There is a conservative way to sell options and an incredibly dangerous way to sell options.

If you don’t know anything about selling options — collecting premium by writing puts and calls — that might be for the best. This is territory for seasoned investors.

If you know a little about selling options, but not a whole lot, your financial well-being could be at risk. This is one of those areas where, as the saying goes, “a little bit of knowledge can be a dangerous thing.”

Seasoned investors — some of them, but not all — use the conservative approach to selling options as part of their overall investing toolkit. There is a way to do it rationally and safely.

Warren Buffett has used this conservative options-selling approach routinely in the past, though he rarely, if ever, talks about it; he and his portfolio managers likely still use it to this day.

But there is another way to sell options — the incredibly dangerous way.

The dangerous way is tempting because it tends to make money so consistently, something like 95% of the time or even 98% of the time. The trouble is that, in that 2 to 5% window where the dangerous way fails, the losses tend to be devastating.

Selling options the dangerous way can lead to “blow-ups” that wipe out an order of magnitude more capital than expected — sometimes multiple orders of magnitude.

When this happens, entire portfolios, entire nest eggs, and entire careers can be destroyed.

A vivid example of this came to light about a week before Thanksgiving, when a Tampa, Florida-based hedge fund manager “blew up” and lost its clients’ money.

The total amount lost was estimated at more than $150 million, spread across hundreds of clients. Many of those clients were retirees. The average loss per client was in the hundreds of thousands.

The money was lost selling options. The whole fund was dedicated to selling options. It even had the name “OptionSellers” and the web address “OptionSellers.com.” (The site is now offline.)

One unique thing about this blow-up, and the reason we know about it, is because the hedge fund manager who ran the accounts, James Cordier, decided to notify clients with a public YouTube video.

The roughly 10-minute video, which is painful and sobering to watch, begins like this:

“Good afternoon, this is James Cordier of OptionSellers.com with a market update for November 16th, 2018. Needless to say, the events of this past week have been incredibly devastating…”

If you want to see it, the video is available on YouTube here. It isn’t pretty. With great pain in his voice, Cordier speaks in a personal manner to a number of clients he thinks of as friends and family, before getting around to the fact that a “rogue wave” has wiped out their accounts.

So, what happened? It turned out that OptionSellers specialized in selling options on commodity futures and had been registered as a Commodity Trading Adviser (CTA) since 2010.

One of the markets OptionSellers.com participated in was natural gas.

Selling unprotected out-of-the-money puts and calls on natural gas, to routinely collect premium, had been an easy way to make money in natural gas markets for quite a long time, as natural gas volatility levels had been exceptionally low for years.

But then, in mid-November, the energy markets saw wildly violent moves. The price of natural gas spiked an incredible 18 percent in a single trading day on Nov. 14.

For anyone selling natural gas options to collect premium, the volatility spike — what Cordier called a “rogue wave” — led to forced liquidation and immediate catastrophic losses.

The dangerous way to sell options — the way OptionSellers did it — involves taking on gigantic risk.

Selling an option, or “writing” a put or call, is a little bit like selling insurance. Most of the time, you collect a premium and nothing happens. The premium feels like free money, and you can collect that free money for years on end.

But if a big, unexpected move happens, that is like a policy claim that you, the insurer, are on the hook for paying. If the claim is large enough, you can be wiped out.

The conservative way to sell options is different.

When an investor sells options the conservative way — and this is done in stocks, not commodities — the worst-case scenario is known and prepared for in advance. The risks are deliberately contained.

Here is a hypothetical example. Say that Warren Buffett wants to own more Wells Fargo stock, but only at a discount to the current share price.

Buffett might sell options — in this case he would write Wells Fargo “puts” — at a strike price below the current share price.

If the price of Wells Fargo never drops far enough, that is no problem. Buffett collects the premium on the puts he sold, waits to buy Wells Fargo stock some other day, and moves on.

But if the stock drops far enough, Buffett takes delivery on the Wells Fargo shares. He only sells options at a level of volume he can handle if the underlying shares are “put” to his account. And he only does this with stocks he wants to own.

The key difference here is that, when a value investor sells put options against a stock he or she wants to own, the number of options contracts sold are limited to the number of shares the investor is willing to own if the put goes “in the money” and the shares are delivered.

The investor also makes sure to have the capital on hand, in advance, to handle any shares assigned to their account.

Another conservative move is to sell a call option — collecting a premium at a strike price above the market price.

But this time, the conservative investor will only sell call options against shares they already own. That way, if the share price goes up, the shares the investor already owns are “called” away.

There are other conservative, limited-risk options selling strategies, like using put or call spreads.

But the key point is this: The conservative approaching to options selling can generate a modest amount of income while always limiting the risk, because:

- All contingencies are prepared for;

- There are no scenarios leading to disaster even if the option is triggered; and

- The option selling is typically done against shares the investor owns or wants to own.

The dangerous approach to selling options, meanwhile, is the one where a surprise price move can cost many multiples of what you expected — or even wipe out the account — because of the extreme leverage and open-ended risk involved.

The leverage and the open-ended risk are precisely what makes the dangerous way to sell options so profitable. The riskier the play, the more premium you collect by writing insurance against it.

But as OptionSellers.com found out, when that approach goes wrong, it can kill you.

In the short run, the conservative way to sell options isn’t anywhere near as profitable as the dangerous way. It can deliver a modest amount of gain, but not the huge amount that requires risky leverage.

In the long run, however, the conservative way is more profitable because you actually get to keep the gains over time — instead of being carried out on a stretcher.

It’s generally best to avoid the dangerous options selling approach, and also to avoid money managers who use it, no matter how “professional” they claim to be. The conservative approach to selling options, meanwhile, can have value if incorporated into a sensible, well-thought-out investment strategy.

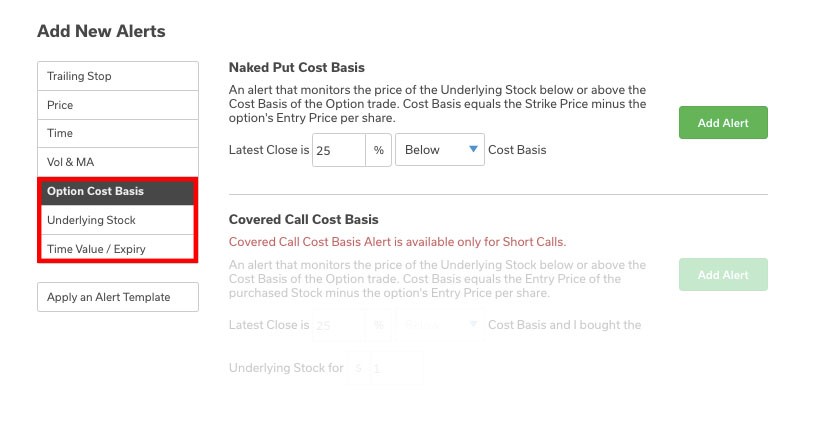

Most TradeStops subscriptions support the conservative approach by allowing you to set up a variety of alerts for your options based on the exit strategy you want to follow.

You can learn more about option cost basis alerts and and others and how to use them in our Knowledge Base.