On March 18, 2020, AutoNation (AN) plunged 17.88%.

As we reflect on the COVID-19 crisis, that was the final day of a brutal weeks-long slump for the new and used auto retailer.

Shares had traded at $48.44 on Feb. 24, just four weeks prior. But on this day, shares slumped to $22.55.

If you think back to that date, the crisis had reached its worst point for the markets. Investors had no idea what to do. So Americans yanked their life savings out of banks and started putting them under the mattress.

Minneapolis Federal Reserve Bank President Neel Kashkari recounted on “60 Minutes” that month that one man walked into a regional bank and asked to withdraw $600,000 in cash.

At the time, the world was in a panic. Stocks across the board plunged as investors worried about the state of the U.S. economy, the prospects of widespread shutdowns, and limited market potential. Following the Fed’s massive capital injection, markets started to rebound and didn’t slow down.

The automotive sector — largely left for dead — experienced a resurgence.

And when COVID-19 supply chain challenges fueled shortages in automotive parts in 2021, AutoNation became one of the sector’s top-performing stocks.

Today, I want to recount what is happening in this sector and why it’s important to follow technical tools to identify buying opportunities in the wake of a crisis.

AutoNation’s Recovery

Back in March 2020, AutoNation faced grim prospects. The company operated more than 300 auto dealerships across the country. Despite having a solid reputation for managing costs and driving revenue growth, analysts raised severe concerns about the company’s short-term and mid-term finances.

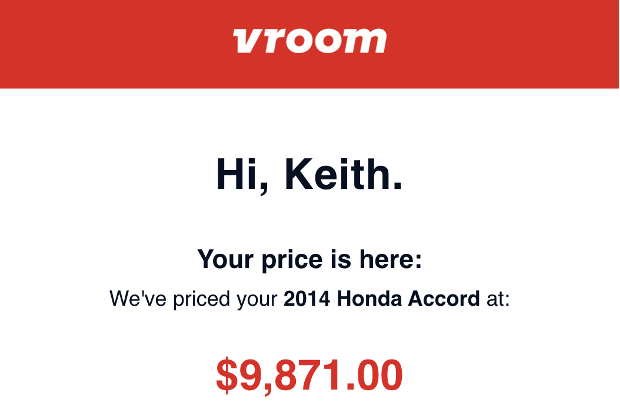

In 2020, the company generated about one-third of its revenue from used vehicles. However, prices of used cars collapsed at the onset of the COVID-19 pandemic.

Rental car companies — spooked by the prospect of slumping business and personal travel — began auctioning off vehicles in a fire sale. Investors were also concerned that rising unemployment could fuel auto credit defaults or limit new auto purchases.

Given that AutoNation also generated a large stake of revenue from luxury vehicles (roughly 33%), the thesis went that Americans would stop buying expensive cars and cut back on their spending.

AutoNation engaged in a significant round of job cuts. It reduced advertising and moved to control costs. These cost efforts proved to be a catalyst for the company.

As 2020 dragged on and the Federal Reserve showered the economy with cash, concerns about consumer credit dissipated. And Americans, flush with cash savings, started to buy cars once again. Tack on low interest rates, and the start of 2021 proved to be favorable for AutoNation.

Enter the Supply Chain Crunch

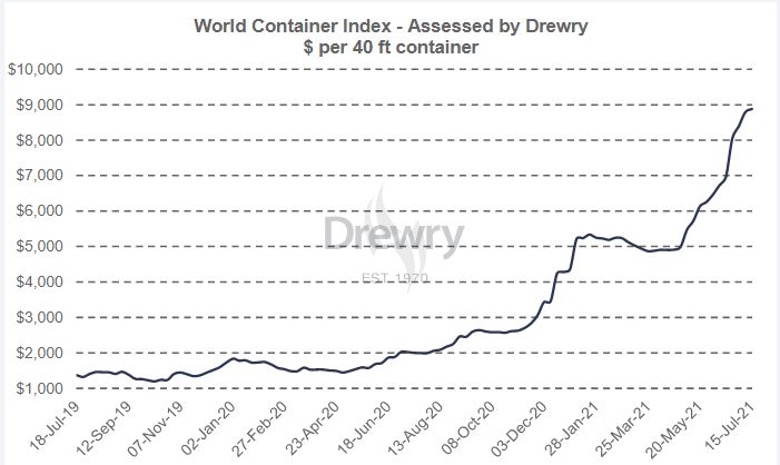

During the COVID-19 crisis, auto companies dramatically cut back on their production expectations for the end of 2020 and into 2021. As a result, auto manufacturers cut back on orders for headrests, plastics, vehicle components, and most of all, semiconductors.

The average new car has more than 100 semiconductors in it. And with demand from the auto industry expected to fall, chip manufacturers conditioned their plants to focus on chip production for the video gaming, cell phone, and computing spaces.

So, when 2021 started, investors started to realize that supply chain shortages were on tap. The global shortage of semiconductors hit the automotive industry especially hard. It was so dramatic that used cars sitting on the lot started to appreciate. With fewer replacement parts available for traditional maintenance, the cost of everything inside of a car started to increase.

As a result, so did the value of new cars, which experienced significant production delays. Meanwhile, COVID-19 served as an incredible catalyst for changes in population behaviors. More Americans were leaving the cities and moving to the suburbs, where automobiles are nearly always required.

And with interest rates still well below where they sat in 2019, automobile demand continues to rise. This combination of trends, aided by a rock-solid balance sheet, has made AutoNation one of the top-performing stocks in the automotive sector.

And analysts anticipate that the company will hit new all-time-high revenues and earnings in 2022. In addition, the ongoing supply chain shortages are allowing the company to raise prices in a time of high consumer demand.

When to Buy AutoNation

A vast number of unforeseen catalysts have driven AutoNation to recent highs of $125.01 per share. TradeSmith Finance currently rates the stock as a “buy.” It is in the Green Zone and has upward momentum signals.

But the right time to buy AutoNation was actually on Aug. 19, 2020. That’s when the stock officially flashed its buy signal. At the time, it was trading at roughly $56 per share, meaning it has more than doubled since entering our buy zone.

This is another reminder that the tools in TradeSmith Finance can help investors identify breakout stocks and breakout trends long before they reach the front page of Barron’s or the Wall Street Journal. Of course, robust and positive momentum captured by TradeSmith Finance might not give you the exact reason why the market is pouring into a stock. Still, it can capitalize on the wave of capital entering a position.

Many people look back on trade opportunities with regret and wonder how they missed a company like AutoNation. However, TradeSmith Finance is forward-thinking and helps you identify the trend over time.