With a daily volume of $6.6 trillion, the foreign exchange market is larger than any government.

Given that reality, no U.S. presidential administration has true control over the direction of the dollar. But all of them like to pretend that they do.

On Tuesday, incoming Treasury Secretary Janet Yellen gave confirmation testimony to the U.S. Senate.

In that testimony, Yellen firmly stated that the Biden administration would not “seek a weaker currency to gain competitive advantage.”

This was a masterful bit of gamesmanship. The dollar is likely to continue weakening under the Biden administration — perhaps by a great deal — and Yellen almost certainly knows this.

Her confirmation testimony was designed to manage the political optics of what comes next, while also leaving room to maneuver.

Before we get to Yellen’s strategy, let’s pull some highlights from the past half-century of dollar policy statements — and presidential administrations trying to project an image of U.S. dollar control.

In August 1971, President Richard M. Nixon “shut the gold window,” meaning that, from August 1971 onward, U.S. dollars were no longer automatically redeemable for a fixed quantity of gold.

What few people realize is that Nixon had no choice: If he hadn’t shut the gold window, some other U.S. president would have been forced to.

That is because the U.S. dollar, as set up under the Bretton Woods system, had the ability to expand its supply — as based on fractional reserve lending, deficit spending, and international trade demand — whereas America’s gold reserves were finite and limited in supply.

When you have something that is expandable in its supply (the dollar) that is redeemable for something fixed in its supply (gold reserves), against a backdrop of rising demand, you eventually run out of road.

Nixon’s 1971 choice was thus to either shut the gold window or deplete America’s gold reserves to zero.

Bretton Woods, in this sense, was guaranteed to fail.

The way the agreement was set up — the U.S. dollar redeemable in gold, where the dollar supply could expand as the gold supply remained fixed — was doomed from the start.

And yet, as a strategic policy matter, Bretton Woods was a huge success for the United States.

By the time Bretton Woods actually failed — when Nixon shut the gold window in 1971 — the U.S. dollar was so entrenched as the world’s reserve currency, in global usage and international trade terms, that the dollar’s world reserve currency status continued.

In a manner of speaking, the U.S. convinced the world to accept the dollar as the world’s reserve currency by promising to back it with gold — and then 26 years later said “guess what, instead of gold you get U.S. Treasury bonds.”

America’s attitude at that point was exemplified by one man: John Connally, the U.S. Treasury Secretary at the time. Connally was a bold, brash Texan who treated policy like a poker game.

After Nixon’s actions in 1971, the newly free-floating dollar was a cause for serious concern. It wasn’t yet clear, at that point, whether Bretton Woods was dead or just badly wounded.

At a meeting of the G10 countries in Rome, Italy, in December 1971, the other members of the G10, shocked by the dollar’s fall, asked Treasury Secretary Connally what America planned to do.

Connally’s answer was brutal: “The dollar is our currency, but your problem.”

Following Connally’s statement, the dollar quickly lost 20% of its value, and the world adjusted to a free-floating exchange rate era (which continues to this day).

The sharp drop in the dollar’s value was something Connally wanted, because it meant an easier time for manufacturers and American exporters (as a weaker currency meant U.S. goods would be more competitive abroad).

Now we can fast-forward to 1985, when U.S. dollar strength, not weakness, had become a big problem.

After Federal Reserve Chairman Paul Volcker successfully “broke the back of inflation” by the year 1980 — having done so with interest rates in the teens — large amounts of capital began flowing into the United States, making the dollar stronger.

Too much dollar strength is a deal-killer for exporters, who see their goods become more expensive in foreign currency terms as the currency gets stronger.

And so, after a 1980 – 85 period where the dollar appreciated in value by 50% against other major currencies, the U.S. manufacturing sector was loudly complaining.

So, in 1985, to counteract excessive dollar strength, the G5 group of nations (the U.S., U.K., France, Germany, and Japan) agreed to coordinate exchange rate policies to drive the value of the dollar lower.

But the 1985 agreement, known as the Plaza Accord, was so successful in countering dollar strength that two years later, in 1987, they came up with another deal, known as the Louvre Accord, to counteract excessive dollar weakness.

The dollar, in other words, was too strong for the first half of the 1980s, so the top-dog industrial nations got together to bash its value down — and then two years later they had to try and prop the dollar up.

If all of this back-and-forth movement sounds goofy, that’s because it is.

Foreign exchange movements have always been driven by government policy choices — but often not in the way that governments intended.

That is why Bruce Kovner, a retired multi-billionaire known as one of the greatest forex traders of all time, once remarked that “stupid governments” were his best source of profits.

Fast forward again to the mid-1990s, and Treasury Secretary Robert Rubin — a former co-chairman of Goldman Sachs — famously instituted a “strong dollar policy.”

Rubin was a master of optics. His “strong dollar policy” played well politically because the U.S. dollar was already strong in the 1990s.

The dollar was strong, at that point, because capital was flowing heavily into U.S. equity markets (stirrings of the later tech bubble) and because U.S. government spending had fallen on balance through most of the 1990s, mainly due to cuts in defense spending after America won the Cold War (the Soviet Union collapsed in 1989) and then the first Gulf War of 1990-91.

While manufacturers and exporters don’t like currency strength, other economic players prefer a strong dollar to a weak one. A strong currency makes foreign goods cheaper to purchase, for example, and increases profits for American corporations that employ workers abroad and manufacture things abroad, and then sell domestically in the United States.

So Rubin, a natural strategist, saw a set of conditions for a strong dollar that the Clinton administration didn’t really control, officially declared “strong dollar policy” a good thing for America, and thus projected an image of competence and control over what was happening to the currency.

But then, in 2001, the new Treasury Secretary for the incoming Bush administration, Paul O’Neill, caused a stir when he openly questioned the strong-dollar policy of the 1990s.

O’Neill, before becoming Treasury Secretary under George W. Bush, had been CEO of Alcoa, the aluminum giant. That meant O’Neill intimately understood the downside of a strong currency policy: It tends to hurt exporters and commodity producers.

Later in O’Neill’s tenure, the joke became that the Bush administration still supported a strong-dollar policy — but it now meant strong in the sense of “a currency that isn’t easily counterfeited.”

Of course, too, it made sense for the Bush administration to soften its attitude toward dollar policy because the government was spending like crazy again (paying for new wars in Iraq and Afghanistan, new tax cuts, and so on) and because monetary policy was kept extremely loose after the dot-com bubble burst (with Alan Greenspan cutting the federal funds rate to 1%, a shocking move at the time).

The emerging pattern here is that the direction of the dollar is determined by big-picture factors the White House doesn’t truly control, except in extreme circumstances.

At the same time, the optics are such that every administration wants to claim a measure of control — so they look at what the dollar is doing, and then sort of say, like Pee Wee Herman after falling off his bike, “I meant to do that,” meaning the official policy pretends to be in sync with whatever the dollar is doing in the cycle dynamics of the moment.

The other thing we can get a sense of here is the big, rhythmic cycles that the dollar tends to move in, where trends of strength or weakness tend to run for many years, if not a whole decade or more.

- In the 1970s, the dollar was weak (after Nixon shut the gold window)

- In the early 1980s, the dollar was very strong (after Volcker beat inflation)

- Then the dollar weakened from 1985 to 1990 through deliberate efforts

- In the 1990s, the dollar was strong, and in the 2000s, it was weak again

- And so go the multi-year cycles, strong and then weak, ad infinitum

In the period from 2002 to 2011, the U.S. dollar was weak, so it’s little surprise that 2002 to 2011 was also a boom time for hard assets of all kinds (and particularly gold).

Then, from 2011 to 2017, the dollar entered another cycle of strength, with the “U.S. exceptionalism” trade in full swing: Even as Europe was in and out of crisis in those years, U.S. equities went from strength to strength, with fiscal policy constrained and monetary policy loose (a perfect recipe for stocks).

But in 2017 the outlook changed again, as the Trump administration openly embraced an aggressively weak dollar policy for the first time in decades.

President Trump, in fact, was the first president since Nixon — if not the first U.S. president ever — to openly and aggressively advocate for a weak dollar policy, making stronger policy statements than his own Treasury Secretary.

Trump tweeted the following in August 2019, which captures the flavor of weak-dollar shout-outs over his four-year tenure:

“As your President, one would think that I would be thrilled with our very strong dollar. I am not!”

President Trump also sought ways to actively weaken the dollar — attempting to do more than just jawbone its value lower (to help close the trade deficit, boost exports higher, and boost international corporate profits).

“President Donald Trump has grown concerned that the strengthening U.S. dollar is a threat to his economic agenda,” Bloomberg reported in July 2019, “and has asked aides to cast about for ways to weaken the greenback…”

The dollar weakened meaningfully in the first 18 months of the Trump administration, but then strengthened again in the years that followed — until the onset of the pandemic, that is, when the picture changed dramatically due to a tsunami of U.S. fiscal spending (with more waves yet to come).

Now, at the onset of the incoming Biden administration, we appear to be in the “weak dollar” part of the cycle — and in our view the weak dollar trend could last for years, if not through the end of the decade.

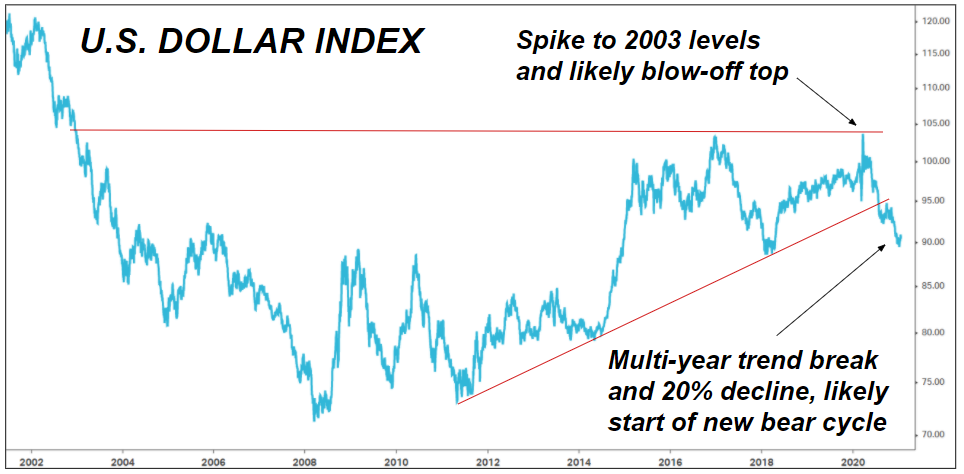

The U.S. Dollar Index spiked to its highest levels since 2003 in March of 2020, and then immediately turned tail to fall nearly 20% from that point. The U.S. dollar downtrend looks persistent and powerful, and shows clear signs of continuation, as you can see in the chart below.

Now, getting back to Yellen and her congressional testimony: Yellen, almost certainly, knows that the U.S. dollar is going to weaken on her watch, perhaps by a lot.

The dollar is set to weaken under a Biden administration because the amount of fiscal stimulus deployed by the United States will dwarf that of Europe and Japan, which in turn will translate into a weaker currency via greater spending and a larger supply of treasury bonds.

There are other reasons in addition to that, some of them important — but U.S. fiscal capacity is the big one. Then, too, because a weaker dollar helps manufacturers and exporters, a Biden administration may well in fact welcome a weaker dollar. A little bit of inflationary heat, aided by a falling, could also help inflate away the debt burden faster (another inevitable policy goal).

But of course, the Treasury Secretary can’t say any of that stuff out loud. Yellen cannot say, “We welcome a weaker dollar and our policies will likely accelerate that weakness.”

Instead, Yellen has to say the opposite. It is all about the optics, you see, combined with plausible deniability when a weaker dollar outcome manifests aggressively in the coming years.

That is why, in her confirmation testimony yesterday, Yellen said the following:

“The intentional targeting of exchange rates to gain commercial advantage is unacceptable…”

“The United States does not seek a weaker currency to gain competitive advantage and we should oppose attempts by other countries to do so…”

“The value of the U.S. dollar and other currencies should be determined by markets. Markets adjust to reflect variations in economic performance and generally facilitate adjustments in the global economy.”

Technically speaking, all of Yellen’s statements are probably 100% true.

The Biden administration is not at all likely to weaken the dollar on purpose. But that is part of the point: They won’t have to try, because it is going to happen anyway, as an indirect result of other policies.

So what Yellen is doing here — which is brilliant in its own subtle way — is laying the groundwork for plausible deniability and righteous indignation, if and when the point comes where the dollar’s value declines so far, so fast, that America’s trading partners openly question whether the Biden administration is weakening the greenback on purpose.

At which point Yellen will be able to say: “Who, us? No, we would never do that. Remember what I said in my confirmation testimony. ‘This is all just the market doing its own thing…’”