I like a fast dollar just as much as everyone else.

But I’ve watched enough videos about the street hustle known as three-card monte that I know there’s always a catch with something that seems too good to be true.

In the case of rising oil prices, I regularly see investors speculating on various funds and other assets that are extremely dangerous. Yesterday, I discussed the two best ways to invest when oil prices remain elevated. As long as these companies remain in the TradeSmith Finance Green Zone, they remain strong buy-and-hold candidates.

But today I want to show you two funds that you must avoid.

These can act as weapons of destruction for your portfolio if you don’t know the rules.

Oil Trade to Avoid: The United States Oil ETF (USO)

It’s incredible to think that last year, U.S. oil prices went into negative territory. West Texas Intermediate, the North American benchmark, fell to minus $37.63, a record low.

At that point, producers were forced to pay “buyers” to take crude (or just get rid of it) as there was a massive oversupply at delivery points and a lack of storage.

For investors investing in oil companies, April 20, 2020 – the date of this historic slide – will live in infamy. As oil prices have steadily recovered over the last year, energy investors have seen stronger balance sheets and improved margins.

But for investors of the United States Oil ETF, every day is a roller coaster.

This ETF is rumored to track the price performance of spot U.S. oil prices.

But that’s just not true. It’s never meant to track spot oil prices in the U.S.

And this is why the commodity ETF should have a warning akin to a skull and crossbones pop up on the screen before you can click the “Buy” button.

This ETF aims to track the front-month futures contract for oil. Unfortunately, the mechanics of commodity ETFs can be a bit complex for the average retail investor. You see, these funds must constantly buy and sell futures contracts to “track” the price of the front-month contract.

They also have a “time value” – similar to what we see in options trading – that evaporates as we move closer to the date of the contract’s expiration.

Let me make this clear – if the price of oil were to stay exactly the same every day, the ETF would slowly decay and fall.

Now, keep in mind that most commodity futures contracts are not meant for wild speculation by anyone who isn’t prepared to take physical delivery of the actual underlying commodity on the expiration date. If they don’t execute these contracts, the ETF rolls them over.

So, unless you’ve got a cavern sitting around or a massive storage container in Cushing, Oklahoma (the delivery point for the NYMEX Light Sweet Crude oil futures contract) it’s not best to be diving too deep into this futures market.

The problem is that this commodity ETF is actively issuing new shares, buying and selling contracts, and thus increasing the cost of ownership. In some cases, investors must pay a premium to own this fund. And worse, there are days when the price of oil will rise, yet the price of this fund will fall because of those high costs that I’ve mentioned.

In 2016, the price of oil increased by 45%, its largest increase in seven years.

Yet USO dropped by 4% through the first 11 months of the year before staging a late-December rally to finish up on the year by just a little more than 6.5%.

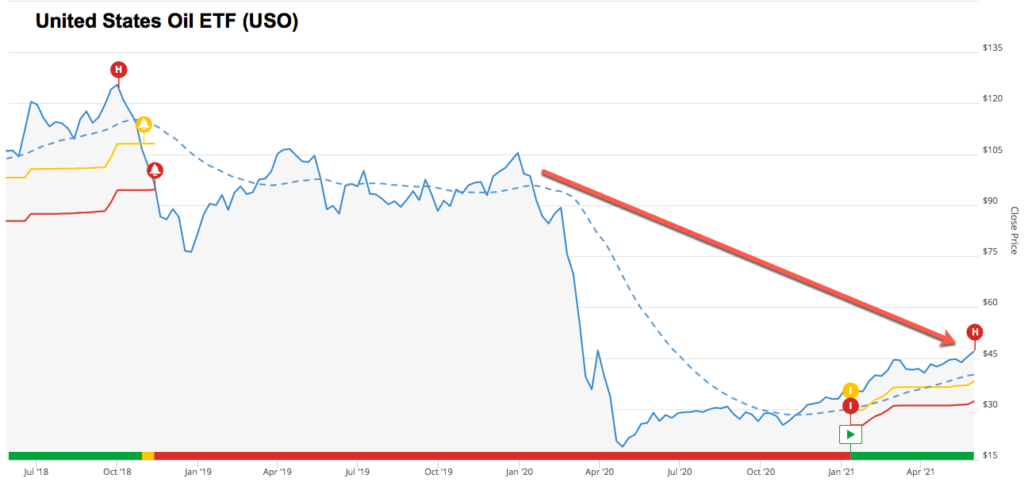

And while oil prices have rallied over the last year, take a look at where USO sat in December 2019. It was more than twice as high as the closing price on Wednesday.

That drop comes despite the news that WTI crude oil is trading higher today than it did on average during December 2019. Those are not good returns for an ETF that is supposed to be tracking a commodity’s price.

By comparison, ConocoPhillips (COP), an independent oil producer that I mentioned yesterday, finished the year up 18.6%. Meanwhile, Diamondback Energy (FANG), also an independent oil company, rallied more than 67% in 2016.

Despite all of my concerns that I’ve listed – and the detachments from oil price – the USO ETF remains very popular with investors. It has more than $3.2 billion in assets, and many people continue to use it as a speculative tool. As a result, there is ample speculation surrounding futures, and it can create an amplified herd effect where people sell contracts in droves.

Oil Trade to Avoid: Leveraged ETFs

If the USO is a potential time bomb waiting to go off in a retail investor’s portfolio, then let me introduce you to the nuclear explosion that can wreck your principal.

A traditional ETF – not a commodity ETF – is a pooled mutual fund. A fund manager purchases a basket of securities, most likely stocks. That ETF will try to track or replicate an underlying index and meet a similar performance to its benchmark over a period of time.

However, a leveraged ETF can offer the allure of a 2x, 3x, or even 4x return. So how do they aim to accomplish this? These products use derivatives and debt to attempt to multiply the return of the benchmark that it tracks.

But there’s always a catch. In this case, there are larger-than-average expense ratios and extremely fast decay in the fund. In addition, you’ll pay trading costs, custody fees, and interest expense. Those fees add up quickly and can eradicate the value of your position very quickly, especially because the portfolio must rebalance daily.

Leveraged ETFs might make investors think that they can obtain an 8% to 10% return in a day. But these do not help investors preserve capital. Instead, one bad day for a leveraged ETF can lead to the loss of an entire position.

In addition, that decay and leverage make it very difficult to buy and hold these positions for more than 24 hours.

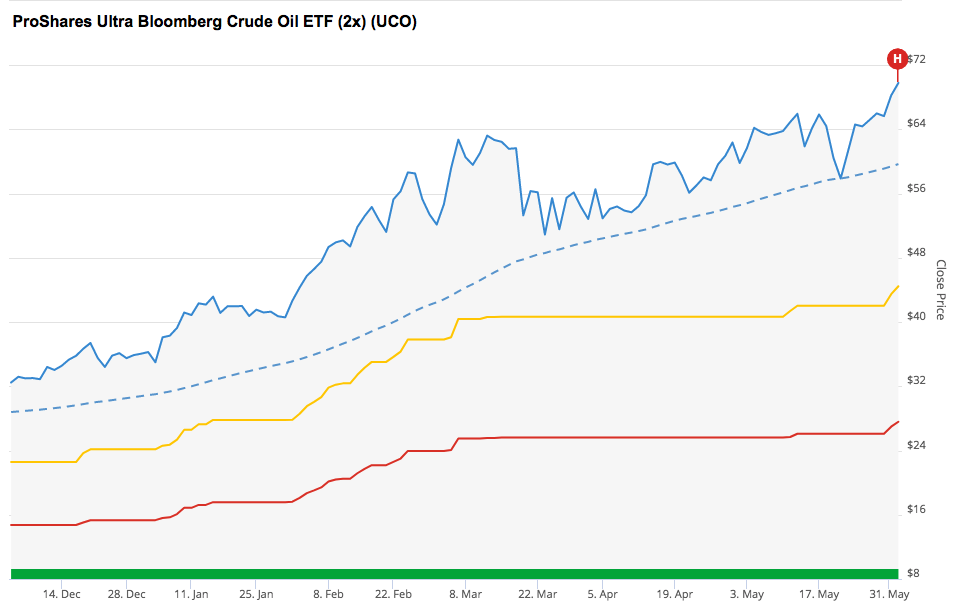

Now, I know what you’re thinking. What if I want to speculate on these funds and hold them for a longer period than a few days? After all, one can look at this chart and argue that shares of the ProShares Ultra Bloomberg Crude Oil ETF (2x) (UCO) have rallied like this since January.

The UCO is up 99% since the start of the year.

That’s very intriguing, but it’s also hindsight.

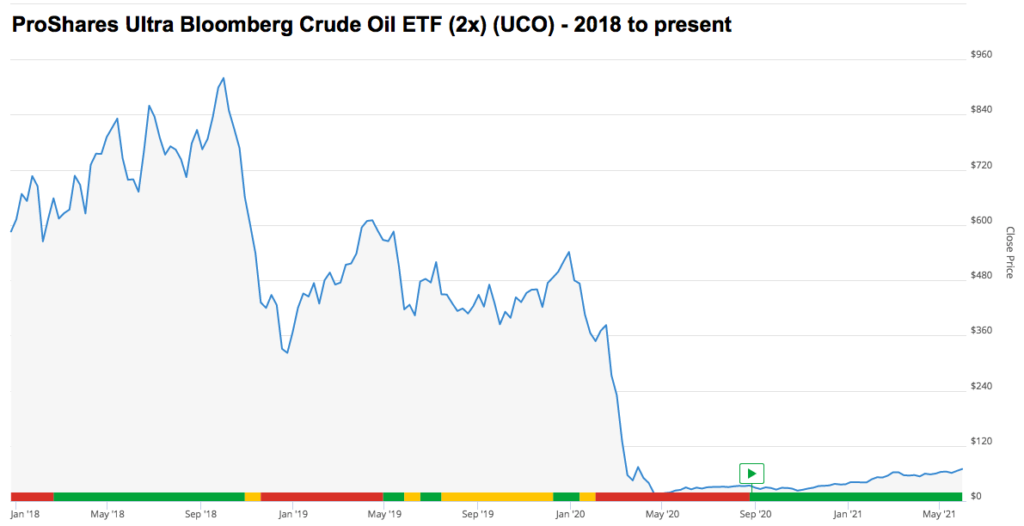

If you stretch it out over the last three years, you’ll see a fund that is actually DOWN more than 88% since the start of 2018.

That could spell a wipeout to a portfolio!

Yes, it’s OK to speculate. But if you’re going to buy and hold, consider oil producers and master-limited partnerships (MLPs) that will pay solid dividends and provide greater upside from growth factors in the energy industry.

One more thing, because I know I’ll get asked this question… if you follow an analyst who hasn’t steered you wrong and they recommend one of the funds mentioned – go for it.

But, watch their advice closely on when to exit (or follow your TradeStops Health Indicator or VQ stops). And make sure the position size is right and you track it in our system so that you have a stop-loss alert on it. Don’t get in trouble speculating! I’ll be back tomorrow to talk about how you can get started investing with less than $50 on some of your favorite stocks – even if the share price is well above that figure.