Since the beginning of human civilization, the growth of our society has inevitably been accompanied by one thing: the energy demand.

Whether it’s for heat, light, or mechanical assistance, the growing energy demand has been a constant throughout history.

And at almost every stage, investing in the energy-generating technology of the day has been a brilliant idea.

Let me show you what I mean.

Innovation at the Heart of Energy Consumption

Back in the day, people used animals for transport, plowing fields, or grinding grains into flour. Later came windmills and water mills to handle the milling.

Wood for fire and heat was eventually replaced by whale oil, the source of huge amounts of wealth.

Today, few people know of the port town of New Bedford, Massachusetts.

This town was once the richest-per-capita city in all of North America.

The reason? New Bedford is where Quakers discovered that whale oil could be made into a clean, smoke- and scent-free oil for lamps.

The city became the world’s whaling capital and was known as “The City That Lit the World.” However, discovering the even cheaper petroleum oil took away New Bedford’s crown and wealth.

Fossil fuels like coal, oil, and natural gas replaced other fuels, too, to power cars, airplanes, power plants, and much of everything else in the modern world.

I don’t have to remind you that John D. Rockefeller, still one of the richest humans in history, built his fortune in the oil business after it replaced the whaling industry.

Today we also have wind, solar, nuclear, and water power, among others, to generate electricity for us.

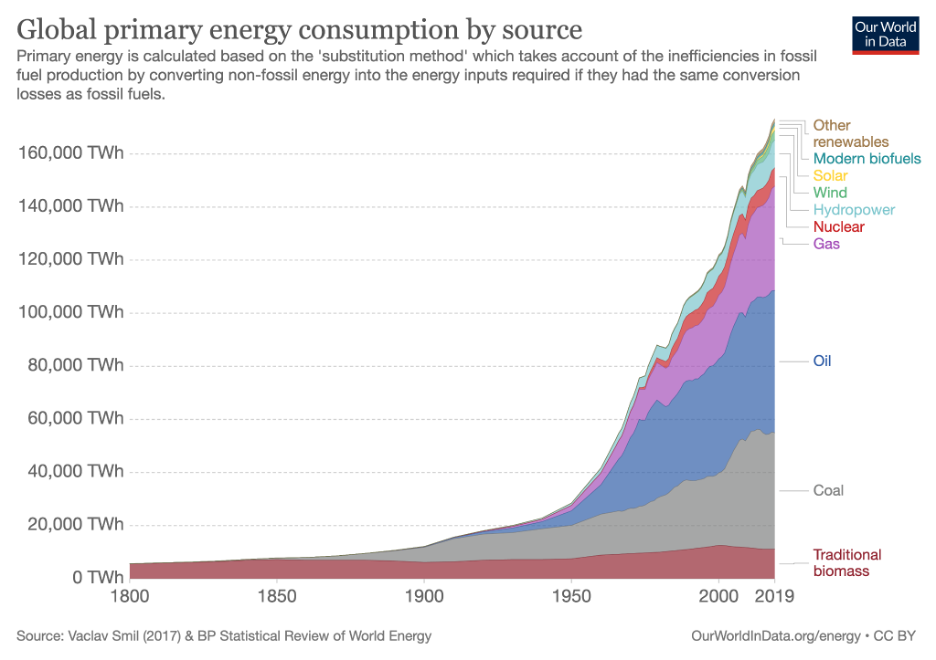

As you can imagine, humans use a lot more energy today than we did even 100 years ago. But you might be surprised by just how much more:

As you can see, there’s been a 13-fold increase in energy consumption since 1900 alone.

If you go back to pre-industrial times, that increase is even higher.

This growth shows no signs of stopping. In 2019, the U.S. Energy Information Administration (EIA) forecast that global energy demand would grow by almost 50% by 2050.

As you can imagine, the increase would primarily come from Asia.

There, fast-growing economies mean more energy demand per person – but the population is growing fast, too.

I bring this up to show that investing in rising power demand is almost always an excellent idea. Not only historically, but right now, too.

Of course, investing in Asian power generation isn’t all that easy (although some select tech companies or solar companies are worth looking at). And you may think that here in the U.S., the picture for energy companies looks much worse.

And while it’s true that total U.S. energy demand growth has slowed down, the devil is in the details.

Because if you split that energy demand up by where the energy comes from, there’s a lot of change.

See, the COVID-19 lockdowns led to total U.S. energy consumption dropping by 7% compared to the year before, according to the EIA.

That’s the biggest drop on record, from data going back to 1949.

Shifting Trends in Energy Consumption

The transportation industry was a major reason for this decline. Overall, energy consumption from transportation dropped by 15%. That makes sense – with cars staying in their garages and factories closing down, Americans had less need for power.

Of course, transportation relies almost exclusively on oil-derived products. Jet fuel, gasoline, and diesel saw a major drop. With that said, that decline precedes an expected long-term decline in the use of gasoline and other oil-based products for transportation.

Electric cars will likely be the dominant form of transportation in the decades ahead. I’m not saying we’re all going to be driving Teslas tomorrow.

I’m not even saying that would be a great world. (Some of those videos of Tesla battery fires look scary.)

But it’s hard to deny the transition to electricity and batteries as part of a broader trend in American (and global) energy use.

Electric vehicles will likely follow the same path for energy generation as most American homes have over the years.

It used to be common to heat homes and cook food with wood, then coal, then gas. Today, more than 25% of U.S. homes are entirely electric, according to the EIA, and that number is only set to grow.

Because while cooking with gas has its enthusiasts, usually electricity is just more convenient. Not to mention that with electricity, you don’t depend on just one fuel source.

It simply makes sense for electrification to eventually hit the transportation sector, too.

Right now, fewer than 1% of cars in the U.S. are electric.

But with all major car manufacturers phasing their nonelectric cars out over the next few years, that’s about to change, and fast.

The impact here will be huge.

For example, if every car in America today were switched over to an electric one, electricity demand would jump by 25%. This would happen – even though total energy demand might go down a bit – because electric engines are more efficient than combustion engines.

Now, this won’t happen overnight.

But it will happen eventually. And power companies need to be thinking about that right now. But more importantly, they need to be building power plants to make up for that difference – and profit from it.

They already are.

That means lots more money heading their way – and to investors who pick up the right utility and energy stocks, too.

Because come rain or shine, pandemic lockdowns or huge bull markets, electricity demand is going up. This is always a sector for long-term investors to exploit in any market conditions.

Consider These Energy Plays for Any Market

If you’re looking for ways to play the changing energy trends of the future, you can start with our signals at TradeSmith Finance. We will see various moves in stocks based on buy and sell recommendations and momentum indicators.

Enterprise Products Partners (EPD): As we’ve noted, Enterprise Products Partners is one of the largest master limited partnerships in the United States. The company specializes in the transport of oil and gas products. It operates in a special part of the energy supply chain known as the midstream. This portion of the supply chain connects oil and gas producers to downstream refineries and other end users of these fuels. EPD currently sits in the TradeSmith Finance Green Zone. It also remains in an uptrend, an important momentum measurement for investors to boost their confidence. EPD pays a very attractive 7.68% dividend.

NextEra Energy (NEE): NextEra Energy is one of the nation’s largest investment companies in energy infrastructure. The company has built the energy infrastructure of the future with significant investments in renewable energy, solar energy, and wind products. The company continues to make massive strides in the Sun Belt, with a special focus on Florida, where it owns Florida Power & Light Company. In 2020, the company won the S&P Global Platts Energy Transition Award for leadership in environmental, social, and governance (ESG). Given the increased interest in ESG as an investment trend, NEE will likely become a viable investment among institutions in the future as the economy continues its trend toward renewable energy sources. It is the largest rate-regulated electric utility in the nation and serves more than 5.6 million customer accounts. NEE pays a reliable dividend of 2.0%, but currently lies in the TradeSmith Yellow Zone and is in a side-trend. Wait for the buy signal and for a nice uptrend to come in the future.

Clean Energy Fuels Corp. (CLNE): Clean Energy Fuels Corp. is a company engaged in the production of renewable natural gas and other fuels. The company aims to reduce carbon emissions and is the largest provider of renewable fuel derived from organic waste. The company stands to benefit from the transportation industry’s shift away from diesel fuel and gasoline. The stock is currently locked in the Red Zone and sits in a side-trend. But based on its potential, keep the stock on a watchlist. The moment it moves into the Green Zone and starts to catch momentum, it could be a very significant long-term opportunity.