In July 2004, one of the world’s most innovative companies completed its initial public offering (IPO).

It was one of the most widely anticipated IPOs in market history. Investors flocked to take advantage of the technological successes that it had. It would go on to create some of the most incredible technologies that consumers use every single day.

In fact, this company transformed the way that people buy products.

But if you think that I’m talking about Google, you’re mistaken.

Google’s IPO was actually in August 2004.

Another company – a global leader in innovation – went public in July 2004.

And it changed your life. You just might not know it yet.

Check This Out

Want to see an incredible chart?

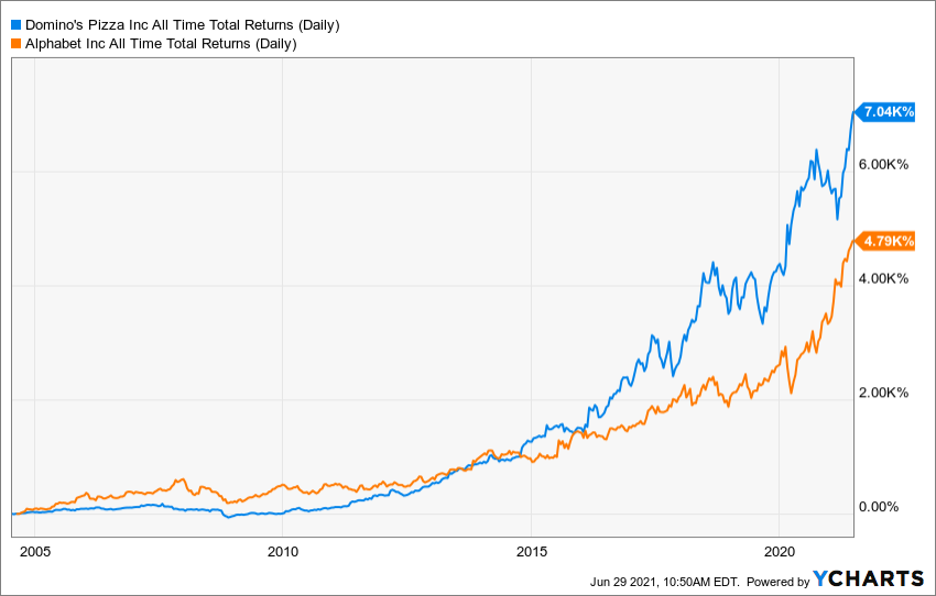

This is the all-time total returns for Google and a little company called Domino’s Pizza since their respective IPOs 17 years ago.

Yes, total returns for Domino’s Pizza – including dividend payments – sit north of 7,000% over the last 17 years.

Google, a company that everyone associates with innovation – is up just 4,790% by comparison.

Now, I’m sure some people are scratching their heads.

Domino’s has been a better stock to own than Google for the last 17 years?

Yes. And that return is well-deserved.

Domino’s is an incredible “technology” company.

About two years ago, there was some bearish chatter around Domino’s stock.

Analysts worried that Domino’s was facing stiff competition from rivals like GrubHub and UberEats.

Domino’s had decided to go it alone when it came to delivery.

The pizza joint did not want to sell its products on popular delivery apps.

Instead, it relied on its history of innovation to win the so-called “Pizza Wars.”

Domino’s has been in the position of fighting off competition for decades.

But people just keep dismissing its popularity and its ability to outperform consistently.

Even during COVID, the company continued to boost same-store growth. In Q1 2021, Domino’s continued its trend of 109 straight quarters of increased international same-store sales growth.

That’s more than 27 years.

So, what is Domino’s doing so well that other restaurants are not?

Mobile First

Domino’s generates 60% of its orders from digital platforms.

Just 10% of its orders are walk-ins.

You don’t get to those levels without early adoption. And Domino’s clearly was in the digital game early.

It was the first major pizza chain to start online and mobile ordering. Back when these platforms began, some analysts scoffed. In their minds, phone orders and walk-in orders were the only way to complete a pizza sale.

But Domino’s has been at the cusp of innovation for decades.

It created the food-warming HeatWave bag back in 1998. Now, these bags are a staple of almost every delivery company in America.

It also created the Domino’s Tracker. I remember people laughing at the idea that you would want to track your food in real-time.

But guess what? This technology is at the center of every single food application that you use today. If it weren’t for Domino’s, you’d be sitting by the window waiting for your delivery driver and shaking a fist at the sky.

Want more innovation? Back in 2015, they made it possible for customers to order food from their watch, from a car stereo console, and even from text messages.

It then created something even more popular before the pandemic. Hotspots – which launched in April 2018 – allow customers to meet their delivery drivers in public places like parks, beaches, and even the local museum. There are more than 150,000 Hotspots locations across the world.

Its latest innovation is even more incredible. And it could be one of the largest drivers of profit margin in the years ahead (no pun intended).

Driverless Delivery

Domino’s latest innovation comes from a partnership with a robotics company called Nuro.

The company is now testing a robot pizza delivery system in Houston, Texas.

That’s right, customers in Woodland Heights can now have a robot drop off their pizza. While it’s en route, customers can follow the robot’s path and get a mobile code to unlock the vehicle upon its arrival.

This isn’t the first time that Domino’s launched autonomous delivery. It tested drone deliveries in London back in 2013.

It all sounds very futuristic. Sometimes the company’s experiments sound downright silly at first glance. But its philosophy on staying out in front of trends and taking risks is why this company has been so successful.

And that success is measured in dollars and cents.

Domino’s has fantastic profitability metrics. It has an operating margin of 17.89%, and net margins are at 11.53%. There isn’t a restaurant in America that would turn down that kind of profit. In addition, we’re starting to see more Wall Street analysts turning increasingly bullish on the stock. One analyst at Longbow Research just hiked a price target to $518. That’s about 11% higher than where the company’s stock sits today.

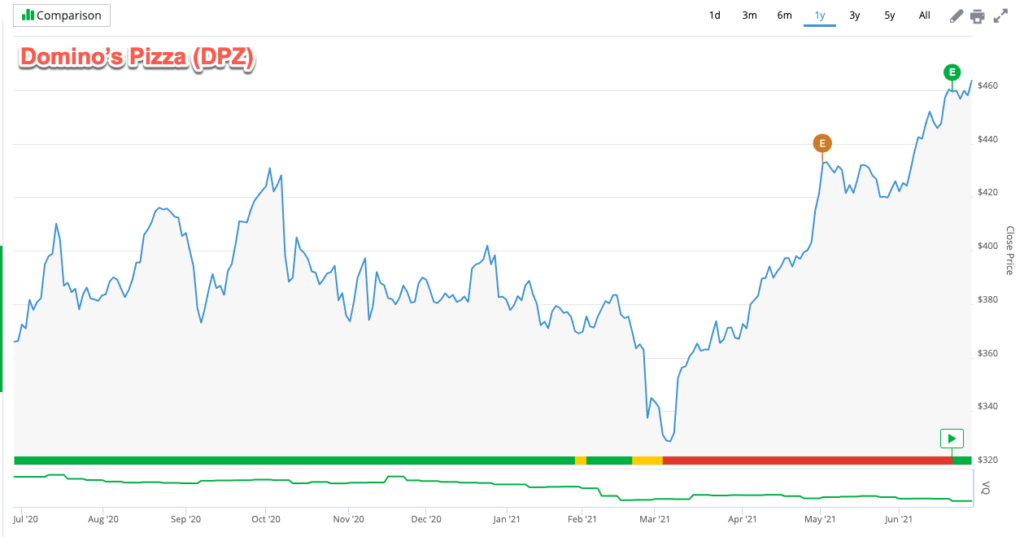

As always, I turned to TradeSmith Finance to get an assessment on Domino’s stock.

Shares are sitting in our Green Zone (signaling that it’s a buy as of June 21). In addition, it maintains upward momentum and has been in an uptrend since June 18.

When it comes to Domino’s, this is really a technology company hiding in plain sight.

I’ll continue to watch what other innovations they deliver in the months and years ahead.