After the markets were shaken in the first part of the year, the averages have been moving nicely higher.

The DJIA is up a little over 3% since its low in March, and the S&P 500 is up more than 5% since its low in February, while the Nasdaq Composite is up over 11% since its low in February. And the S&P 600 Small Cap Index is up almost 15.8% from its lows.

It looks as if all’s well, right? Maybe not.

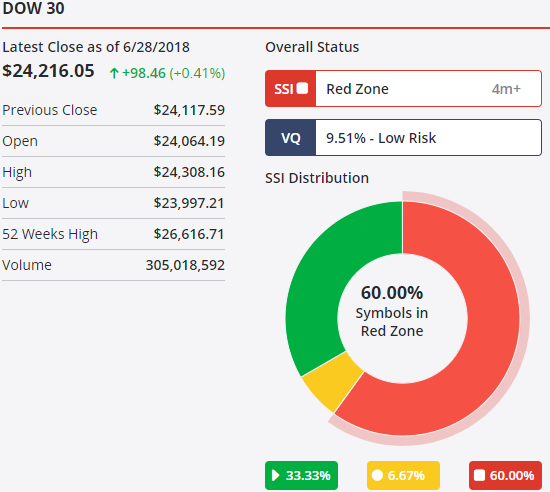

While the markets move higher, the number of stocks in the Stock State Indicator (SSI) Red Zone are at cautiously high levels.

Let me show you what I mean.

Currently, the DJIA has 60% of its component stocks in the SSI Red Zone.

The S&P 500 has more than 40% of its stocks in the SSI Red Zone, and the Nasdaq 100 has just under 40% of its stocks in the SSI Red Zone.

We showed you three months ago that when more than 40% of the stocks in an index are in the SSI Red Zone, it can be a precursor to the markets moving lower.

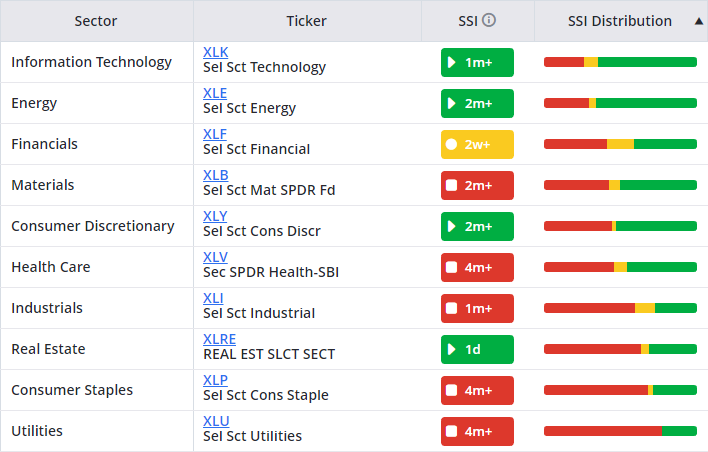

Here’s a look at the sectors that make up the S&P 500. Notice that with the exception of the technology and energy sectors, they’re all showing more than 40% of their stocks in the SSI Red Zone. The consumer staples, real estate, and utility sectors each have more than 60% of their stocks in the SSI Red Zone.

Why do we have such divergences? With so many stocks in the SSI Red Zone, how are the averages still moving higher?

The answer lies in how the averages are constructed.

The top 10 stocks in each of these indices account for an overwhelming percentage of the overall index.

For instance, the top 10 stocks of the S&P 500 account for over 21% of the index. The top 10 stocks of the Nasdaq 100 account for over 55% of the index. And there is a very significant amount of overlap between these two. The following stocks are part of the top 10 holdings in each of these two indices:

- Apple, Inc. (AAPL)

- Amazon (AMZN)

- Facebook (FB)

- Alphabet (GOOGL)

- Alphabet non-voting (GOOG)

- Microsoft (MSFT)

All of these stocks are moving strongly higher and are well-entrenched in the SSI Green Zone. What do you think will happen when one or more of these stocks starts to roll over?

The bottom line is this: When the top holdings in these indices begin to show weakness, that could be the beginning of a significant move lower.

But nobody knows when this will happen. This doesn’t mean that you should have a knee-jerk reaction and move to the sidelines. It does mean that you can’t just blindly buy any stock out there. With so many stocks in the SSI Red Zone, investing today requires more diligence.

It’s a good time to review my roadmap to investment success:

- Start with great investment ideas

- Embrace uncertainty and risk

- Limit your downside

- Un-limit your upside

- Invest enough so you can sleep at night

- Buy what’s already going up

- Concentrate your portfolio

- Pay attention to your overall portfolio risk

Stick to these rules and they can help you manage your investments during these challenging times.