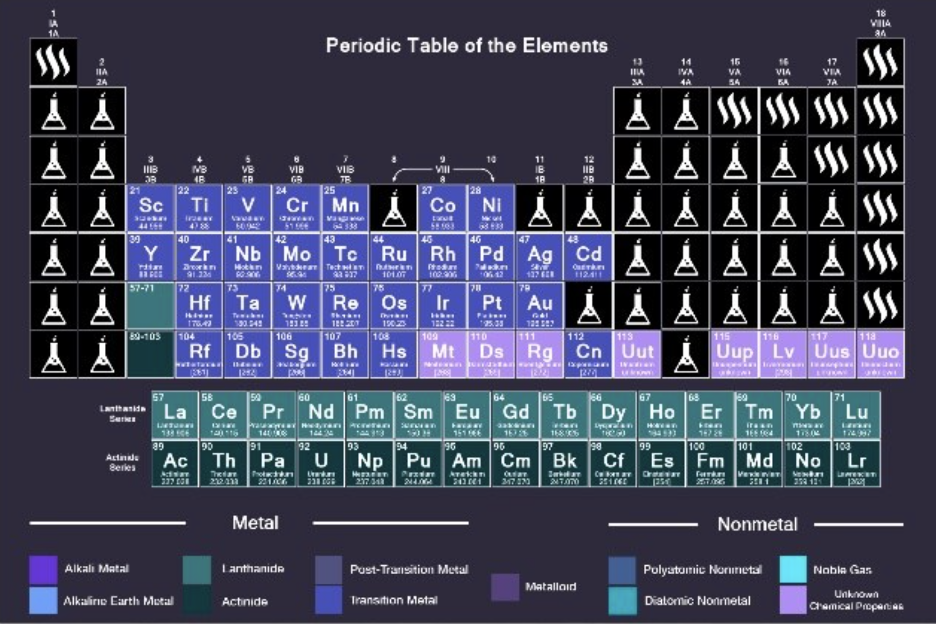

Next, money cannot be reactive or corrosive. Imagine if something was so unstable that it burned your hand (rather than a hole in your pocket). That quality knocked out another 38 elements like lithium (which is explosive) and iron (which rusts).

Source: Winklevoss Presentation: “Money is Broken; Its Future is Not.”

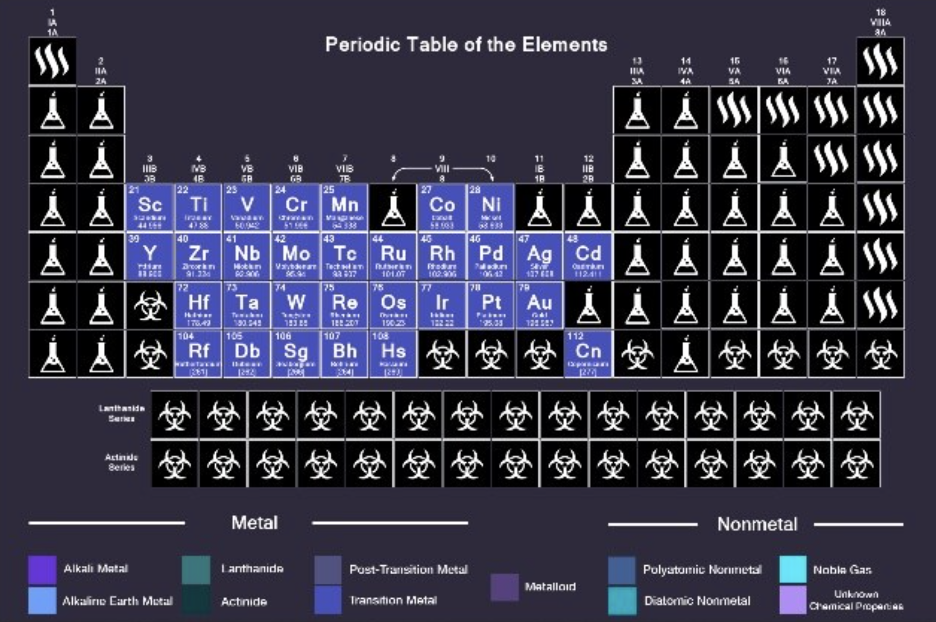

The brothers also explained that money can’t be radioactive. This makes sense. So, all the elements that could kill you were eliminated. And with that, another 40 elements on earth were eliminated.

Source: Winklevoss Presentation: “Money is Broken; Its Future is Not.”

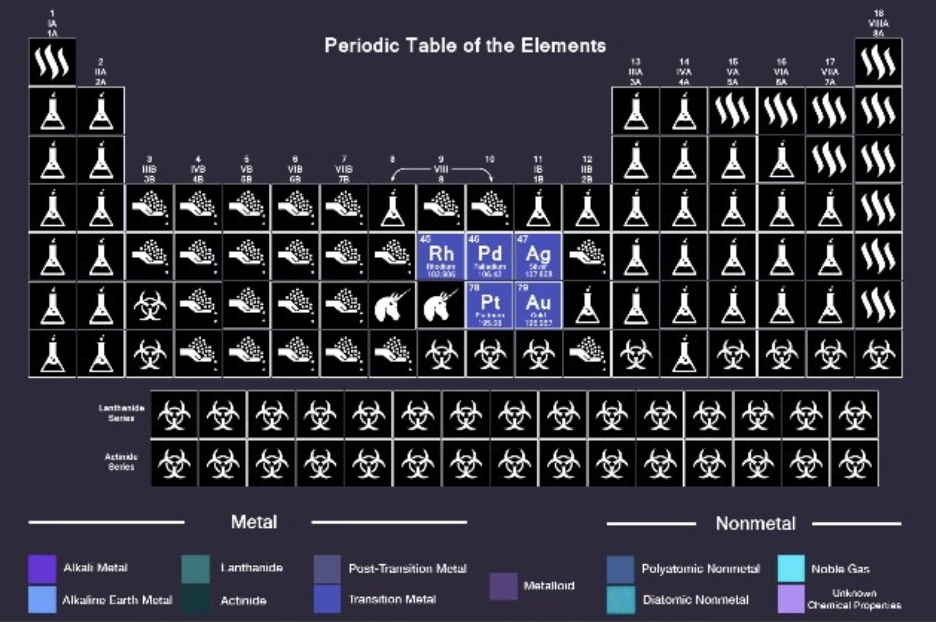

The Winklevoss brothers then homed in on the first quality of money: scarcity.

They noted that copper is far too abundant to be a stable store of value. But you also can’t have something like osmium, which comes from meteors and is extremely rare. So that knocked out another 26 elements.

Source: Winklevoss Presentation: “Money is Broken; Its Future is Not.”

The thesis goes that there were only five elements that fit all the qualities we listed above: rhodium, palladium, silver, platinum, and gold.

But scientists didn’t discover palladium or rhodium until the 1880s.

Platinum, meanwhile, has too high of a melting point. Pre-industrial coin makers would have struggled to get their furnaces up to that temperature.

That left gold and silver.

But there’s one last point that they made about the remaining two. Silver tarnishes quickly, while gold keeps its luster and shine.

In the end, the Winklevoss brothers said that gold is “just useless enough” to be the currency of the first 2,500 years of money.

The Future of Money

Now, the Winklevoss brothers make no effort to hide their enthusiasm for cryptocurrency. After all, gold – in its physical form – is still a challenging element to transport in large sums.

Despite all its inflationary flaws, fiat currency is more portable, more divisible, more storable, more fungible, and more difficult to counterfeit than gold is. (It’s very difficult to get forged money into the banking system.)

But cryptocurrency is better in all these departments when compared to both gold and fiat currencies like the U.S. dollar.

The U.S. dollar has primarily been digital since the 1960s with the advent of large computing and banking networks. The purpose of money, as noted, is to facilitate trade.

And when consumers have a currency that is more easily transferable, it can accelerate trade and consumption. For these reasons, the Winklevoss brothers argue that Bitcoin and other cryptocurrencies will become the money of the future.

It’s not very far off. And it’s a very compelling thesis. It’s hard to imagine, but Bitcoin and cryptocurrencies have only been around for 12 years.

Fiat currency – government-backed banknotes – has been around since the 11th century in China. And gold had a head start of several thousand years.

So, yes, Bitcoin will be volatile, as we have witnessed in recent months.

But if you’re not exposing yourself to the potential of this technology, you could be missing out on the most significant shift in global commerce since the onset of the Internet.

I’ll be back tomorrow to talk more about the history of Bitcoin and why it’s so compelling. And if you’re trading cryptocurrency in this choppy market, remember to use Crypto by TradeSmith to help manage your positions and set trailing stops should this market selloff continue.