In December 2020, a medical student named Jack Stuef made a startling discovery in the Rocky Mountains.

He uncovered a treasure chest containing gold, diamonds, jewelry, and more valuables worth between $1 million and $2 million.

The discovery is less remarkable than the true story about how the chest arrived in the Rockies in the first place.

About 10 years prior, a mysterious man named Forrest Fenn hid this treasure chest in a still-undisclosed location. (Stuef believes that Fenn, who passed away last year, would have preferred to keep the site secret.)

Fenn’s effort in 2010 set off one of the most extraordinary treasure-hunting expeditions in the history of the world. Some believe it rivaled the search for Blackbeard’s Treasure or the search for the Titanic.

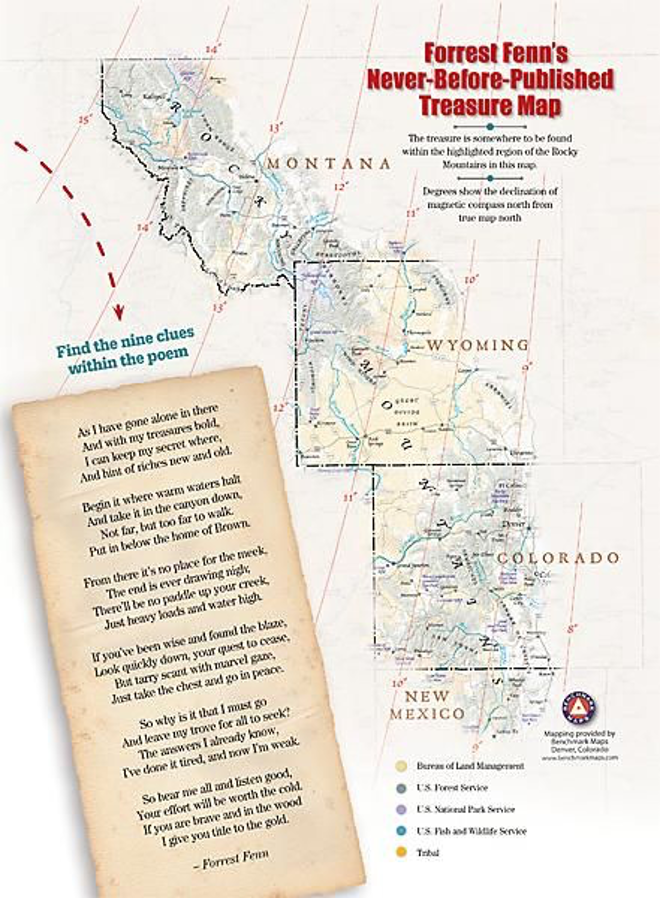

Today, I want to tell you more about this story. I’ll show you a Forrest Fenn treasure map, and then my favorite treasure map that can make you a tidy profit as the economy reopens.

The Legend of Forrest Fenn

Forrest Fenn was a former combat pilot in the Vietnam war.

He flew hundreds of combat missions in less than a year.

After he retired, he opened an art and collectibles gallery that generated millions of dollars in sales of artifacts, paintings, sculptures, and much more.

After surviving cancer in the 1980s, Fenn decided to hide a treasure chest in an outdoor location. He wanted to create something exciting for people. He wanted to create a cultural phenomenon.

Decades later, in 2010, he took to it.

Leading up to the treasure hunt, Fenn wrote a self-published book called The Thrill of the Chase, a Memoir.

The book contained stories about his life. It also included clues about where he was hiding this valuable treasure chest.

Here’s a user-generated map of places where the treasure may or may not be based on all of the engagement by individuals trying to locate it. He also put clues into a poem in a book chapter called “Gold and More.”

He said he took no money from the book sales so that authorities didn’t accuse him of fraud.

In the era of the internet and eager treasure hunters, Fenn’s gambit became an extremely popular search among amateur and professional sleuths alike.

The treasure hunt resulted in thousands of people trekking across the region in search of fabled treasure. Five people died during their search.

Authorities across Western states eventually asked Fenn to call off the treasure hunt, suggesting he was putting lives at risk.

But last year, Jack Stuef found it. He had pursued the catch for three years. He’d read the poem by Fenn over and over. He traveled across the places where other people had died, trying to locate it.

When he did find it, Stuef initially tried to remain anonymous.

You see, plenty of other people who wanted to find the treasure might issue threats, wish him ill, or worse.

And that’s what happened.

He was sued by other treasure hunters who said that the chest was rightfully theirs. One person said that Stuef stole clues from him. His name

would eventually come out. So, he came forward and revealed his success in a series of stories published across different media outlets.

This is Your Treasure Map

Treasure hunting is dangerous, it seems.

Not just finding the treasure, but what comes after.

If someone puts another treasure in the mountains, you can count me out.

I’m not planning on wandering through rough terrain with a compass and a walking stick. I don’t like bears. I’m not a big fan of sleeping in tents or being away from my family.

It turns out, however, that I don’t need to. I already have a real-life treasure map. And so do you.

No, you won’t find diamonds and gold hidden in the mountains.

But if you are looking to increase your wealth and boost your income, then take a look below.

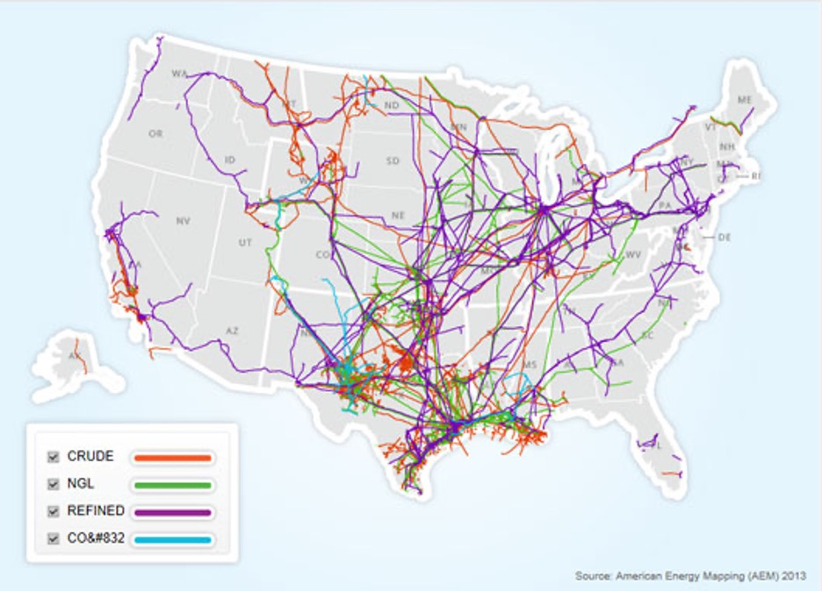

This is a map of the more than 190,000 miles of liquid petroleum pipelines across the United States. The pipelines stretch through all 49 continental states and the District of Columbia.

And don’t underestimate Alaska (included above). Its Trans-Alaskan pipeline is 801 miles, nearly as long as the straight-line distance of Texas from north to south. (Alaska itself is 1,400 miles long.)

What makes this a great treasure map?

All you need to do is point to the map and find profit from U.S. oil pipelines.

Oil pipelines push crude across the U.S. energy supply chain from production fields to refineries and ultimately end producers. Think of these pipelines like you might a toll bridge that generates huge gobs of cash every day. People pay money to cross bridges, ride ferries, or drive in tunnels from place to place.

Energy companies pay pipeline operators the same way. Best of all, pipelines are running 24 hours a day, seven days a week, 365 days per year as they pump crude – the lifeblood of the U.S economy – across the entire nation.

Learn It, Know It, Live It

Now, a quick word.

There is a very important term that I want you to understand. We’re going to be talking about it all this week. It’s called “Midstream.”

The U.S. oil sector is divided into three different sections. They are:

Upstream: These are the producers of oil and gas in fields. They operate in shale fields like the Permian (in Texas) or the Bakken (in Montana), offshore wells like in the Gulf of Mexico, or more developed energy fields like the Canadian sands in Alberta. These producers sit on reserves and pull crude out of the ground.

Downstream: At the end of the supply chain, downstream companies turn fuels into finished products. These include the refineries that turn crude oil into gasoline and plastics. Downstream can also have operations that produce fertilizers for agriculture and critical products in medicine, cosmetics, and more.

Midstream: Finally, we have the midstream. This is the critical part of the supply chain that connects the upstream and downstream. Midstream companies are involved in the processing, storage, and transport of crude oil and gas. They might operate tanker ships, extensive storage facilities, and, of course, pipelines.

Midstream is a sweet spot for investors because crude oil is always in transport. Midstream investments also tend to provide large dividends to their investors because of the incredible cash flow that they generate.

If you’ll recall, last week, I talked about how master limited partnerships (MLPs) are among the best ways to make money in an environment for rising oil prices. Energy MLPs tend to “live” in the midstream. And they make terrific investments because of their tax structure. These tax structures allow them to pass-through income to their investors as long as they generate at least 90% of their revenue through their primary assets.

In MLPs like Enterprise Products Partners (EPD) or Energy Transfer (ET), companies can pay respective dividends of 7.5% and 5.6% due to their rising demand.

Both companies are worth your consideration and provide a very intriguing way for you to play the treasure map that I’ve shown you above. They both sit in the Green Zone on TradeSmith Finance, and they are both in upward momentum conditions.

In addition, Energy Transfer has buy ratings from eight Wall Street research firms with a consensus upside of 23.2%. Meanwhile, Enterprise Products Partners has seven buy ratings with a consensus upside of 17.9%, according to TipRanks data.

They are both part of a midstream segment that can treat you well over the long term and help you generate income in a low-interest-rate environment. But, you can also look at this map every day and picture the millions of oil barrels pumping across the nation. And with it, the gobs and gobs of cash flow that it generates for midstream companies.

This week, I’ll dive deeper into the other parts of the supply chain. With the economy reopening, oil demand rising, and producers being patient with increasing supply, it’s a perfect time to capture potential upside from companies that took a few hits over the last 15 months.