In December and again in January, we outlined a script for gold to form a bottom and start a sustained rally through 2017. That script continues to play out nicely … with gold really starting to shine in the past month.

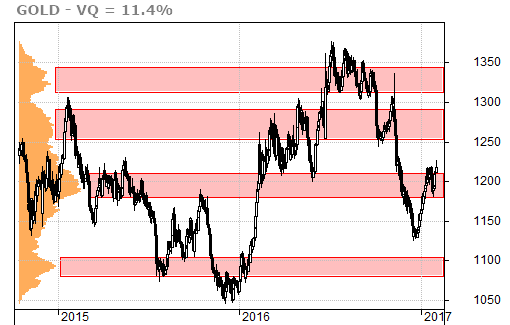

In just the past six weeks, gold has gained over 8% or nearly $90 per ounce. Most critically, it has recently climbed above critical volume-at-price (VAP) resistance at $1,200 an ounce.

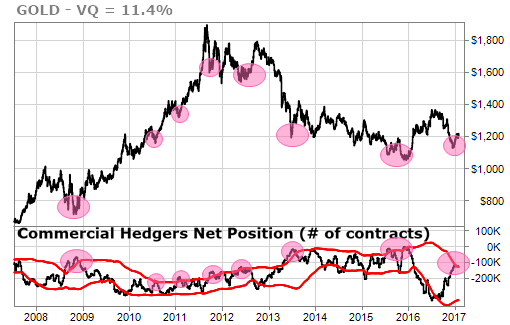

The big boys also continue to stake their claim to potential gold profits. The chart below shows how each time the commercial players in the gold futures markets have reached a local extreme (bottom section of chart below where black volume line touches top of red bands) the price of gold has rallied shortly thereafter.

Our time cycles also continue to be bullish for gold … both in the short-term:

… and in the long term:

We highlighted the above chart back in December too and mentioned how the real kicker for me would be when the commercial hedgers (bottom section of chart above) add to their position and get back near the zero line.

That would mean that their gold would be officially unhedged and a very strong indication that they’re expecting higher prices ahead. Nice progress has been made in this area in the past month.

Before we get too far ahead of ourselves, however, gold is still in the SSI Red Zone after getting stopped out back in November of 2016.

Yes, we took a small loss on the 2016 SSI entry and exit signals, but I’m fine with being wrong once or twice … and then being right big time after that.

We think that the next SSI entry signal for gold could be the biggie. We’re watching the U.S. dollar, which is falling nicely … and we’re watching the commercial hedgers in the futures markets to see when they’re signaling “all in.”

For those looking to dip their toes in the water ahead of a new SSI entry signal, call options or a stop loss around $1,100 both look like good bets to us.

TradeSmith Team