The auto manufacturing industry already had a bleak outlook. The prospect of prolonged trade war makes that outlook much worse.

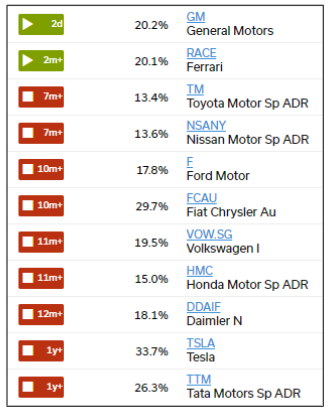

In fact, there is only one automaker that looks attractive right now — Ferrari (NYSE: RACE); all of the others look bearish.

You can track the auto industry in general via CARZ, the global auto index ETF. It could also be worthwhile to consider long-dated put options on some of the major automakers — Ford, General Motors, Toyota, and so on — as a hedge against market downside risk.

If the global economy goes into a downturn, and especially if the United States enters a recession in the next 12 months — an event the bond market is forecasting — the automakers will feel the brunt of it.

Auto manufacturing is a lousy business in the best of times. Aswath Damodaran, the NYU Stern professor known as the “dean of valuation” for publicly traded companies, ranks the best and worst industries in the world each year. Autos are consistently one of the 10 worst.

In recent decades, the automakers have shown single-digit revenue growth. So they aren’t growth stocks by any stretch. Meanwhile, about half of that growth came from China, which makes them vulnerable to a China slowdown (more on that shortly).

Auto manufacturing also requires heavy reinvestment and ongoing capital expenditures. When you add that to low revenue growth, it’s an ugly combo.

Growth stocks justify high levels of investment because the expansion opportunity is worth it. Value stocks preferably deliver quiet profits at low cost. An industry with slow growth and a high-cost business model is the worst of both worlds.

Adding insult to injury, auto manufacturing is highly cyclical, which means profits get wiped out in downturns and recessions. Cars are expensive items typically bought with financing. In a downturn, the financing dries up and consumers close their wallets.

Ferrari, however, is different than any other automaker because they don’t have a mass market business model. Their vehicles are a high-end luxury good, which gives them multiple advantages.

Ferrari’s customer base is extremely wealthy, so spending patterns don’t change much even in severe recessions. Ferrari had steady sales and stable revenue flows right through the crash of 2008.

Ferrari also saves money on advertising by relying on word of mouth. Their traditional advertising budget is almost nothing, whereas the big automakers spend billions.

In addition, Ferrari can charge eye-bulging prices. A Ferrari is a top-end status item and, if you are buying one, by definition you have no price sensitivity whatsoever (at least when it comes to cars).

As a result of these advantages, Ferrari’s average profit per car is through the roof in comparison to the other guys. A study conducted by the Center for Automotive Research (CAR), a firm based in Duisburg, Germany, estimated that Ferrari’s average profit per car sold is $80,000.

By comparison, Porsche, whose cars are a slightly more accessible status item, makes an estimated $17,250 profit per car. BMW, Audi, and Mercedes average $10,500.

Then, down at the bottom, you have the true mass-market automakers like Ford, whose average profit per vehicle in 2017 was a mere $1,100. Ferrari beats them by a multiple of 70-plus!

|

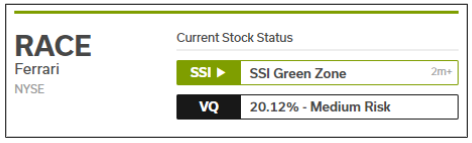

So Ferrari looks strong and the price trend reflects that. The super-rich aren’t worried about household budgets or unemployment rates. Ferrari’s stock is in a smooth uptrend, with green zone SSI status and medium volatility risk.

The other automakers could be in big trouble however. As explained, automaking as a business is generally low growth, high investment, and cyclical — a terrible combination. The prospect of trade war makes all of that worse.

Take General Motors (GM) for example, whose future growth prospects depend on China. General Motors sells more high-end Cadillac luxury SUVs in China than it does in the United States. Or at least it used to, because that will likely change.

China has long accounted for roughly half the growth in global car sales (which is single-digit in the first place). But in 2018, China car sales fell an estimated 3% — the first contraction since the 1990s. The 2019 drop is expected to be worse — and all of that was before trade negotiations went south.

For a long time, the Wall Street base case was that U.S.-China trade negotiations would be worked out. A deal was seen as serving the best interests of both sides. Now, though, the base case is prolonged trade war, with new escalations by the week if not the day.

For example, China just slapped Changon Ford, a local Ford joint venture, with a $24 million fine for a vehicle pricing technicality. The penalty is small, but the action is seen as a warning shot. China could make the pain much worse for U.S. automakers — GM and Ford in particular — by shutting them out of a vital growth market. And that growth market is heading into a downturn, possibly a severe one.

The potential for Mexico tariffs is another nightmare for automakers. Deutsche Bank estimates that, out of the $350 billion worth of goods the United States imported from Mexico last year, $93 billion worth had to do with cars and car parts.

Meanwhile the supply chain for autos is so complex, a part can cross and re-cross borders as many as eight separate times as it goes through various manufacturing processes. That’s a lot of tariff headaches.

Automakers in Japan and Europe also face severe headwinds. For instance: If the global economy goes into a downturn, the Japanese yen is likely to strengthen substantially, which could wreck Toyota’s profit margins. And Germany is high on the list of candidates for who gets tariffed next.

|

The bottom line is that, apart from Ferrari, which marches to the beat of its own drum, the auto industry already looked vulnerable due to its highly cyclical nature, the first contraction of China car sales since the 1990s, and weakness in the global economy.

Now, the prolonged trade war dynamic, the likelihood of “tit for tat” punishments, and the threat of global supply-chain disruption serves to amplify those concerns dramatically.

This makes automakers an attractive way to hedge against downside portfolio risk, via long-dated puts that could gain in value if the market outlook worsens.